Fast Take

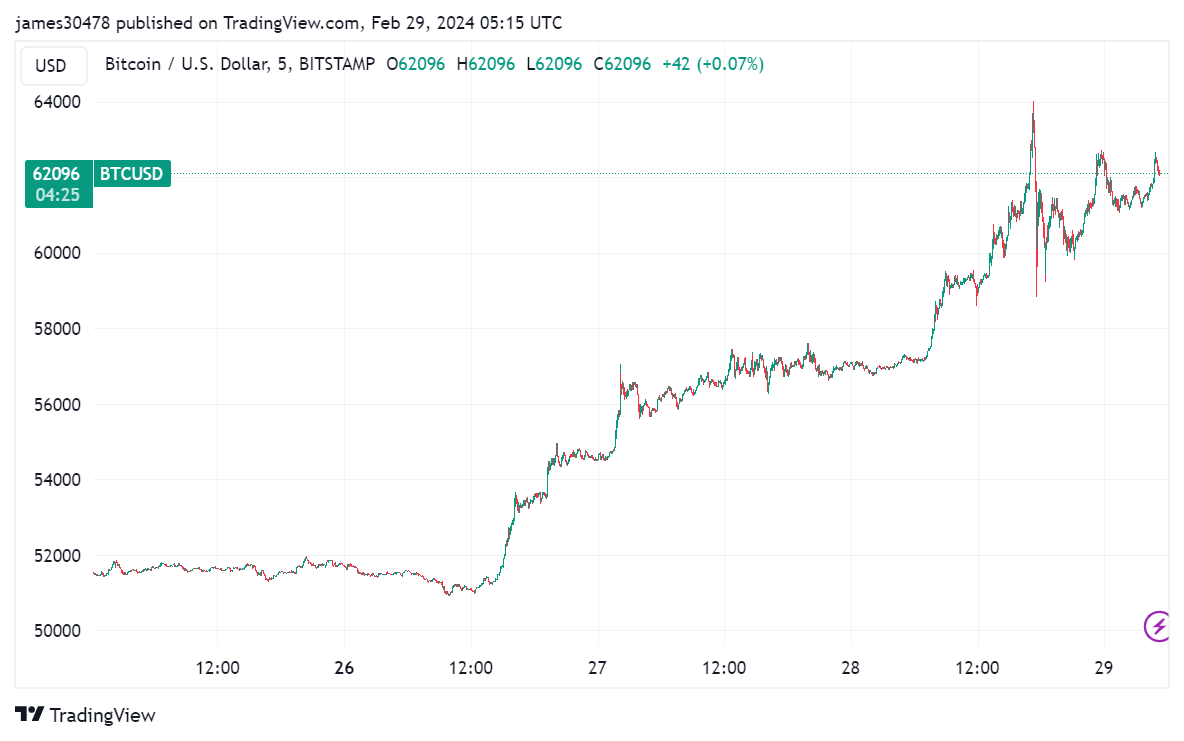

In a wild 24-hour experience, Bitcoin’s worth underwent a rollercoaster of fluctuations, skyrocketing to a peak of $64,000, subsequently plunging to $59,000, earlier than making a restoration to above $60,000.

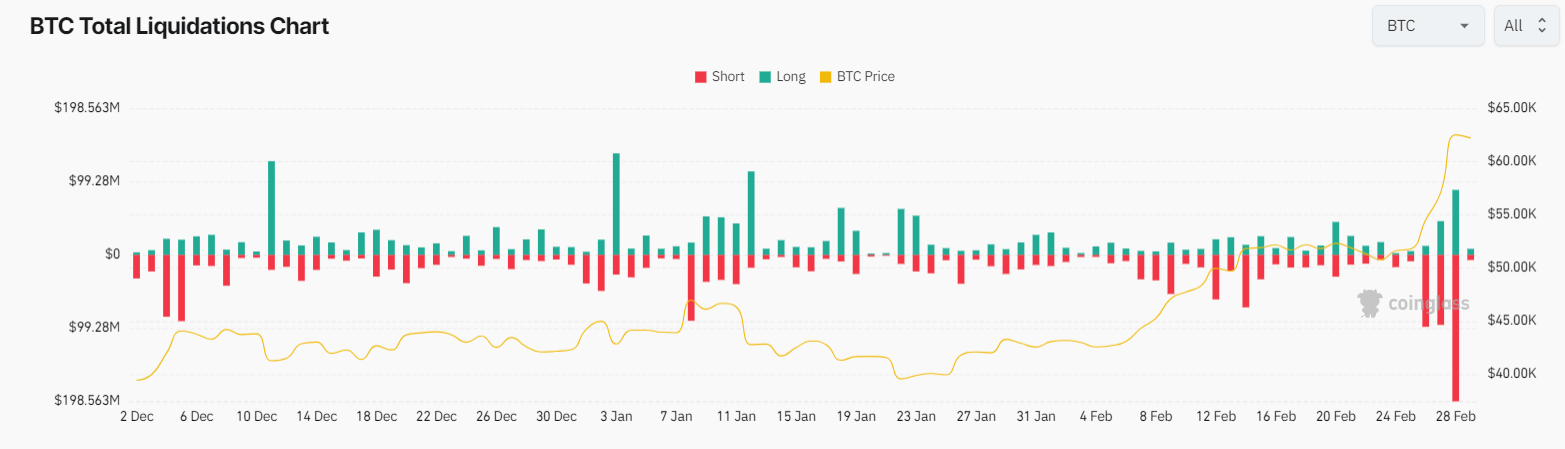

This climb triggered a wave of liquidations, totaling roughly $800 million within the digital asset ecosystem, in keeping with Coinglass. Throughout Bitcoin’s ascent, brief positions have been battered, whereas then lengthy positions received liquidated because of Coinbase’s technical snag.

Based on Coinglass, the $300 million liquidation in Bitcoin, cut up between roughly $200 million shorts and $100 million longs, represents the most important brief liquidation occasion previously three months.

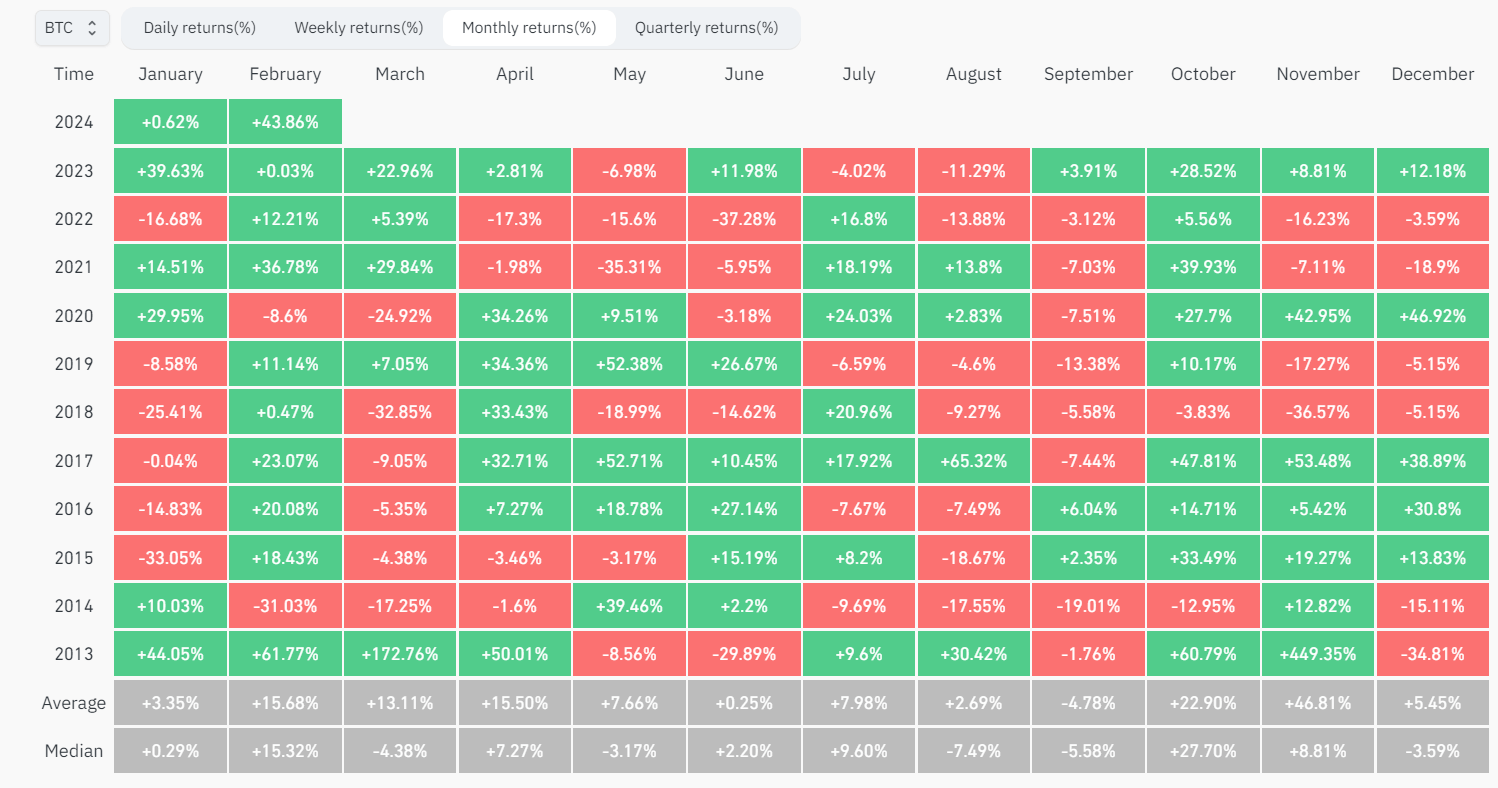

Wanting past the tumultuous 24 hours, Bitcoin continues its upward development, notching a 44% acquire in February alone. If the momentum holds via the final day of the month, Bitcoin will shut with six consecutive months of beneficial properties – a month-to-month efficiency not seen since December 2020, in keeping with Coinglass.

The put up Bitcoin eyes six-month profitable streak amid $300 million in BTC liquidations appeared first on CryptoSlate.