Lengthy positions on Bitcoin have hit an all-time excessive on Bitfinex as they spike over 60% in a day. The spike is likely one of the most aggressive strikes up that has ever been seen on the change. The earlier all-time excessive was hit in July 2021 with the BTCUSD Longs product being first launched in August 2017.

The historical past of lengthy positions on Bitfinex can maybe give some perception into the state of the market and the place we might be headed subsequent. Some analysts are on the lookout for the final time that longs peaked to recommend that there could also be a respite within the downward motion of the market forward.

A evaluation of the BTCUSD Shorts product additionally makes attention-grabbing studying. On the weekly chart, there’s a lengthy wick up in the direction of 7500 earlier than a weekly shut of 3111. This means that the quick positions took benefit of the volatility out there throughout the previous week however have now closed out positions. When that is paired with the 60% improve in lengthy positions it signifies bullish sentiment for the market general.

Bitfinex CTO, Paolo Ardoino called the occasion “accumulation” suggesting that he agrees Whales are buying Bitcoin at a reduced worth. He went on to say,

“Some whales are rising their current longs rather a lot. Remember that he might hedge himself elsewhere, so not essentially bullish (though I’m by nature)” (from Italian through Google Translate)

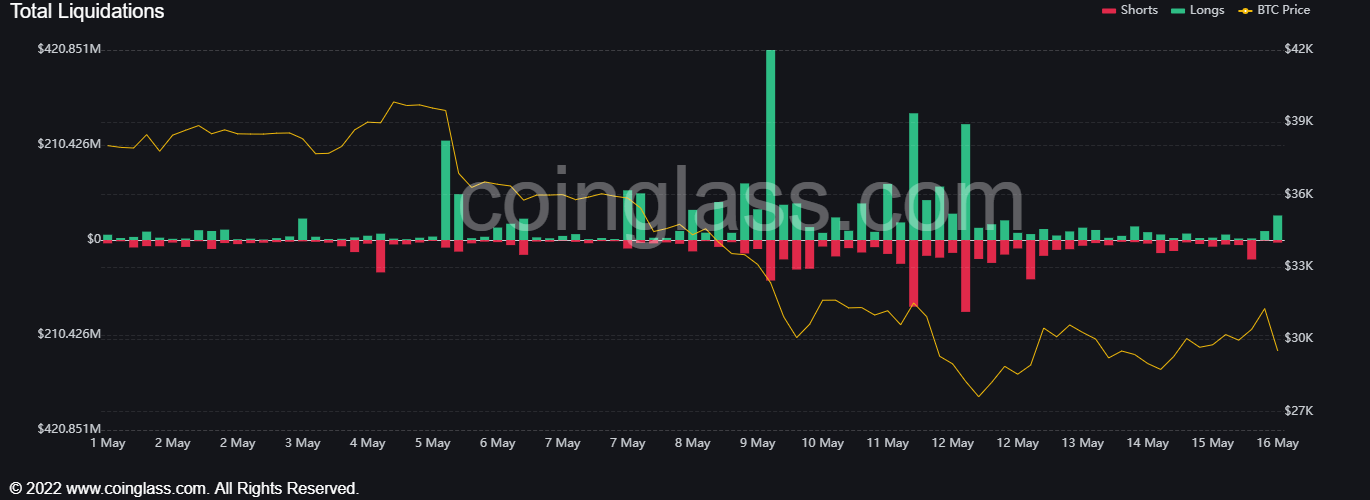

This remark is essential to notice as Ardoino highlights that lengthy positions in futures markets are sometimes offset by promoting Bitcoin (shorting) on the spot market. This technique may give you a hedge in opposition to additional market volatility relying on the way you set your restrict orders within the futures contract. A small miss-step on this technique can result in outsized losses, particularly for these utilizing margin or leverage. Over $500 million in Bitcoin lengthy positions have been liquidated since Could 9 and over $2 billion throughout all the crypto market. The beneath graph from Coinglass reveals each lengthy and quick liquidations since Could 1.

![[UPDATE]NCSoft’s Horizon MMO Has Reportedly Been Shelved Following Feasibility Review [UPDATE]NCSoft’s Horizon MMO Has Reportedly Been Shelved Following Feasibility Review](https://www.psu.com/wp/wp-content/uploads/2025/01/Horizon.jpeg)