In accordance with knowledge from CoinMarketCap, Bitcoin at the moment hovers close to the $62,000 worth mark with no important motion previously day. Notably, the premier cryptocurrency has slipped right into a minor consolidation state for the reason that little beneficial properties recorded on Friday. Nonetheless, for long-term merchants, Bitcoin has remained in a range-bound motion stretching to March. And whereas many buyers are extremely expectant of a bullish breakout in This fall 2024, sure market situations have to be met.

Associated Studying: Bitcoin Futures Liquidation Types Native Worth Backside — A Return To $65,000 Inevitable?

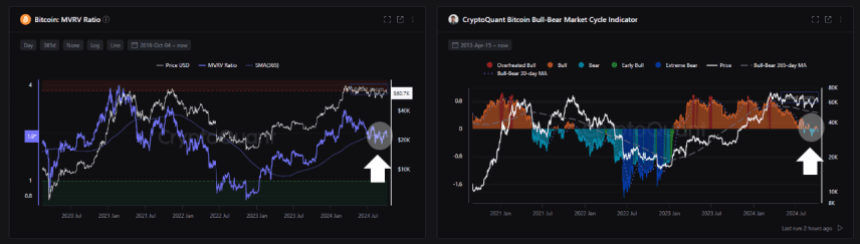

Bitcoin MVRV, CQ Bull & Bear Indicators Present Market Uneasiness

In a Quicktake submit on CryptoQuant, an analyst with username burakkesmeci shares that the Bitcoin market is at the moment set for key worth actions. Based mostly on the MVRV Ratio and CQ Bull & Bear metric, burakkesmeci notes that Bitcoin buyers are presently exhibiting a major stage of market anticipation.

For context, the MVRV Ratio compares the present worth of Bitcoin to its realized worth i.e. the worth at which the asset final moved on-chain. It’s typically used to point if Bitcoin is undervalued or overvalued relative to its realized worth.

When the MVRV ratio crosses above its 365-day Easy Shifting Common (SMA 365), it signifies a bullish development as buyers are seeing a year-to-date achieve on their belongings. Nonetheless, burakkesmeci notes that Bitcoin’s MVRV at the moment at 1.90 has been hovering just under its SMA 365 (2.03) since July exhibiting the BTC market stays in a gentle place ready for a breakout.

The analyst has additionally noticed the same sample within the CQ Bull & Bear indicator which measures current worth motion relative to longer-term worth actions. In accordance with burrakesmeci, the CQ Bull & Bear metric has been oscillating barely beneath its SMA 365 (0.46) since August imposing the notion that the Bitcoin market is in a holding sample.

Components That Will Spark A Bitcoin Rally

For Bitcoin to expertise a bullish breakout from its present holding place, burakkesmeci highlights sure occasions that should happen. First, he notes that the Federal Reserve should absolutely interact in a rate-cut cycle, step by step decreasing rates of interest over time. Curiously, following a 50 foundation factors lower in September, market specialists are tipping the Fed to implement one other 25% lower at their subsequent FOMC assembly in November.

One other bullish issue highlighted by burakkesmeci is an impending quantitative easing which is able to see the US authorities inject liquidity into the economic system. It’s anticipated that larger liquidity will enable people to discover dangerous investments equivalent to Bitcoin.

On the time of writing, Bitcoin trades at $62,009 with a 0.02% loss previously 24 hours. In the meantime, the asset’s each day buying and selling quantity is down by 53.80% and valued at $12.97 billion.