Whereas decentralized finance (defi) has created a plethora of protocols that make it so crypto belongings can collect a yield, ten and a half years in the past a bitcoin trade known as Bitcoinica launched the primary curiosity accruing system for bitcoin deposits. Regardless of being the primary to check the waters, Bitcoinica finally went bust after a collection of hacks that noticed roughly 62,101 bitcoin stolen from the trade, and interest-bearing crypto accounts didn’t return till eight years later.

Bitcoin Curiosity-Bearing Accounts Had been Launched by Bitcoinica in 2012

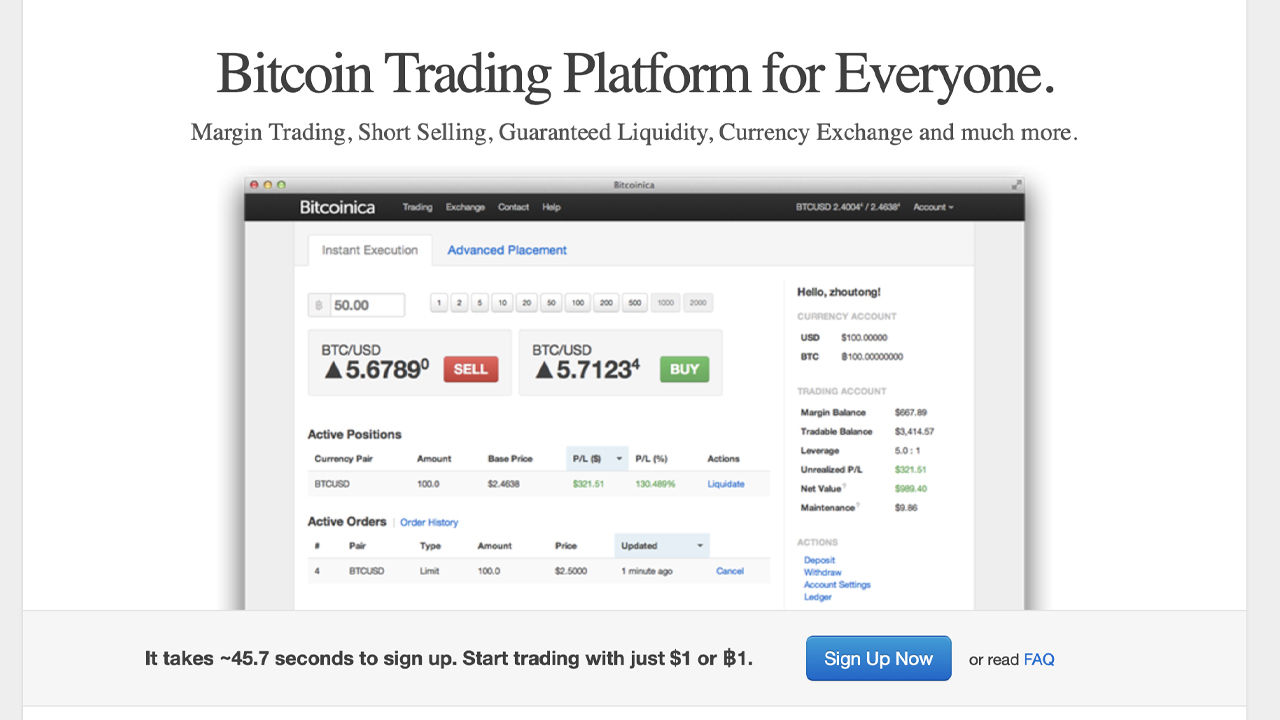

Lately, interest-bearing accounts and yield-gathering defi protocols are all the trend on the planet of cryptocurrency, however most individuals don’t know that the concept was launched greater than a decade in the past. In mid-February 2012, the now-defunct bitcoin trade, Bitcoinica, developed an concept that allowed bitcoin deposits on the trade to collect curiosity. The thought was introduced by the 18-year-old Zhou Tong, a bitcoin fanatic who based the trade the 12 months earlier than. Bitcoinica noticed 3,724.12 BTC, value $71.56 million at this time, traded in the course of the buying and selling platform’s first 24 hours of operation.

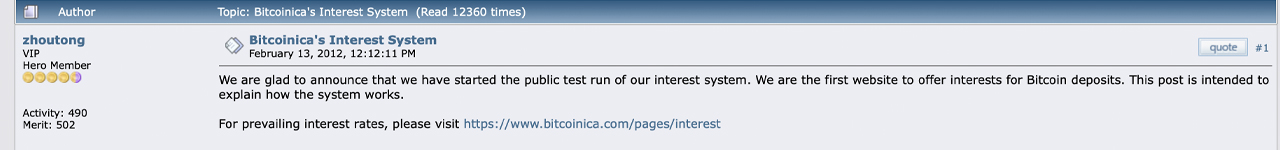

By September 2011, Bitcoinica was the second-largest bitcoin buying and selling platform by quantity behind Mt Gox. “We’re glad to announce that we’ve got began the general public take a look at run of our curiosity system,” the Bitcoinica founder wrote on February 13, 2012. “We’re the primary web site to supply curiosity for Bitcoin deposits. This put up is meant to elucidate how the system works — Assuming you deposit $10,000 with us and the rate of interest is all the time 4.17, you’ll get $4.17 each day or $1,644 yearly (with compound curiosity).”

A substantial amount of at this time’s interest-bearing protocols stems from the world of decentralized finance (defi), which is a complete lot completely different than Bitcoinica’s interest-bearing account providing. Bitcoinica’s idea is just like what centralized crypto exchanges like Coinbase, Crypto.com, and plenty of others provide at this time, as Bitcoinica was a centralized bitcoin buying and selling platform.

Bitcoinica was just like Celsius, in a way, because it supplied interest-bearing funds however finally went beneath from monetary difficulties. Bitcoinica’s curiosity accounts had been calculated each hour, and payouts had been distributed after every day ended. “Bitcoinica has been operating nice for the final [five] months, and we’re the quickest rising bitcoin enterprise ever,” Zhou Tong wrote on the time.

After the Bitcoinica interest-bearing accounts had been launched, the very subsequent month Bitcoinica was hacked and misplaced 43,554 bitcoins value $837.17 million utilizing at this time’s trade charges. Then greater than a month later, on Could 11, 2012, Bitcoinica was hacked once more dropping 18,547 bitcoins, value roughly $356.50 million at this time.

Crypto Yields took 8 years to Mature After Bitcoinica’s Collapse

The interest-bearing accounts by way of Bitcoinica by no means actually noticed traction after the controversy that surrounded the Bitcoinica founder Zhou Tong and the mysterious hacks. Bitcoinica was finally taken offline and by August 2012, the corporate entered into liquidation. Apparently sufficient, the very day Zhou Tong introduced the BTC interest-bearing account idea, one of many first feedback requested the founder to guarantee the group that their funds had been secure.

“Soothe our fears and inform us why Bitcoinica won’t be hacked, and inform us about how our cash won’t be stolen out of skinny air?” the person requested the Bitcoinica founder. Whereas Zhou Tong pledged to maintain the trade secure, the buying and selling platform’s two breaches had been thought of among the most controversial hacks in crypto historical past, moreover the scandals surrounding Mt Gox.

It took greater than eight years to see crypto interest-bearing accounts lastly take maintain within the digital forex business. Furthermore, with defi protocols, yields could be earned in a personal and noncustodial vogue with out holding crypto belongings on a centralized trade.

Nonetheless, very similar to Bitcoinica, interest-bearing crypto platforms can fail, and Celsius is one such lender that went bankrupt in current instances. Whereas Celsius and Bitcoinica had been centralized, defi platforms can go beneath too, like when the Terra blockchain ecosystem imploded.

When UST de-pegged from the $1 parity, defi customers leveraging the lending utility Anchor Protocol they needed to cope with the financial institution run that adopted. Different defi functions have been hacked or have seen rug pulls, and defi customers seeking to acquire curiosity have misplaced all their cash.

What do you concentrate on the primary bitcoin interest-bearing accounts supplied by Bitcoinica greater than a decade in the past? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any harm or loss triggered or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.