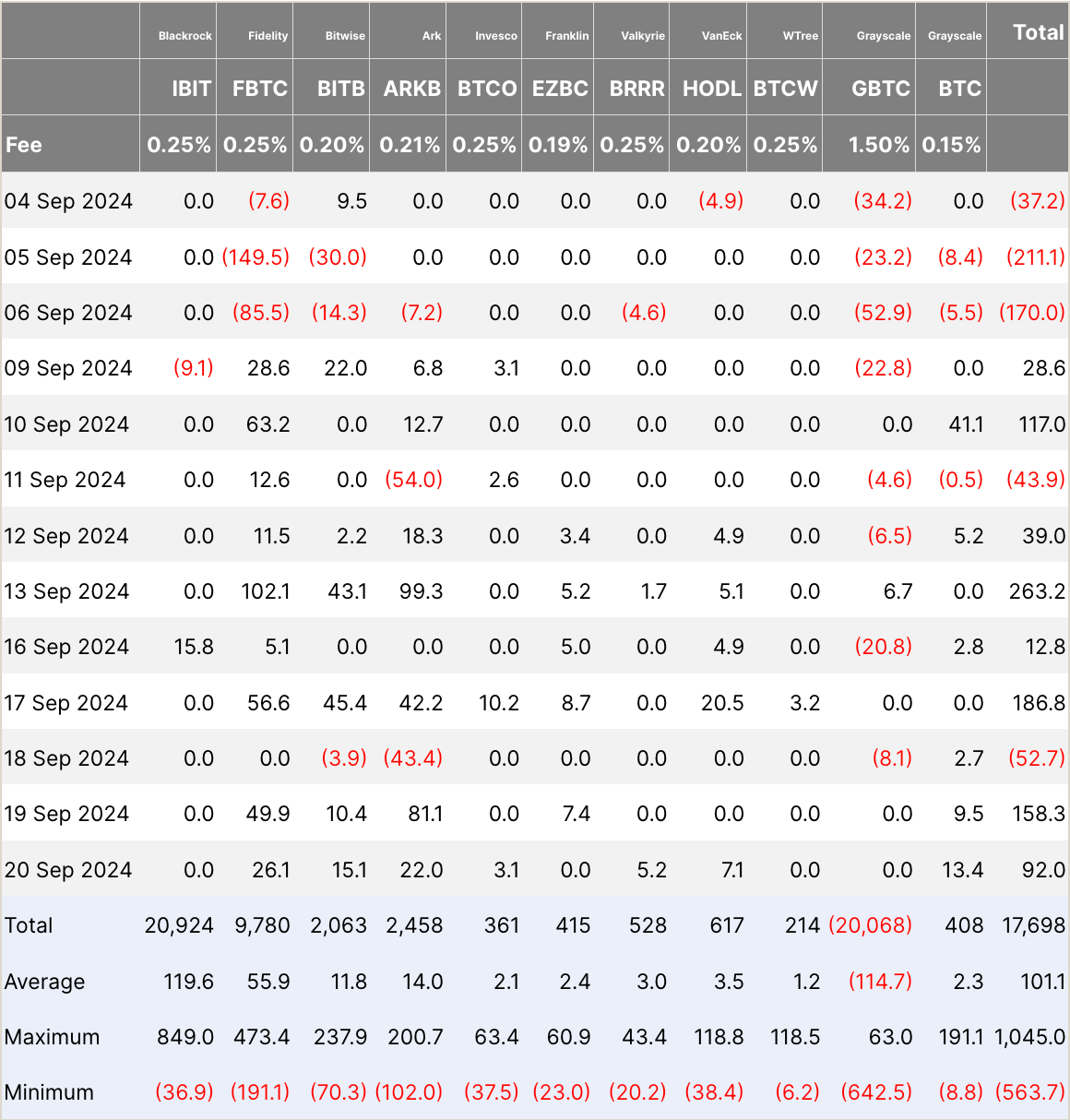

On Sept. 20, Bitcoin ETFs noticed a complete influx of $92 million, reflecting broad-based curiosity throughout a number of funds, in line with Farside information.. Constancy’s FBTC led the market with $26.1 million in inflows, adopted by Ark’s ARKB ETF with $22 million. Bitwise’s BITB ETF recorded $15.1 million, whereas Valkyrie’s BRRR and VanEck’s HODL ETFs added $5.2 million and $7.1 million, respectively. Invesco’s BTCO additionally contributed with $3.1 million in inflows, and Grayscale’s smaller BTC ETF noticed $13.4 million.

No important exercise was famous from BlackRock’s IBIT, Franklin’s EZBC, WisdomTree’s BTCW, or Grayscale’s major GBTC fund, which remained flat for the day.

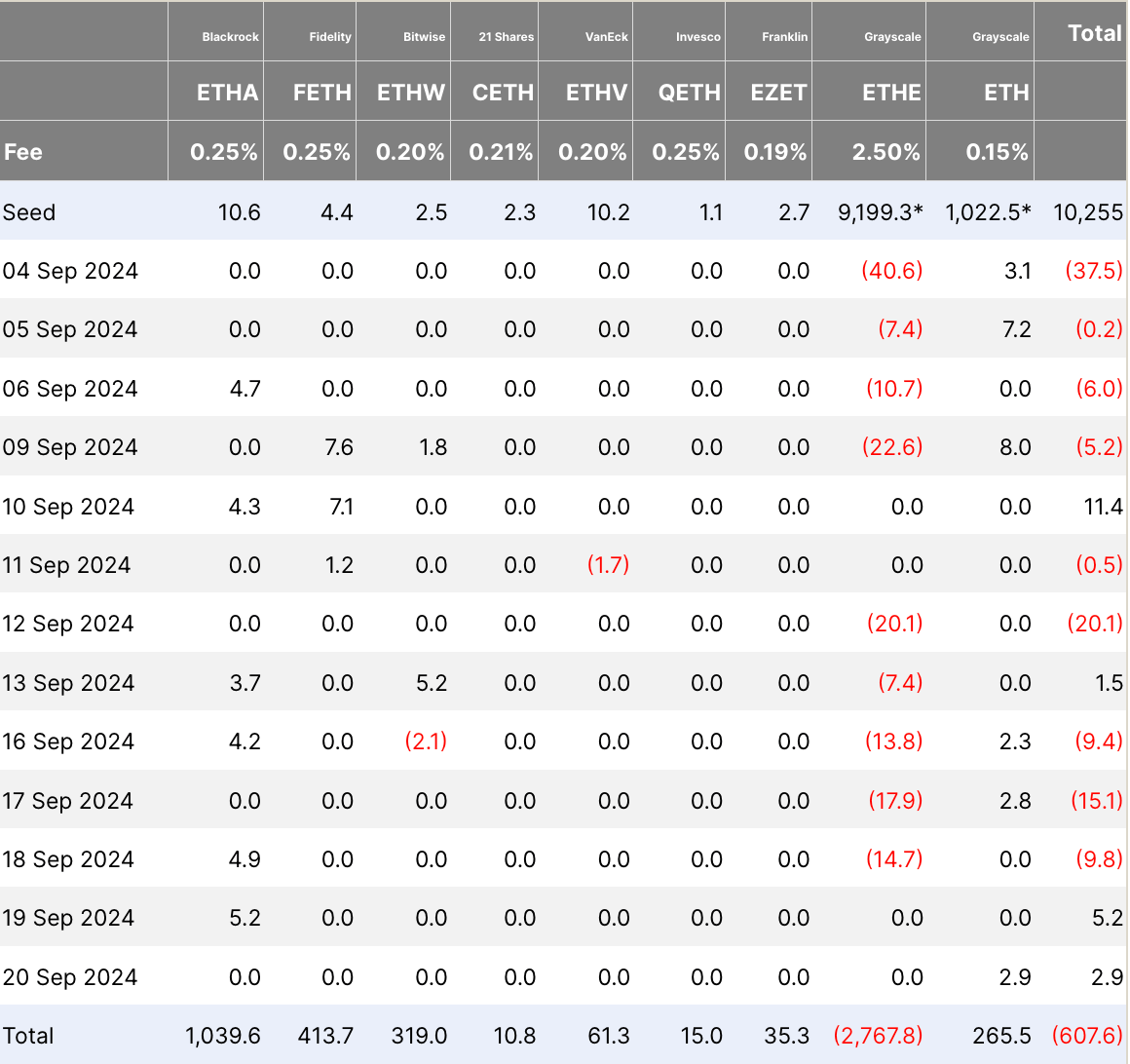

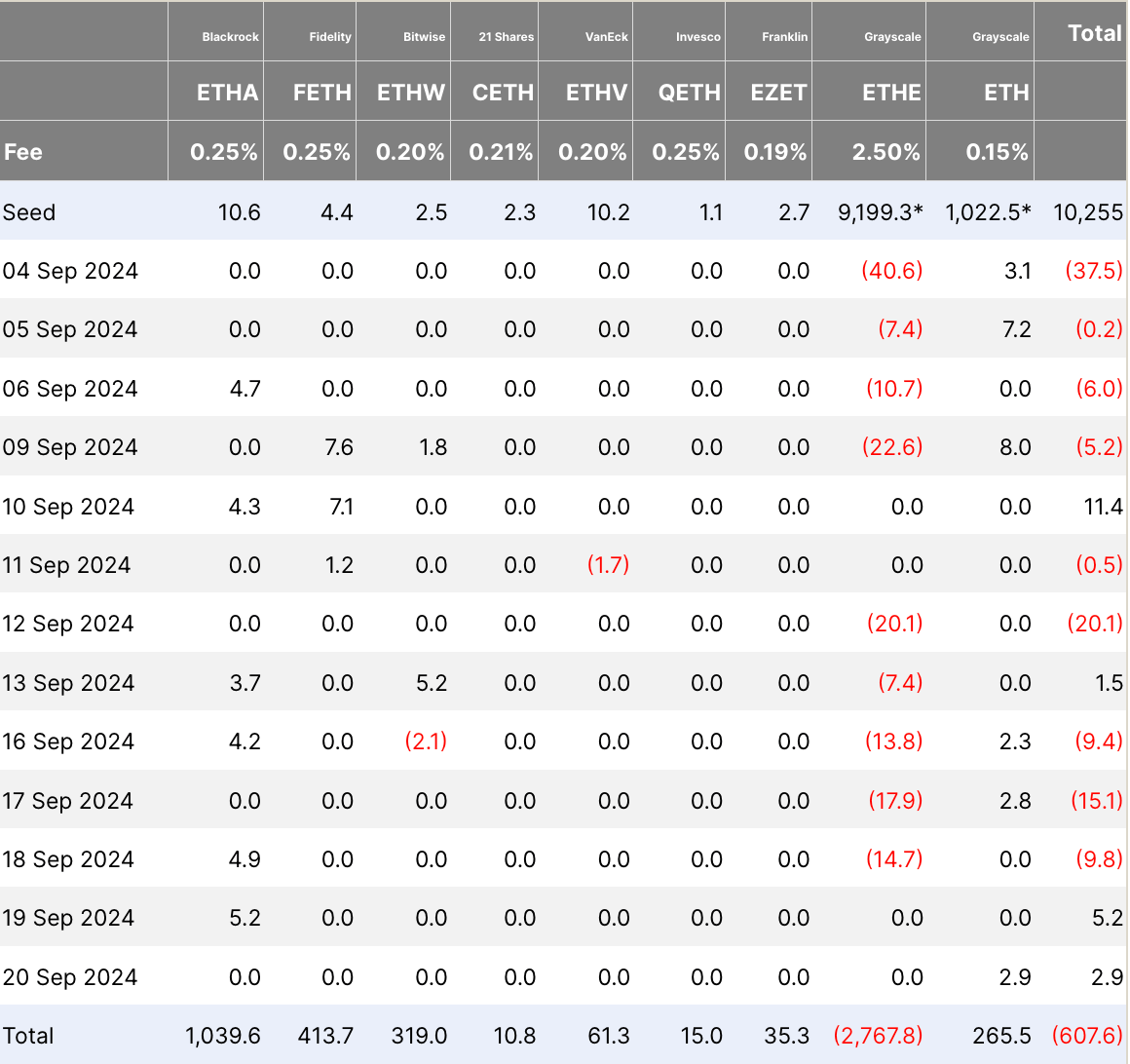

Ethereum ETFs, in distinction, have been largely inactive, with a complete influx of solely $2.9 million, solely attributed to Grayscale’s mini Ethereum ETF, ETH. All different Ethereum ETFs, together with these from BlackRock, Constancy, Bitwise, 21Shares, VanEck, Invesco, Franklin, and Grayscale’s bigger ETHE, recorded no inflows or outflows.

The marked distinction in exercise between Bitcoin and Ethereum ETFs highlights a centered institutional curiosity in Bitcoin publicity, whereas Ethereum ETFs noticed restricted engagement.