Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin continues to commerce inside a decent vary, consolidating under the $85,000 mark and holding above the $81,000 help zone. Bulls are making efforts to reclaim larger ranges and spark a restoration rally, however persistent macroeconomic uncertainty and rising issues over world commerce tensions proceed to weigh on market sentiment.

Associated Studying

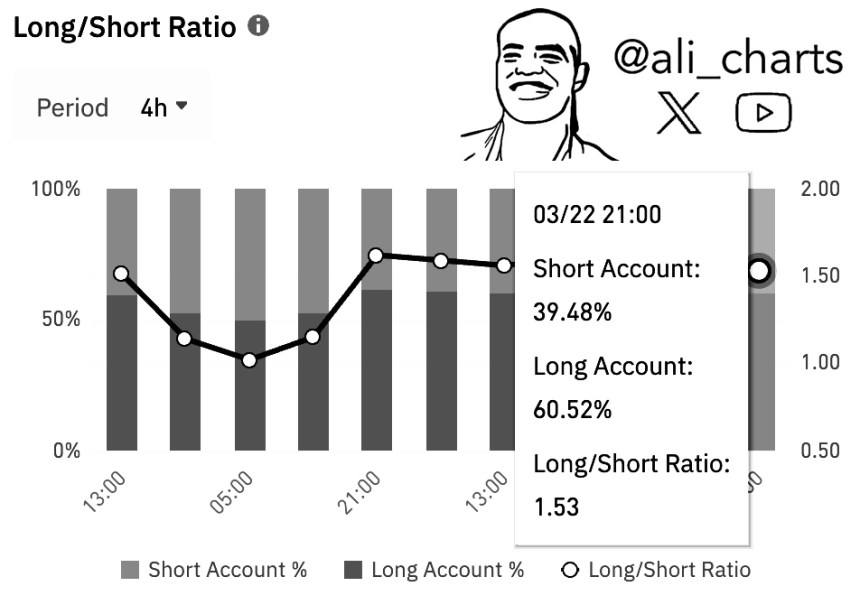

The shortage of momentum in both path has left Bitcoin range-bound for the previous a number of classes. Nonetheless, optimism stays amongst futures merchants. In keeping with current information, 60.52% of merchants with open Bitcoin positions on Binance Futures are presently holding lengthy positions, suggesting a majority nonetheless consider in an upside breakout.

This bullish leaning amongst leveraged merchants highlights rising expectations that Bitcoin may get better as soon as broader market sentiment improves. Nonetheless, the consolidation sample stays in place till BTC can break decisively above the $85K stage and goal $88K or larger.

If bulls fail to reclaim resistance quickly, the chance of a breakdown under $81K will increase, probably triggering a deeper correction. As uncertainty dominates headlines, Bitcoin stays at a crossroads, and merchants proceed to observe intently for a catalyst to drive the following main transfer.

Bitcoin Buyers Cut up On Market Path As Lengthy Positions Dominate Futures

After months of volatility and a pointy correction from Bitcoin’s January all-time excessive, some market individuals are making ready for a chronic bear market. Sentiment amongst this group is pushed by persistent macroeconomic uncertainty, erratic world coverage shifts, and rising issues of recession, all of which have shaken confidence throughout each crypto and conventional markets.

Nonetheless, a extra optimistic view persists amongst analysts who argue that the present worth motion is solely a wholesome correction inside a bigger bull cycle. They consider that Bitcoin is present process an ordinary consolidation part following its parabolic transfer in late 2024. The structural fundamentals supporting Bitcoin—together with rising institutional curiosity and broader adoption—stay intact.

Supporting this view, prime analyst Ali Martinez shared a key metric on X: the Bitcoin Lengthy/Quick Ratio on Binance Futures. Martinez revealed that 60.52% of merchants with open BTC positions are presently leaning lengthy, signaling a bullish sentiment amongst futures merchants.

This bullish skew in leveraged positions suggests {that a} potential breakout could also be on the horizon. If bulls can reclaim resistance ranges close to $88K and push above the $90K mark, it may verify the beginning of a restoration rally and assist restore confidence.

Associated Studying

Till then, indecision continues to dominate the market, and Bitcoin stays trapped in a decent vary the place each situations—a deeper correction or a bullish breakout—stay on the desk.

BTC Worth Vary Narrows As Key Resistance Holds Robust

Bitcoin (BTC) is buying and selling at $84,200 after a number of days of tight consolidation between the $87,000 resistance and the $81,000 help stage. Regardless of current makes an attempt to push larger, bulls have struggled to interrupt by way of key resistance, leaving the value vary certain and susceptible to sudden volatility.

At present, BTC sits roughly 4% under the 4-hour 200-day Shifting Common (MA) and Exponential Shifting Common (EMA). These indicators, now performing as dynamic resistance round $87,300, are broadly watched by merchants as essential short-term pattern indicators. Reclaiming this zone as help could possibly be the catalyst for a restoration rally towards the $90,000 mark, serving to shift sentiment again in favor of the bulls.

Associated Studying: Buyers Withdraw 360,000 Ethereum From Exchanges In Simply 48 Hours – Accumulation Development?

Nonetheless, the failure to interrupt above this technical ceiling raises issues. If worth motion stays weak and fails to retake the 200 MA and EMA within the coming classes, the probability of a drop under the $81,000 help will increase. Such a transfer wouldn’t solely set off contemporary promoting strain however may additionally ship BTC into deeper correction territory.

Featured picture from Dall-E, chart from TradingView