Bitcoin’s (BTC) year-long decline has left a number of holders with unrealized losses, together with long-term holders (LTH) who’ve held the coin for at the very least six months.

Nonetheless, CryptoSlate’s evaluation of Glassnode knowledge confirmed that this group of buyers stays bullish on the flagship digital asset.

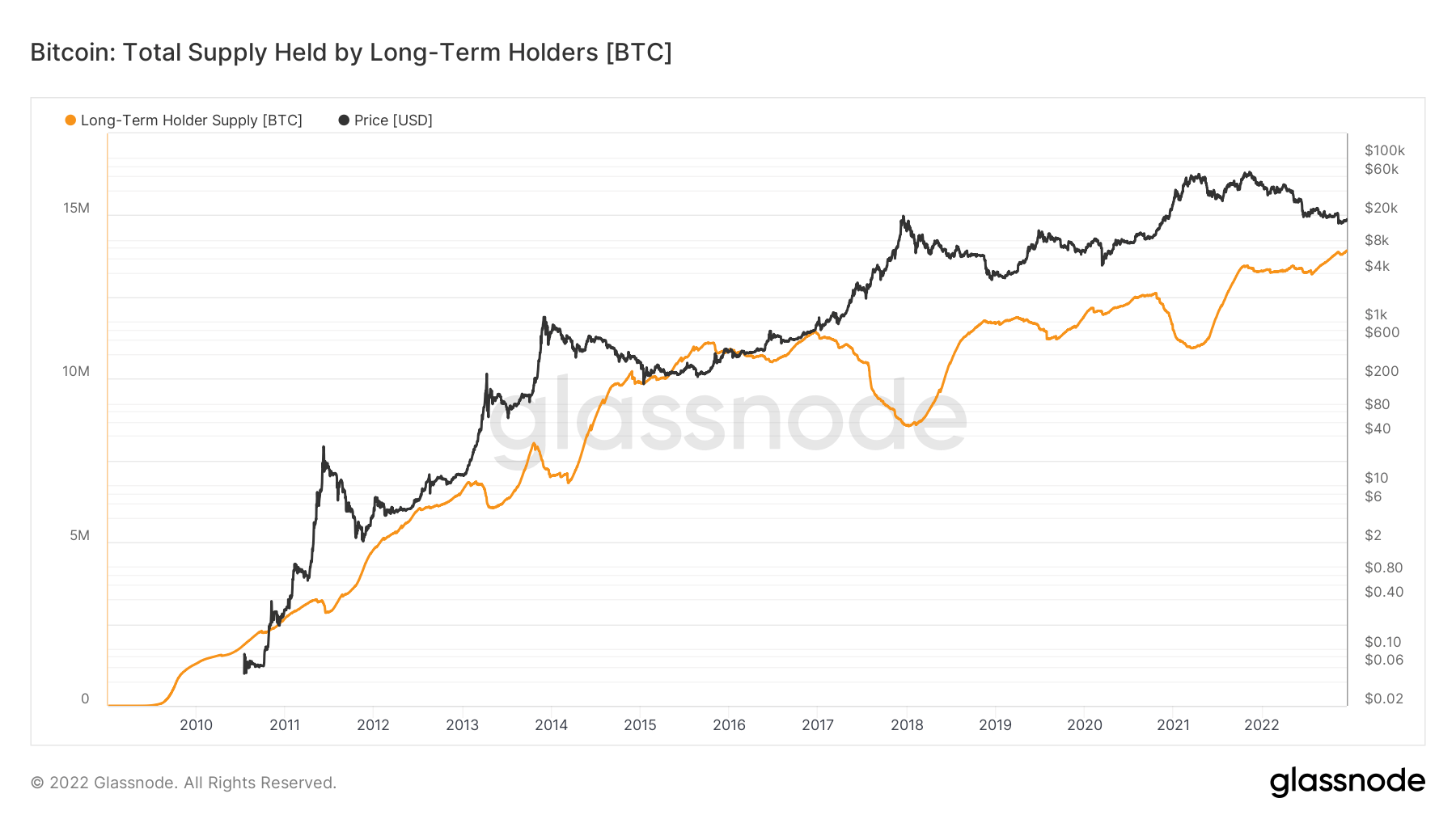

In line with Glassnode knowledge, the cohort holds a record-high quantity of Bitcoin –13.8 million. The group can also be thought of the good cash of the Bitcoin ecosystem as a result of they often accumulate throughout bear markets and promote throughout bull runs.

For context, long-term holders added round 1 million BTC to their holdings in November. This was as a result of LUNA’s crash in Could triggered a big dip in worth that allowed merchants to build up the asset. Those who purchased Bitcoin on the time are actually a part of this cohort, as they’ve held for the final six months.

Lengthy-term holders at ATH regardless of Nov. capitulation

In the meantime, the current FTX collapse led to a minor capitulation amongst LTH, inflicting their provide to drop barely in early November. Regardless of this, the Glassnode knowledge chart under exhibits that long-term holders’ provide continues to be at an all-time excessive.

For a lot of, that’s bullish as a result of buyers aren’t capitulating. Ark Funding shares this view, because it mentioned the info level signifies the cohort’s “long-term focus and excessive conviction, regardless of current occasions.”

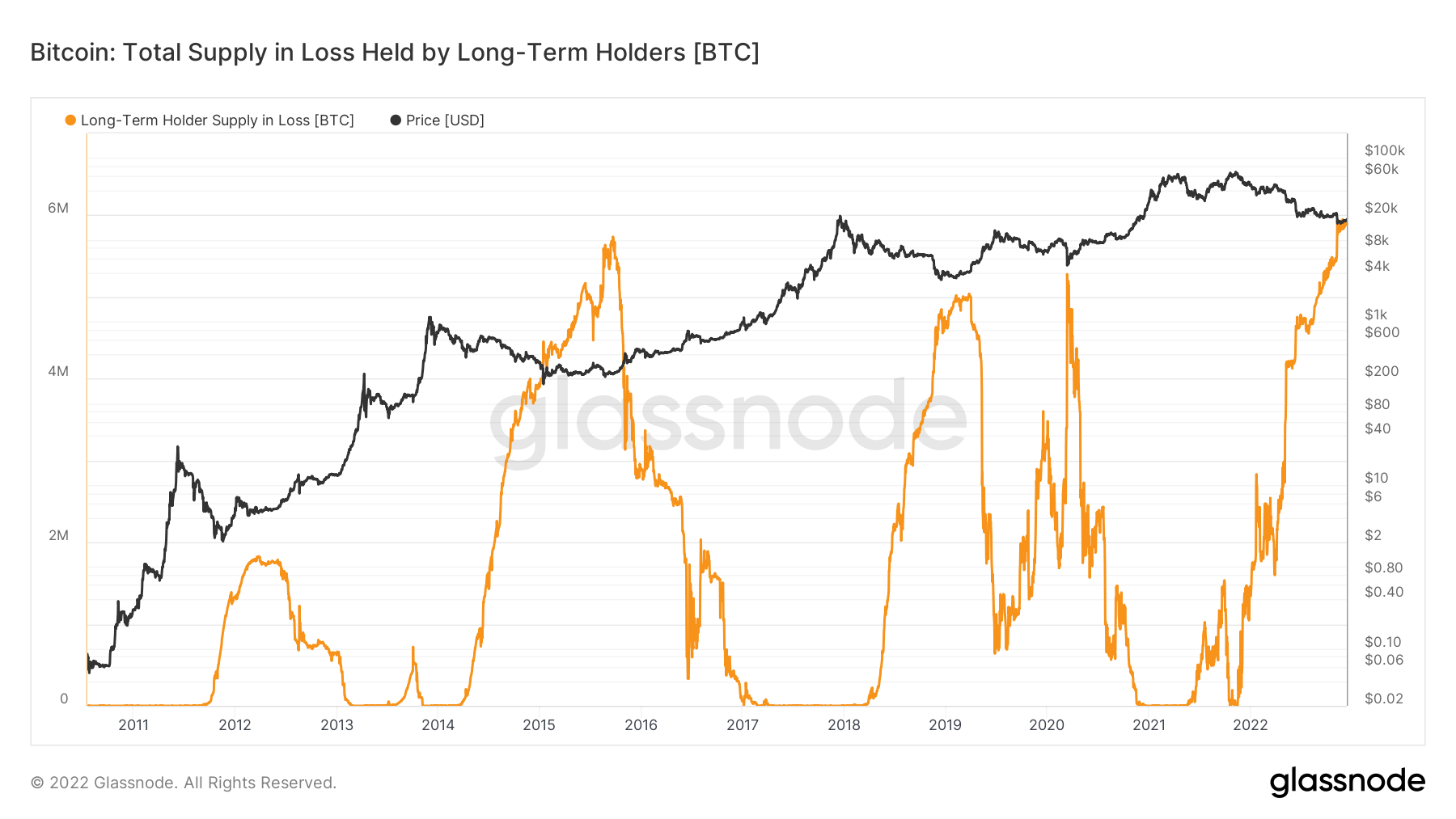

6 million BTCs held at a loss by long-term holders

Glassnode knowledge, as analyzed by CryptoSlate, confirmed that long-term holders may be holding their Bitcoin as a result of they stand to incur substantial losses in the event that they promote.

In line with the info, round 6 million BTC held by long-term holders is presently at a loss –the best ever.

The final time the group had this much-unrealized losses was in 2015, 2019, and 2020 once they held over 5 million BTC.

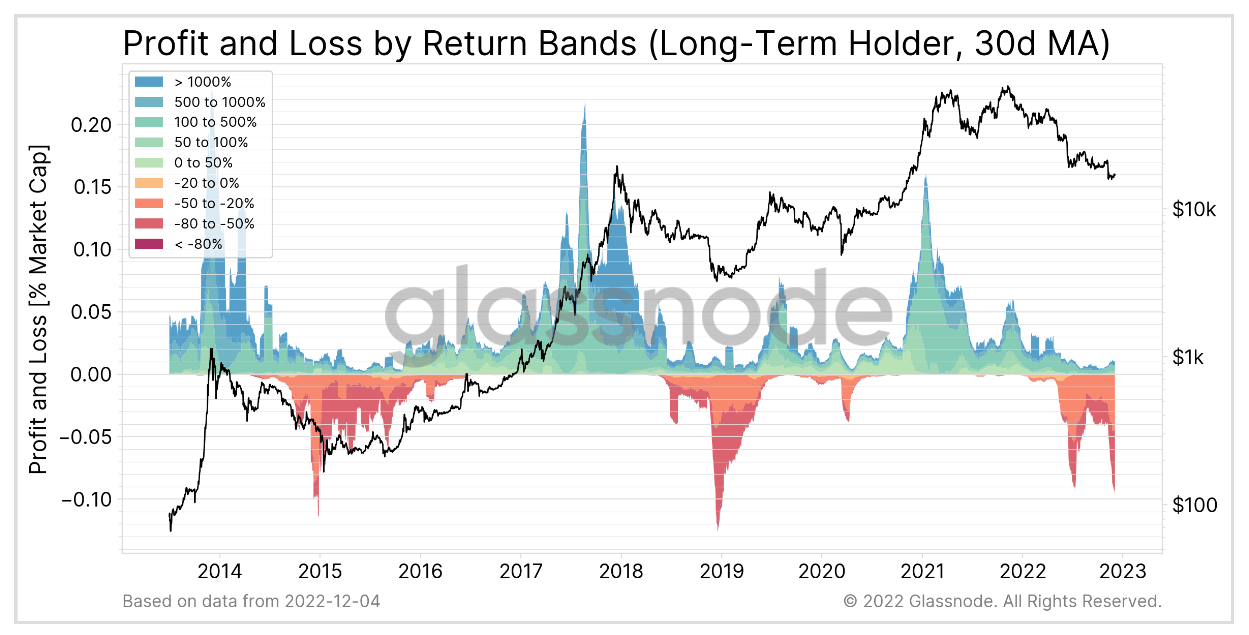

This cycle’s long-term holders recorded the 2 greatest losses

Additional evaluation by CryptoSlate confirmed that long-term holders recorded two of the most important losses in historical past throughout this market cycle.

In line with Glassnode knowledge, this cycle’s long-term holders misplaced 0.09% of BTC’s market cap per day in June and November when the trade reeled from the collapse of Terra’s ecosystem and FTX’s crash. This was solely surpassed by losses recorded in 2015 and 2019.

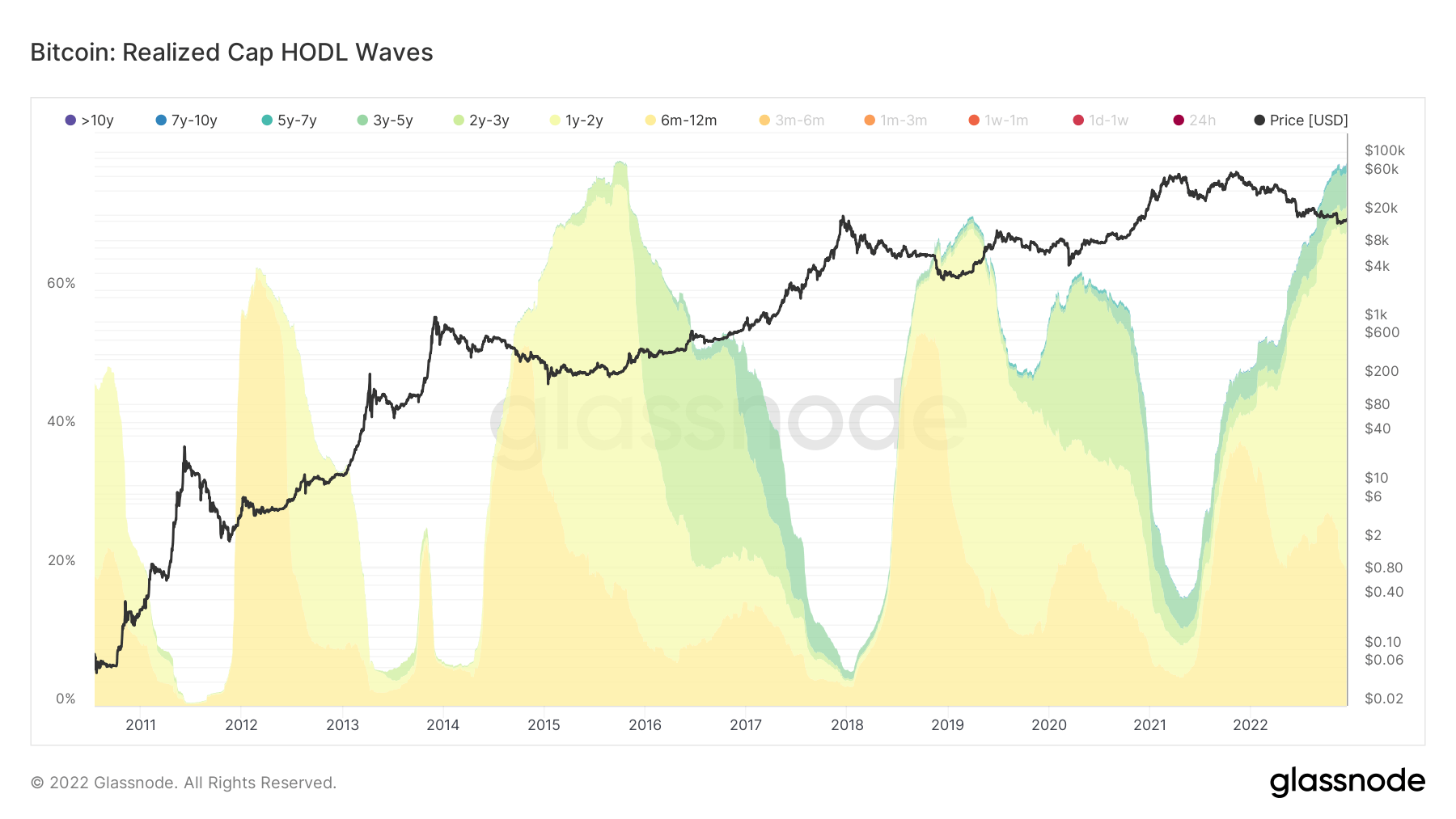

No matter these large losses, 78% of BTC’s whole provide continues to be held by long-term holders, much like the 2015 bear market ranges.