Information from Glassnode suggests Bitcoin is presently within the historic bear market to bull market transition interval.

Bitcoin Correlation Between Value And Provide In Revenue Has Not too long ago Been Beneath 0.75

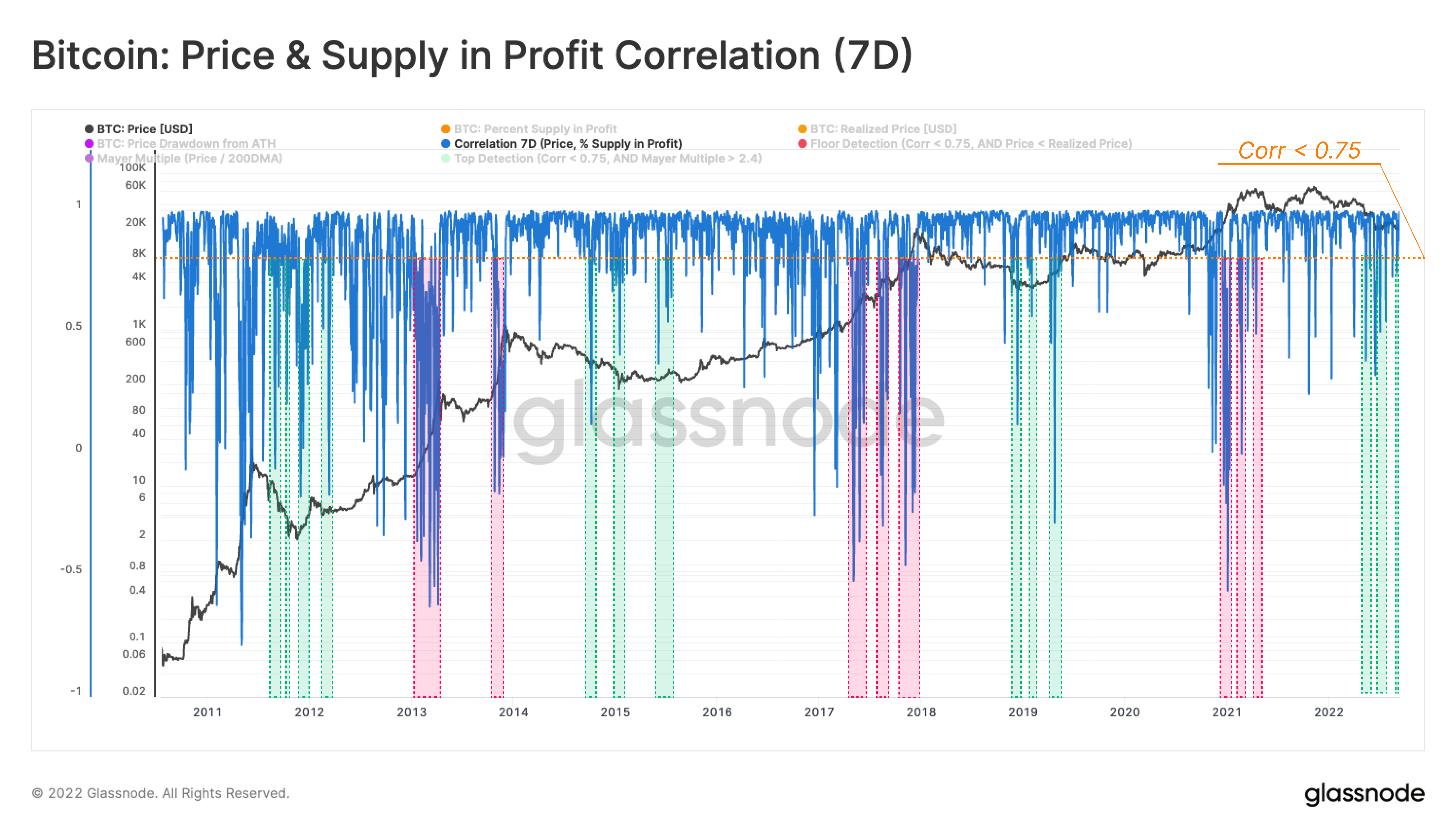

As per a current report by Glassnode, the BTC correlation between the worth and the availability in revenue typically observes a number of drops under 0.75 throughout transitional intervals.

The “provide in revenue” is an indicator that measures the proportion of the entire Bitcoin provide that’s holding some revenue proper now.

The metric works by wanting on the on-chain historical past of every coin to see what value it was final moved at. If this earlier promoting value is lower than the present BTC worth for any coin, then that exact coin has some unrealized earnings in the mean time.

The correlation between the crypto’s value and its provide in revenue tells us whether or not the 2 metrics have been shifting in the identical path or not.

Now, here’s a chart that reveals the development on this Bitcoin correlation over the historical past of the crypto:

The worth of the metric has been low a number of occasions in current days | Supply: Glassnode's Market Pulse

At any time when the correlation is optimistic, it means the worth and the availability in revenue are each shifting in the identical path. Then again, unfavorable values suggest they’re going reverse methods.

As you’ll be able to see within the above graph, Bitcoin has traditionally had values above 0.9 for a majority of the time throughout every of the earlier value cycles.

Nonetheless, in periods of transition between bull markets and bear markets (in addition to vice versa), the indicator often observes a number of drops under 0.75.

In keeping with the report, these deviations happen within the case of bear to bull transitions as a result of at late bear market phases, sellers flip exhausted whereas the remaining traders develop into reluctant to maneuver their funds out of frustration, thus reducing the correlation between value and provide in revenue.

And through the reverse transitions, the availability in revenue typically surges to nearly 100% (as the worth rises to a brand new ATH), thus diminishing any correlation with the worth.

Not too long ago, the indicator has noticed a number of plunges under the 0.75 threshold, suggesting that Bitcoin is presently within the historic bear to bull transition zone.

BTC Value

On the time of writing, Bitcoin’s value floats round $19.1k, down 4% within the final seven days. Over the previous month, the crypto has misplaced 10% in worth.

The under chart reveals the development within the BTC value during the last 5 days.

Seems to be like the worth of the crypto hasn't proven a lot motion up to now few days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com