The worth of Bitcoin seems to have returned to a uneven market situation, quashing any hopes of a breakout to new highs quickly. Nevertheless, the excellent news is that the present bull cycle should still not be over, although it’s taking some time for the premier cryptocurrency to renew its upward momentum.

Particularly, the newest on-chain remark exhibits that Bitcoin has been going by means of a “euphoria wave” over the previous few months. Right here’s the implication of this section on the present bull run.

How Outdated Is The Present Bitcoin ‘Euphoria Wave’?

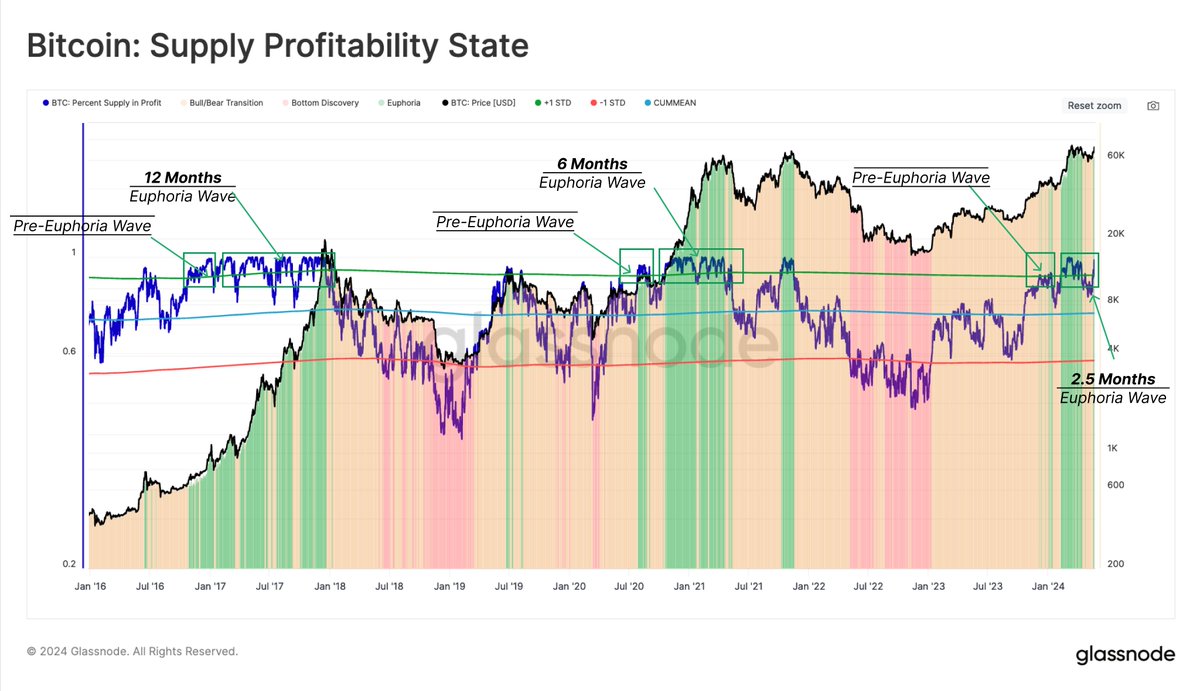

Blockchain intelligence agency Glassnode revealed through a put up on the X platform that Bitcoin has entered the euphoria section of the market cycle. This on-chain remark relies on the “% Provide in Revenue” metric, which measures the proportion of the overall circulating Bitcoin provide that’s at present in revenue.

Associated Studying

Based on Glassnode, the “Euphoria Wave” is recognized as a interval throughout which the availability in revenue normally fluctuates across the 90% degree. This section usually lasts between 6 to 12 months and is characterised by elevated investor sentiment and heightened market hypothesis.

Glassnode’s information exhibits that 93.4% of the circulating Bitcoin provide is at present within the inexperienced and that the Euphoria Wave is “comparatively younger”. The on-chain analytics platform famous that the euphoria section has solely been energetic for about two and a half months.

As with each section available in the market cycle, the Euphoria Wave will finally come to an finish sooner or later. Traditionally, the euphoria section can sign tops and is normally adopted by a cooling-off interval, which is marked by a downturn within the worth of Bitcoin.

If the final cycle – with a 6-month Euphoria Wave – is something to go by, then there would possibly nonetheless be about three to 4 months within the present bull run. Finally, the present profitability of the premier cryptocurrency could show pivotal within the period of its bull cycle and general future trajectory.

Rise Of BTC Accumulation Addresses Continued In Could: Analyst

One of many tell-tale indicators of the bullish sentiment round Bitcoin is the continual rise in accumulation addresses. Based on an on-chain analyst on CryptoQuant’s platform, there was a notable improve within the variety of new BTC accumulation addresses.

The analyst identified the continuity of this constructive development regardless of BTC’s comparatively sluggish worth motion in Could. In the meantime, the big Bitcoin holders have additionally continued to load their baggage, with important purchases recorded over the previous month.

Associated Studying

As of this writing, Bitcoin is valued at $67,744, reflecting a mere 0.4% improve within the final 24 hours. Based on information from CoinGecko, the pioneer cryptocurrency is up by about 15% up to now month.

Featured picture from iStock, chart from TradingView