On-chain information reveals Bitcoin has not too long ago made a break that led to rallies of a minimum of 99% over the last 3 times it occurred.

Bitcoin Has Now Crossed Above “Single Cycle HODLers” Price Foundation

In a brand new post on X, analyst Ali has talked a few stage that BTC has damaged not too long ago. The extent in query is the fee foundation of the single-cycle Bitcoin long-term holders. The phrases could also be unfamiliar, so right here’s what they imply, one after the other.

First, the “long-term holders” (LTHs) right here check with the traders who’ve been holding onto their cash since a minimum of 155 days in the past. The LTHs are made up of the resolute diamond fingers or HODLers, who not often promote even when volatility happens out there.

Subsequent, the “single cycle HODLers” particularly check with these LTHs who purchased throughout the span of a single BTC cycle. Their vary is usually taken to be 6 months to three years. Which means that the oldest amongst these traders (with cash aged 3 years) would have gone by means of the complete chaos of the present cycle, from the highs of the 2021 bull to the lows of the 2022 bear.

Lastly, “price foundation” refers back to the common shopping for worth of a gaggle of Bitcoin traders. If the spot worth of the cryptocurrency is buying and selling beneath this worth, it signifies that the cohort in query is in a state of web loss. Equally, the asset being above implies the dominance of earnings.

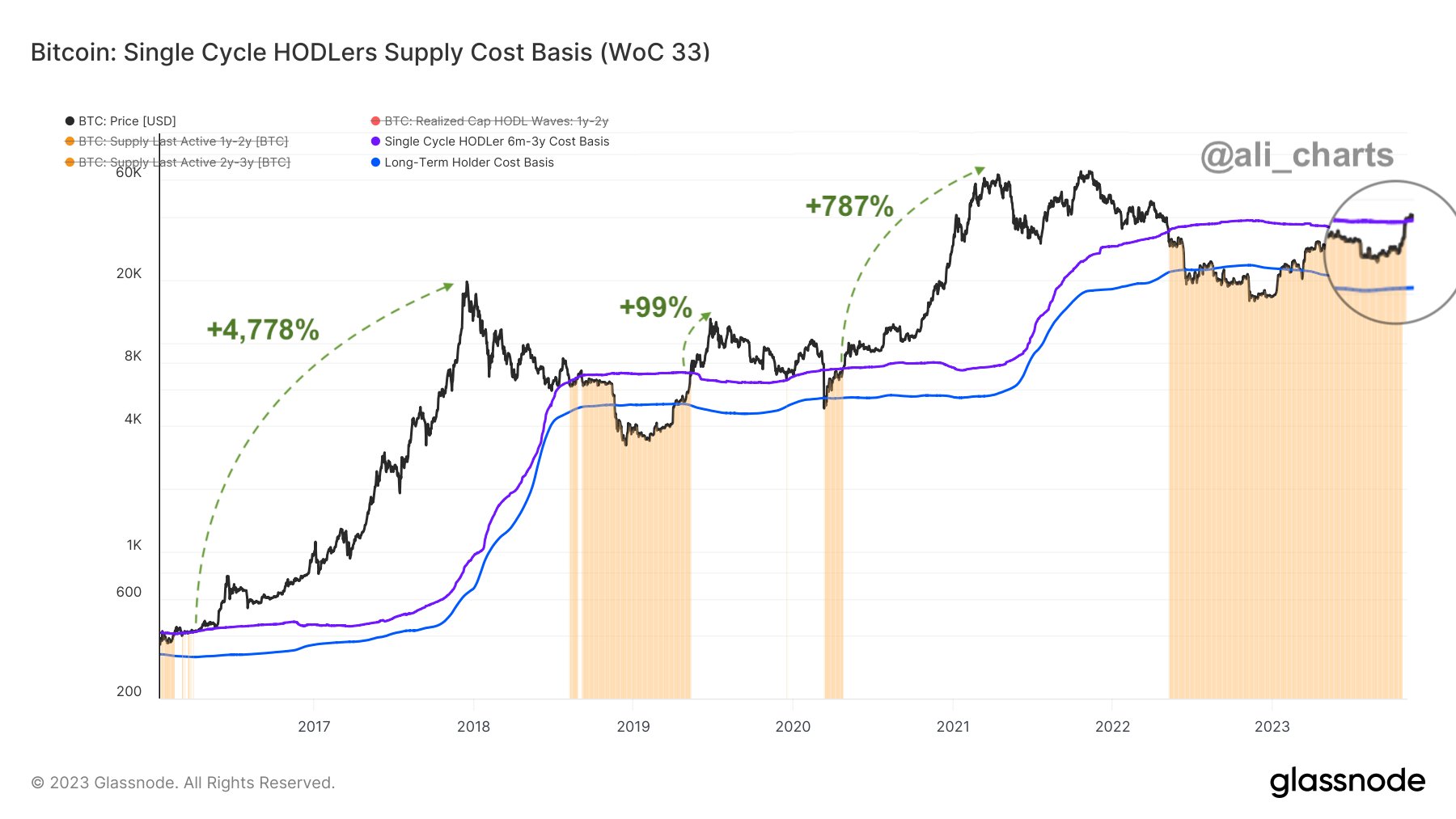

Now, here’s a chart that reveals the development in the fee foundation of the single-cycle LTHs over the previous few years:

Seems to be like the worth of the asset has interacted with this stage in latest days | Supply: Glassnode on X

Presently, this metric has a price of $34,150, which signifies that Bitcoin has already surged above it with the most recent rally. Which means that the common single cycle HODLer who had been in losses because the first half of 2022 has now lastly returned to earnings.

Within the graph, Ali has additionally highlighted the trajectory that BTC adopted over the last 3 times a break above this stage happened. It might seem that every of the final two main bull rallies occurred after the breaks that happened in 2016 and 2020, respectively.

From the purpose of this breach, the cryptocurrency loved returns of 4,778% and 787% over the course of the respective rallies. The restoration rally that began in April 2019 additionally noticed a break of this price foundation, following which BTC registered good points of 99%.

If this sample of the only cycle HODLer price foundation paving the best way for a Bitcoin rally is something to go by, then the asset might probably see a surge now that it has as soon as once more damaged above it.

As Bitcoin’s present rally is most just like the April 2019 restoration rally, it’s potential that, if a surge does happen, it could be extra consistent with this rally, quite than the full-blown bull runs.

BTC Value

Bitcoin has gone silent not too long ago because it has solely registered good points of two% up to now week, with the worth now floating above $35,200.

BTC has been caught in consolidation not too long ago | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, Glassnode.com