Whereas Bitcoin treads water round $50,000, with some predicting a hunch, one analyst on X is swimming in opposition to the present, claiming the coin has “by no means been this bullish.” The coin is bullish regardless of cooling off from 2024 highs above $54,000.

Analyst: Bitcoin Is Bullish, Right here’s Why

The analyst Mags argues that Bitcoin is, at spot charges, defying historic patterns and exhibiting bullish indicators, particularly trying on the candlestick preparations. Particularly, Bitcoin not too long ago closed a weekly candle above the 0.618 Fibonacci stage earlier than the following halving occasion. Mags mentioned that is the primary time within the four-year cycle.

Due to this fact, although Bitcoin costs have been transferring horizontally up to now few buying and selling days, with fears of worth slumps, the event within the weekly chart is overly bullish. Additional bolstering their optimism, Mags factors to the rising demand for Bitcoin from institutional traders following the launch of spot Bitcoin exchange-traded funds (ETFs).

Wall Avenue heavyweights, together with Constancy, difficulty a few of these merchandise. BitMEX Analysis information shows that spot ETFs proceed to siphon increasingly cash from circulating provide, sending them to custodians, like Coinbase Custody, for safekeeping. These cash will probably be launched within the coming years, not months.

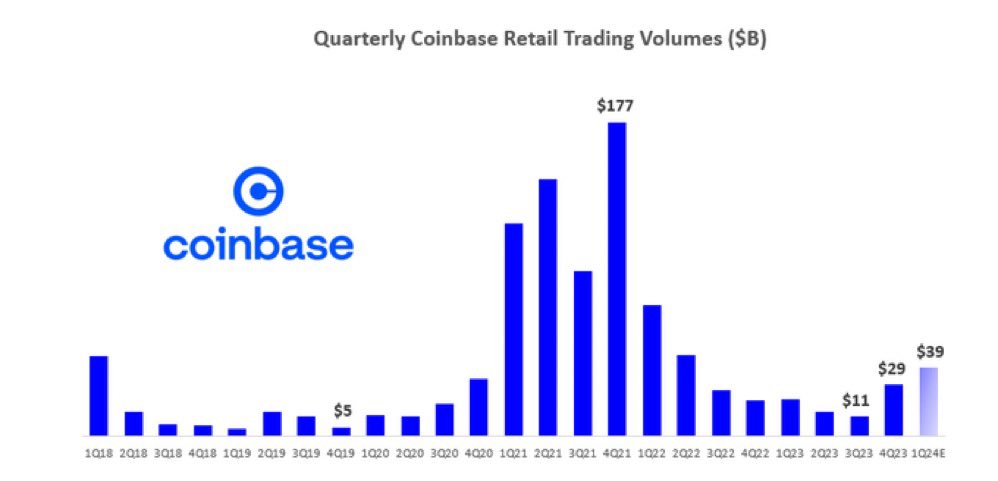

Apart from institutional curiosity, optimism for extra worth positive factors additionally stems from the absence of retail curiosity at spot charges. Knowledge from Coinbase exhibits that not like the spike in curiosity that drove Bitcoin to $70,000, primarily in the back of retailers, BTC costs are up, however the dynamics are altering.

Will Retailers Take BTC To New Ranges?

Stable information reveals that retailers are largely not within the coin at spot charges, trying on the quantity retailers have been spending on the coin. By This fall 2021, retailers buying Bitcoin through Coinbase spent roughly $177 billion. Nonetheless, this determine sharply fell all through 2022 through the bear market, discovering help in H2 2023.

Then, based on alternate information shared by Will Clemente on X, retailers started loading the coin from Q3 2023. The determine has risen to round $39 billion in Q1 2024–lower than 25% of This fall 2021 volumes.

How retailers will influence the value of Bitcoin sooner or later is but to be seen. Prior to now, retail worry of lacking out (FOMO) has been a important worth driver. Presently, CoinStats sentiment tracker, Concern & Greed indicator, stands at 74, at “greed” territory, down from “excessive greed” on February 22.

This discount could possibly be doable due to the faux breakout that lifted Bitcoin above $53,000. The coin has help at $50,500 however typically stays in a bullish sample.

Function picture from DALLE, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site fully at your individual threat.