Este artículo también está disponible en español.

Bitcoin not too long ago noticed a 9% retrace from its all-time excessive of $99,800, narrowly lacking the psychological $100K milestone. The pullback introduced BTC all the way down to a low of $90,700 on Tuesday, sparking concern amongst some traders.

Nonetheless, the worth has since recovered, displaying resilience because it climbs again towards key resistance ranges. Regardless of the volatility, Bitcoin’s long-term bullish construction stays intact, with market sentiment leaning optimistic.

Associated Studying

Prime analyst Axel Adler has offered key on-chain insights that counsel that the sturdy demand for Bitcoin persists at present ranges.

Based on Adler, this shopping for exercise signifies that traders view pullbacks as alternatives to build up, underscoring confidence in Bitcoin’s potential for additional development. Nonetheless, he additionally highlighted strong assist at lower cost ranges, which might come into play if the present restoration fails to maintain.

The following few days shall be essential as Bitcoin exams its potential to reclaim momentum and probably break by the $100K barrier. With demand remaining sturdy and market circumstances aligning for a possible breakout, all eyes are on whether or not BTC can maintain its upward trajectory or if additional consolidation is on the horizon. The stage is ready for a decisive transfer in Bitcoin’s value motion.

Bitcoin Information Reveals Buyers’ Entry Costs

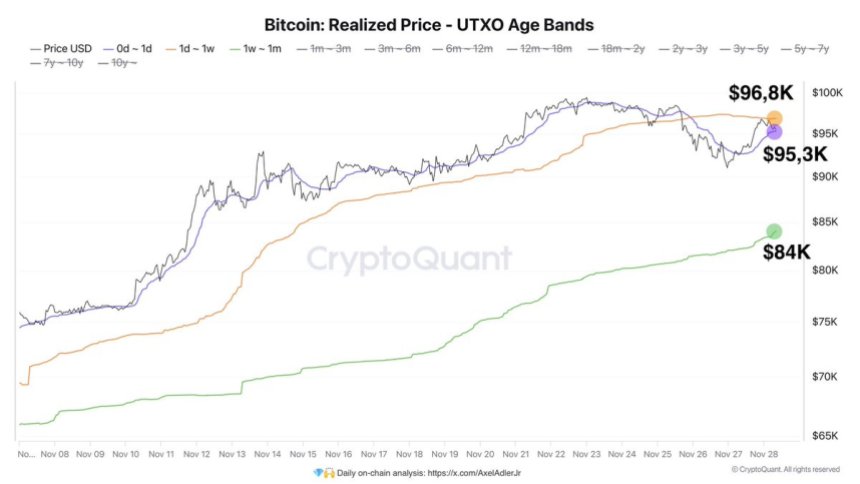

Bitcoin continues to showcase extraordinarily bullish value motion, pushed by growing demand from institutional and retail traders. Key on-chain information from CryptoQuant analyst Axel Adler highlights vital value dynamics shaping the present market.

Based on Adler, Bitcoin’s value is presently consolidating throughout the common buy vary of two key investor cohorts: the 1D ($96.8K) and the 1D-1W ($95.3K). These ranges act as essential assist zones, reflecting sturdy purchaser curiosity at present costs.

Moreover, the common buy degree within the 1W-1M vary, positioned at $84K, supplies an additional layer of assist in case of a broader market pullback. This means that even in a extra bearish state of affairs, Bitcoin will possible discover stability round $84K earlier than resuming its upward trajectory.

The information reinforces a extensively held bullish outlook for Bitcoin amongst analysts and traders, a lot of whom consider the present cycle continues to be in its early phases. The sturdy demand and sturdy assist ranges counsel that Bitcoin is well-positioned to keep up its bullish momentum within the weeks forward.

Associated Studying

Whether or not BTC holds above its present ranges or experiences a short lived dip, the consensus stays optimistic about additional beneficial properties, with this cycle probably marking a historic run for the cryptocurrency.

BTC Nears $100K

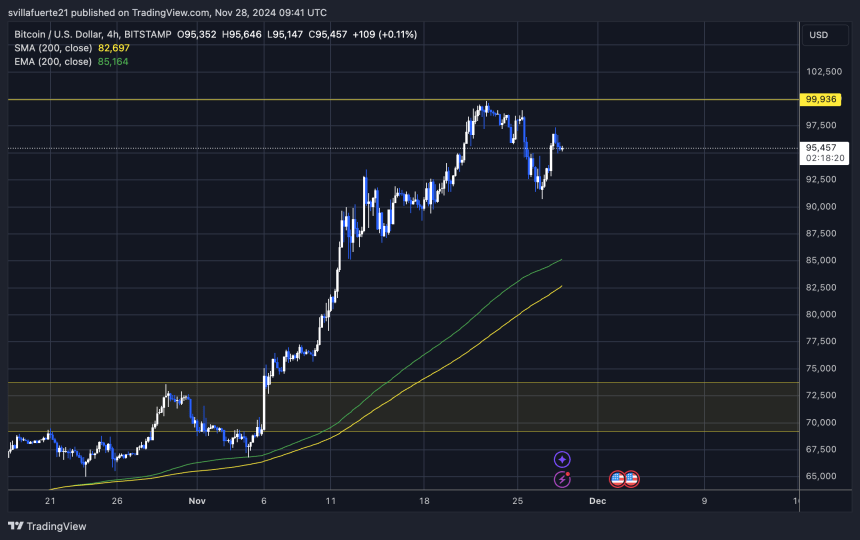

Bitcoin is at the moment buying and selling at $95,200, a pivotal degree that might decide its subsequent main transfer. This value level serves as a vital threshold, and if Bitcoin holds above it, the stage could be set for a possible check of the extremely anticipated $100,000 degree.

Earlier than reaching this psychological milestone, the subsequent vital provide zone lies at $98,800. A break above this degree would possible set off an enormous breakout, propelling BTC past its all-time excessive and into six-figure territory for the primary time.

Nonetheless, the stakes stay excessive. Bitcoin might face a deeper correction if it fails to keep up its place above the $90,000 degree. In such a state of affairs, the subsequent sturdy assist is at $85,500, a vital degree that would wish to carry to protect Bitcoin’s bullish construction.

Associated Studying

Market members intently monitor these key ranges, as Bitcoin’s trajectory will affect broader market sentiment. With sturdy demand and momentum, the approaching days shall be pivotal in figuring out whether or not BTC surges previous $100,000 or consolidates additional earlier than resuming its bullish run. Because the market stays extremely dynamic, merchants and traders are bracing for vital strikes forward.

Featured picture from Dall-E, chart from TradingView