Need to work with us? CryptoSlate is hiring for a handful of positions!

Need to work with us? CryptoSlate is hiring for a handful of positions!

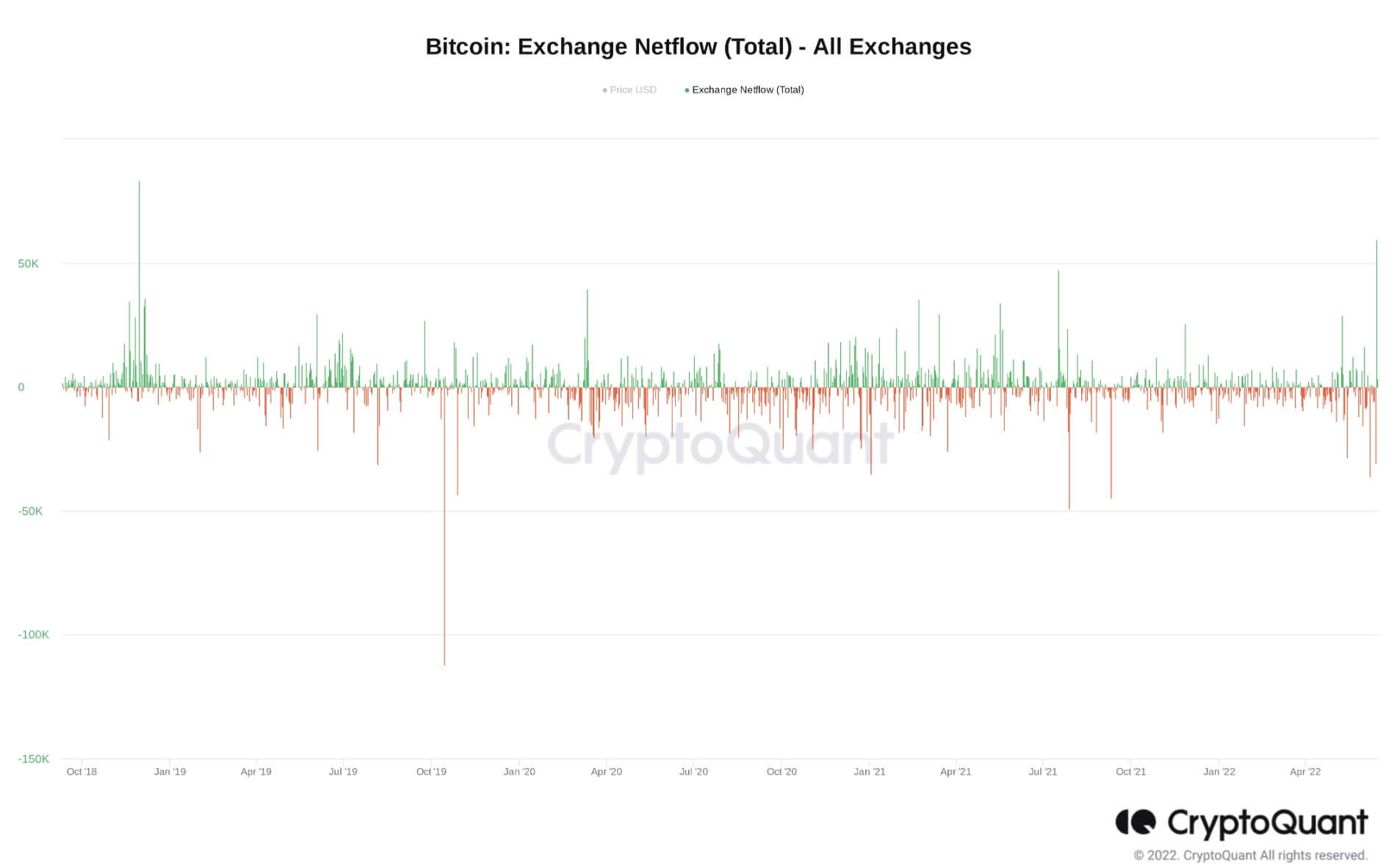

Utilizing information from CryptoQuant, YouTuber Lark Davies tweeted that the variety of Bitcoin flowing into exchanges is at its highest “for the reason that bear market backside of 2018.” Daves added that market lows all the time appear to be met with panic promoting.

#bitcoin simply noticed the most important alternate influx for the reason that bear market backside of 2018!

Each time the market tanks buyers rush to panic promote the lows. pic.twitter.com/tUNMIqo32G

— Lark Davis (@TheCryptoLark) June 15, 2022

U.S fee hike doesn’t spook the market

Bitcoin closed under $30,000, on June 10, following the discharge of knowledge exhibiting U.S client costs for Could have been at a 40-year excessive.

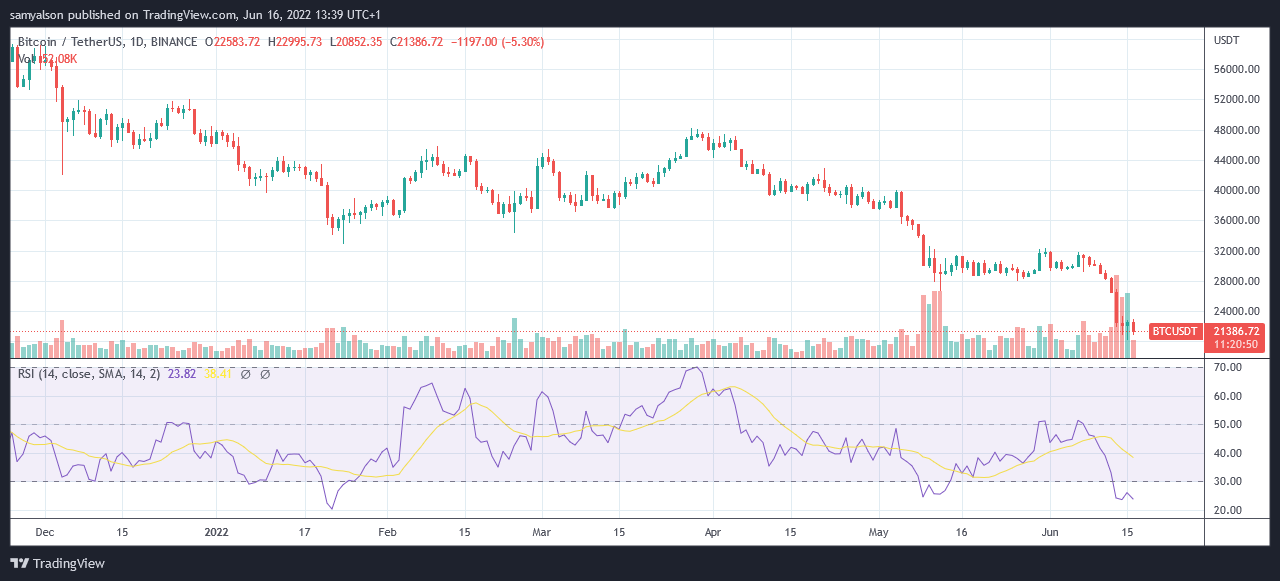

Since then, the BTC value has been cascading decrease, hitting a backside of $20,100 on Wednesday. Giant buying and selling quantity accompanied the following bounce, however every day momentum is weak because the Relative Energy Index (RSI) stays deep in oversold territory.

Wednesday’s Fed coverage assembly introduced a 75-basis-point improve within the benchmark coverage fee, taking the first fee to 1.75%.

Opposite to expectations of a market sell-off, as a response, Bitcoin rose to peak at $23,000 within the early hours of Thursday (GMT).

Bitcoin alternate inflows spike amid market uncertainty

Amid this, crypto exchanges noticed their highest web Bitcoin inflows since November 2018, at roughly 83,000 BTC. This means rising sell-side strain is mounting, which pulls issues over whether or not the native backside, $20,100, will maintain within the coming days and weeks.

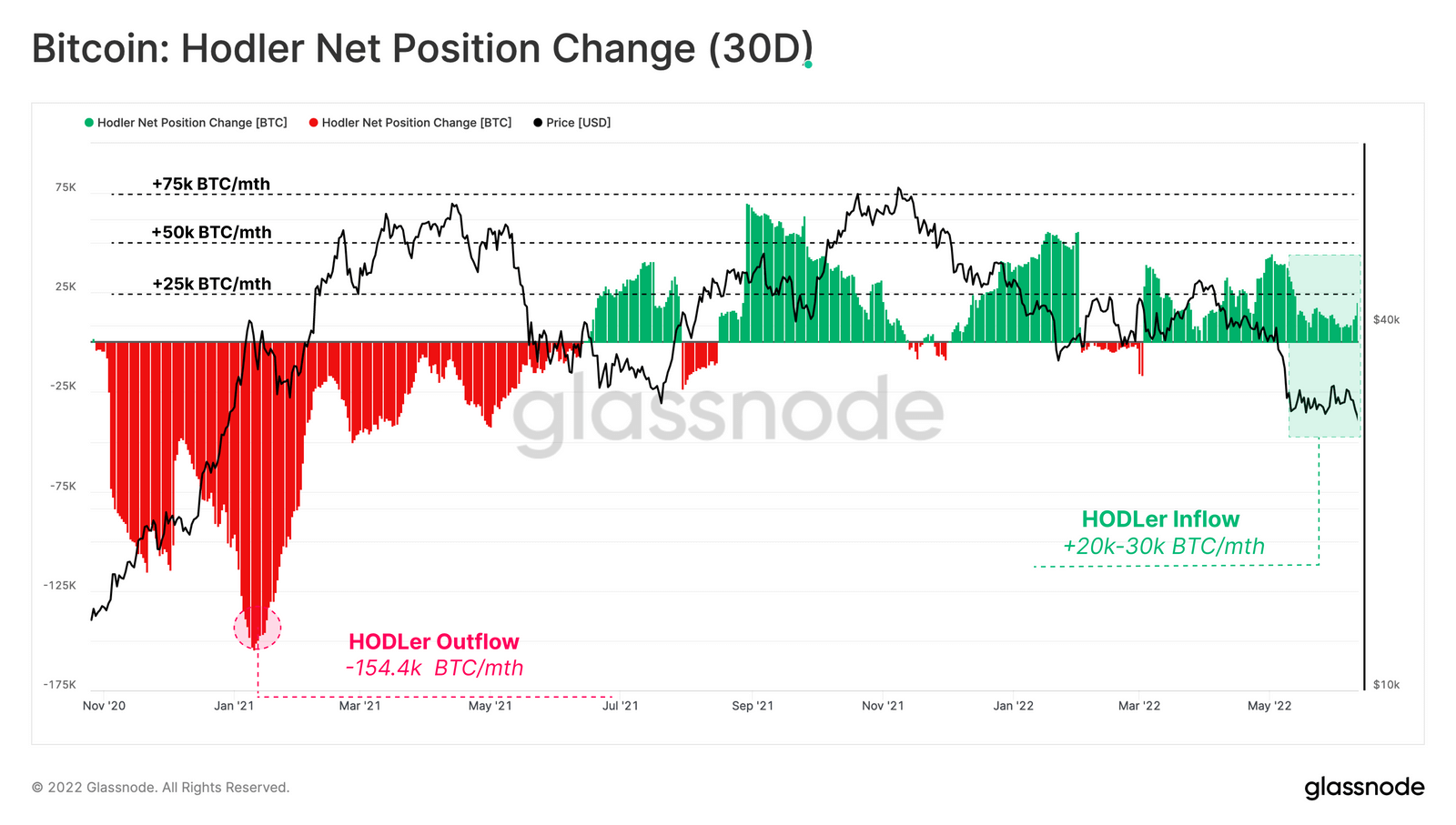

In the meantime, Glassnode information on the HODLer web place change, which examines the speed of accumulation or distribution by long-term buyers, suggests weak spot within the accumulation urge for food of hodlers.

The chart under reveals a present web hodler inflows are nonetheless web constructive. However latest web inflows are down considerably for the reason that Could native high, suggesting “a weakening accumulation response” by hodlers.

“roughly 15k-20k BTC per thirty days are transitioning into the fingers of Bitcoin HODLers. This has declined by round 64% since early Could, suggesting a weakening accumulation response.”

When taken together with important alternate inflows, the indicators point out additional value declines for Bitcoin. Glassnode expects BTC to drop between 40% and 64%.

However, in a divergence from his regular work, on-chain analyst Willy Woo brings within the macroeconomic issue by saying a backside comes “when macro markets stabilize.”

“I feel it’s easier than this, IMO we’ll discover a backside when macro markets stabilize.“