Fast Take

A number of key metrics within the Bitcoin market counsel a neighborhood backside, an inflection level indicating a possible reversal from the latest downward development.

Open curiosity, a metric that tracks the entire variety of excellent derivatives contracts, has been reset, indicating that gamers are repositioning themselves for a possible market shift. In the meantime, the perpetual funding fee has remained unfavourable for 3 consecutive days, suggesting a contraction of leveraged positions out there.

Furthermore, the miner capitulation part, a interval the place smaller or inefficient miners promote their holdings because of unfavorable market circumstances, seems to have handed. That is strengthened by the continual offloading of cash from cryptocurrency exchanges. Quick-term holders (STHs) reportedly capitulated and bought at a loss final Thursday, typically an indication of market bottoming.

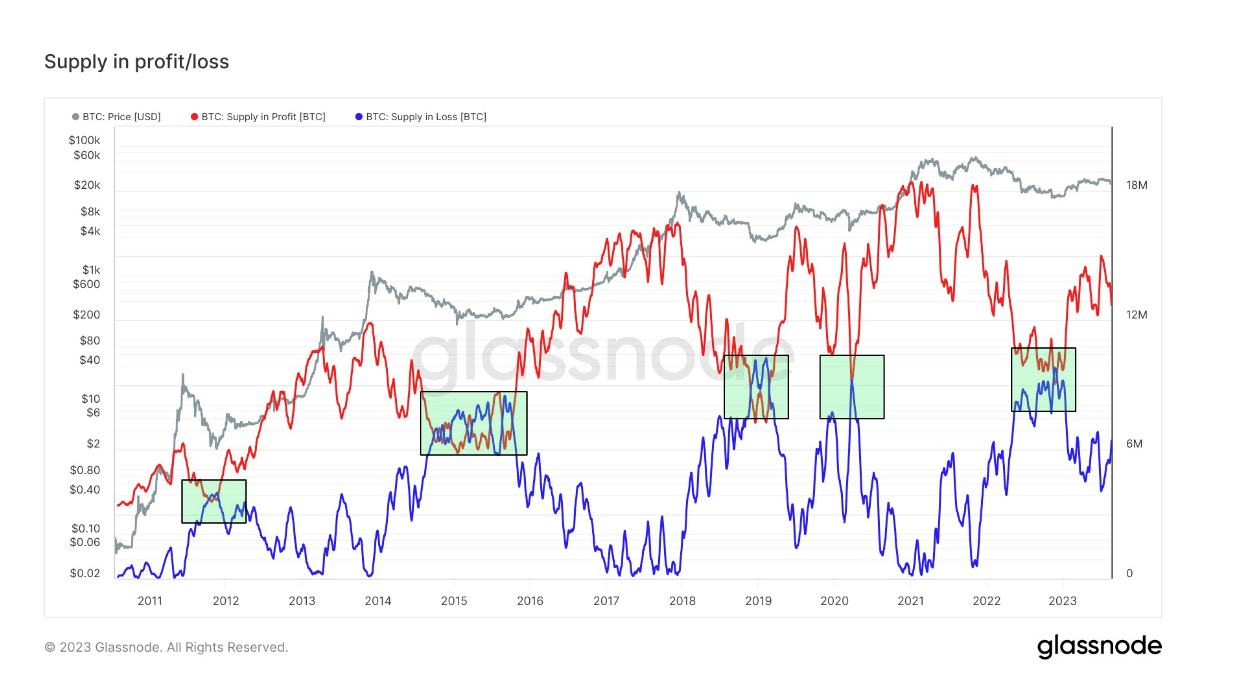

Nonetheless, one indicator continues to be absent from this potential bottoming situation – the availability in revenue/loss. This metric swings in direction of a ‘backside’ when extra Bitcoin is at a loss than revenue. This indicator reveals a discrepancy of 6 million, suggesting that the market has not but reached the underside based on this particular metric.

The submit Bitcoin market indicators native backside as key indicators counsel potential reversal appeared first on CryptoSlate.