Onchain Highlights

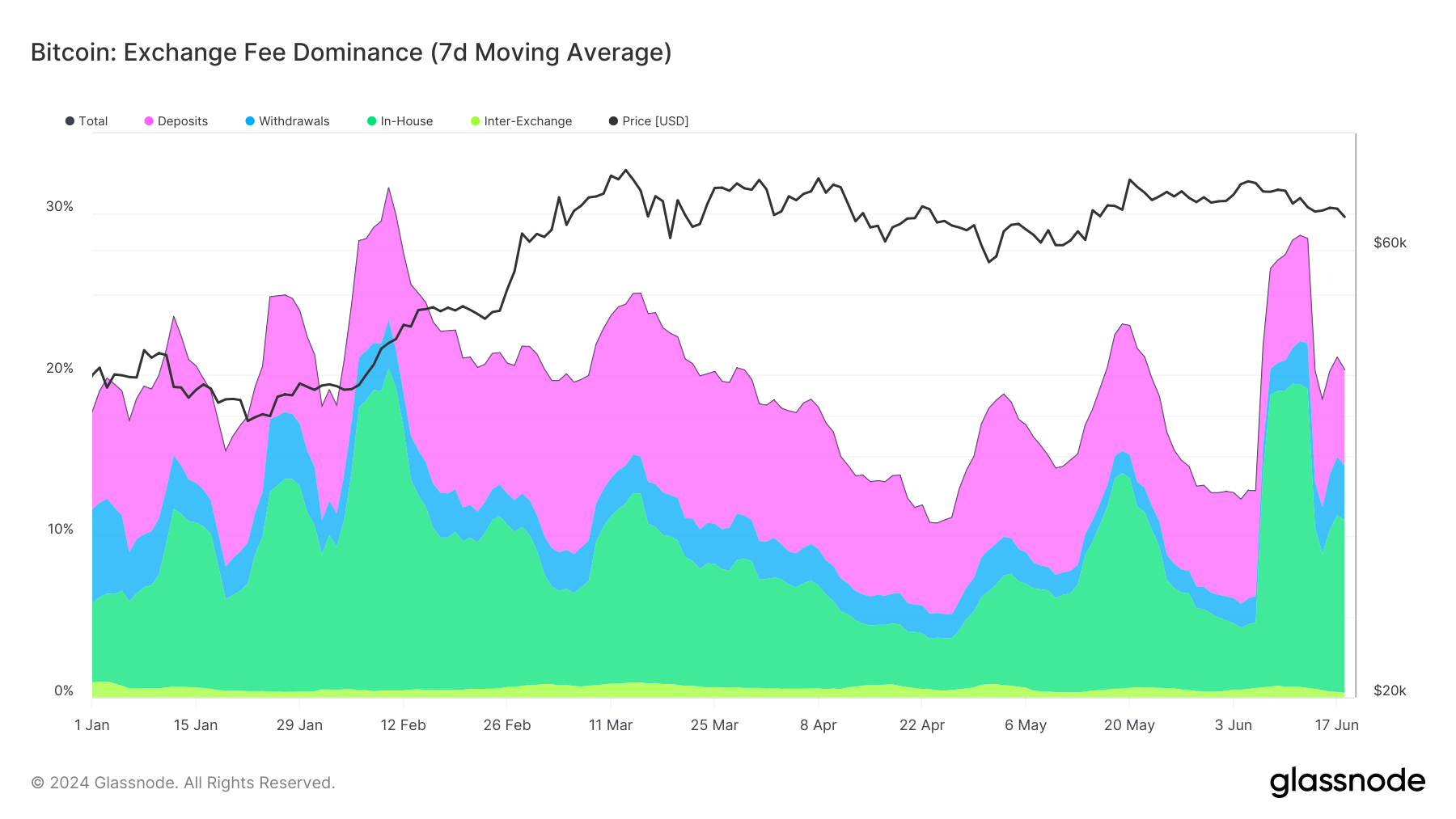

DEFINITION: The Alternate Charge Dominance metric is outlined because the p.c quantity of whole charges paid in transactions associated to on-chain trade exercise.

- Deposits: Transactions that embrace an trade tackle because the receiver of funds.

- Withdrawals: Transactions that embrace an trade tackle because the sender of funds.

- In-Home: Transactions that embrace addresses of a single trade as each the sender and receiver of funds.

- Inter-Alternate: Transactions that embrace addresses of (distinct) exchanges as each the sender and receiver of funds.

Bitcoin’s trade price dominance, represented as a 7-day transferring common, has proven important fluctuations for the reason that starting of 2024. Notably, the dominance of charges related to deposits, withdrawals, in-house transfers, and inter-exchange transactions has skilled intervals of sharp improve and decline.

In early 2024, a pronounced surge in exchange-related charges occurred, peaking round early February. This spike was primarily pushed by heightened exercise in deposits and in-house transactions. Because the 12 months progressed, trade price dominance displayed a cyclical sample with notable peaks in mid-Could and mid-June, coinciding with elevated market exercise and potential strategic repositioning by buyers.

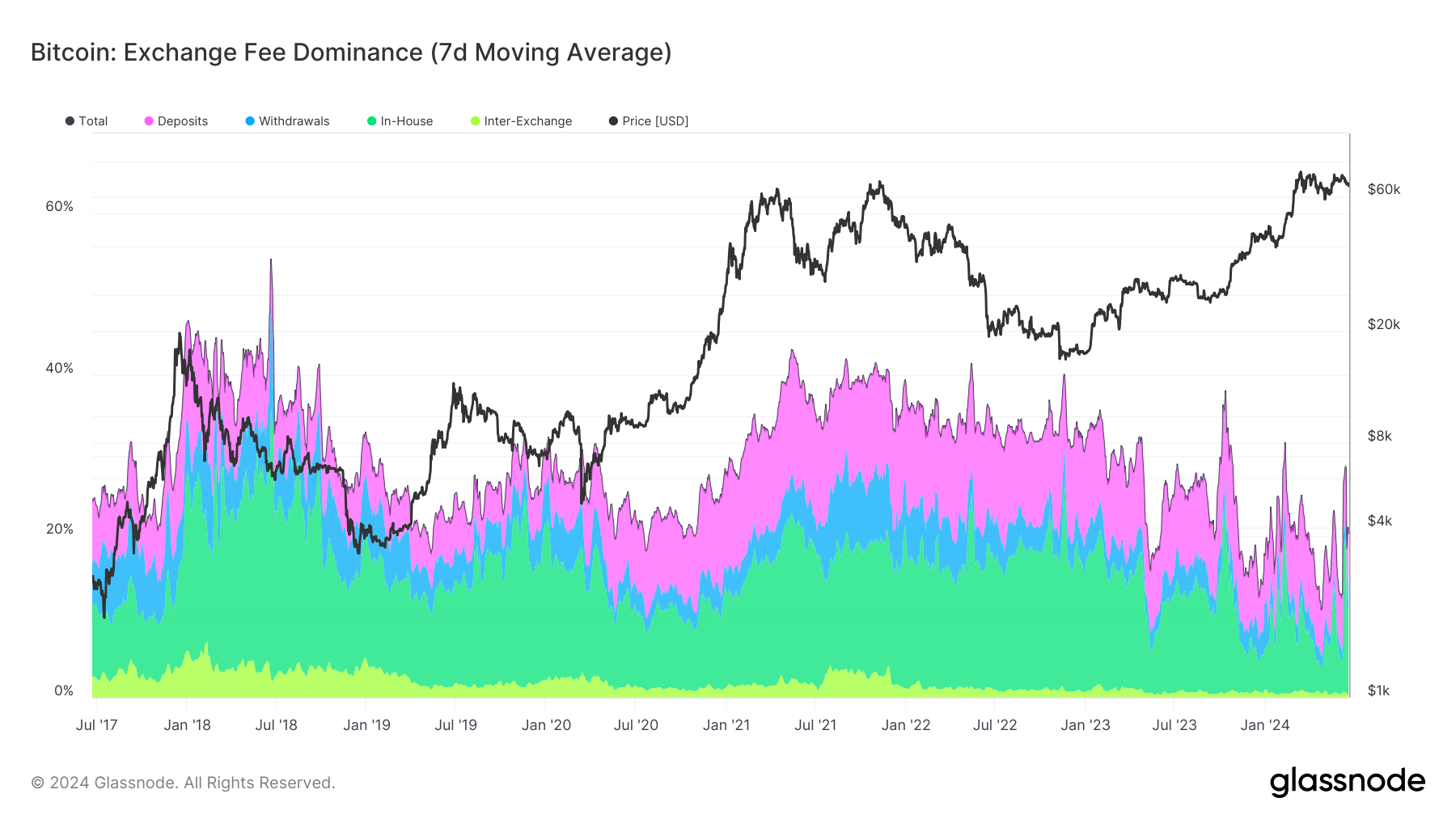

Comparatively, long-term knowledge since 2017 reveal a broader development of trade price dominance aligning intently with main market actions. Important spikes in exchange-related charges corresponded with vital worth milestones, such because the bull runs of late 2017 and early 2021. These intervals have been marked by substantial market volatility, reflecting elevated buying and selling quantity and better on-chain trade exercise.

Latest knowledge recommend that Bitcoin’s post-halving worth and trade price dominance principally correlate, reflecting broader market circumstances and investor habits. This ongoing interaction emphasizes the importance of exchange-related actions within the Bitcoin ecosystem, influencing transaction prices and total market liquidity.