Fast Take

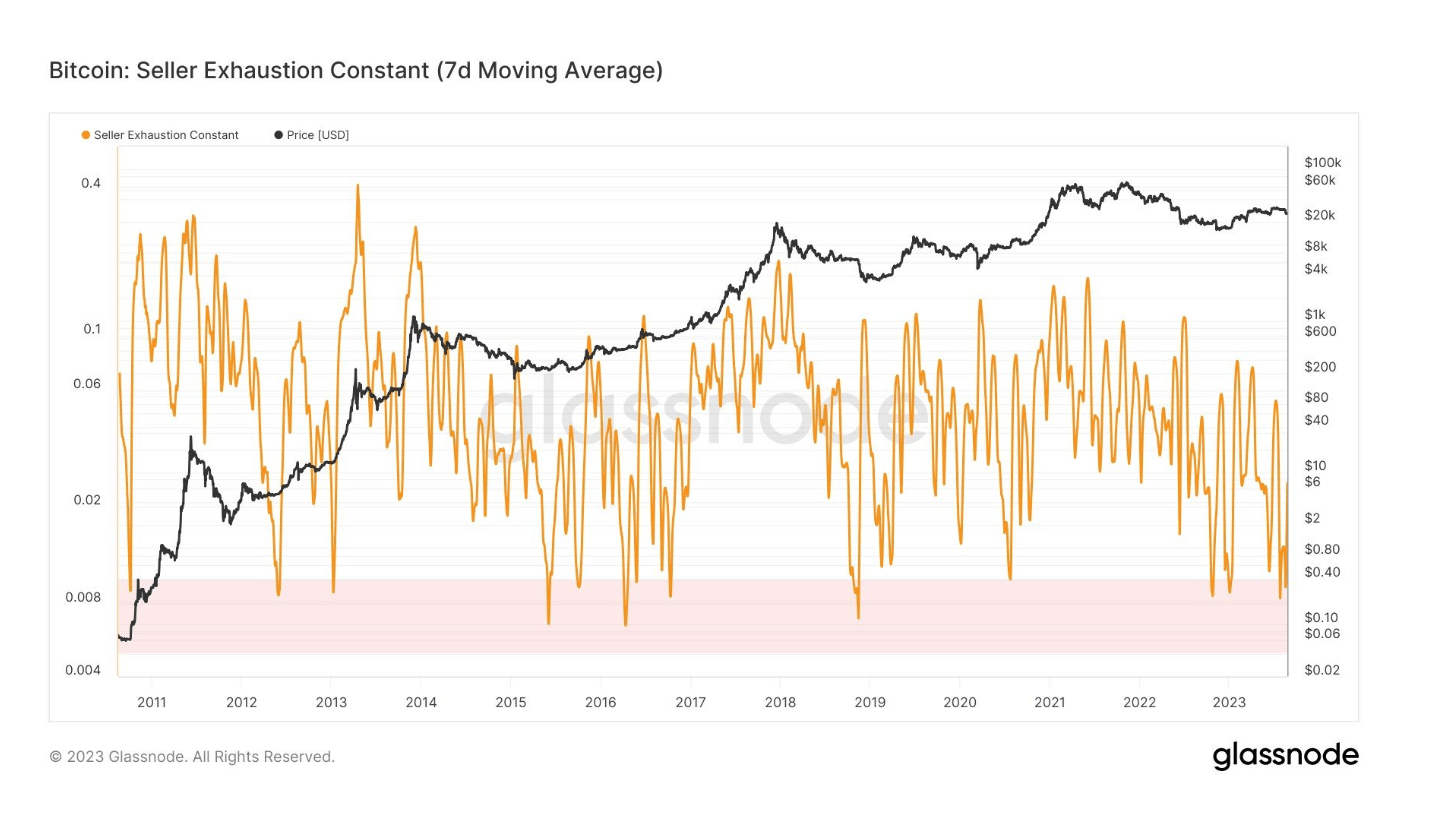

The Bitcoin market in 2023 shows an attention-grabbing revelation: a marked escalation in vendor exhaustion.

To place it in perspective, this uncommon prevalence has solely occurred roughly 15 instances in Bitcoin’s historical past, with an uncommon focus of 4 incidences in 2023 alone.

The metric, outlined by the product of the Proportion Provide in Revenue and 30-day value volatility, is an efficient barometer for detecting intervals of low-risk bottoms.

It acts as a canary within the coal mine, signaling when two contingent elements co-align: low volatility and excessive losses.

These are intervals characterised by languid value fluctuations and a excessive proportion of sellers working at a loss.

Such occasions often current a paradoxical state of affairs the place sellers are weary, and the market is seemingly at a low-risk backside. The heightened frequency in 2023 of this traditionally uncommon metric gives a novel perception into the present dynamics of the Bitcoin market.

The publish Bitcoin market poised as heightened vendor exhaustion signifies low-risk backside appeared first on CryptoSlate.