On-chain information exhibits the Bitcoin miner promoting energy has plunged just lately, an indication that could possibly be constructive for the crypto’s value.

Bitcoin Miner Promoting Energy Has Plummeted In Current Days

As identified by an analyst in a CryptoQuant publish, there was much less promoting strain from the miners just lately. There are two related indicators right here, the miner provide and the miner outflow. The primary of those, the miner provide, is solely a measure of the whole quantity of Bitcoin at present sitting within the wallets of miners.

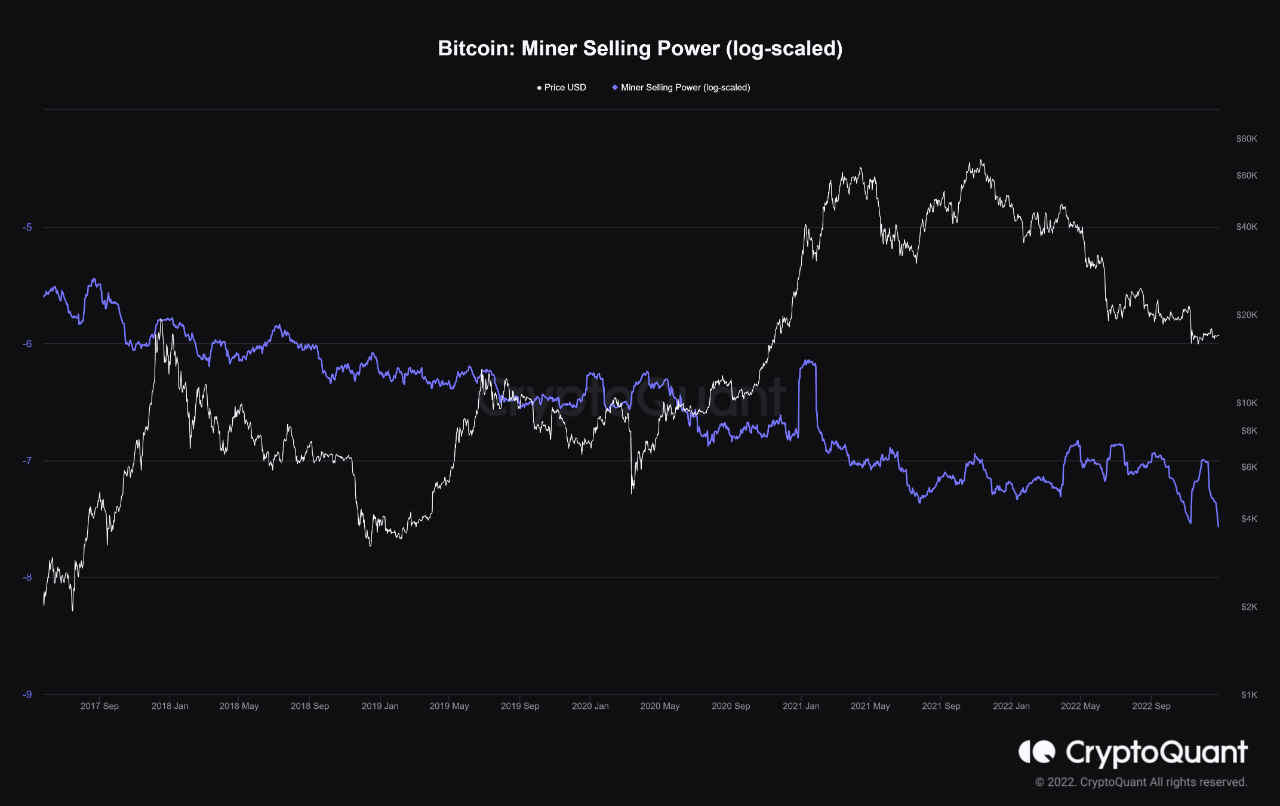

The opposite one, the miner outflow, is a metric that retains monitor of the whole variety of cash that miners are transferring out of their provide for the time being. Now, the “miner promoting energy” is outlined as this miner outflow divided by the miner provide (30-day transferring common, log-scaled).

When the worth of this indicator is excessive, it means miners are transferring out massive quantities in comparison with their complete provide proper now. Since miners normally take out their BTC for dumping functions, this pattern could be bearish for the worth of the crypto. Alternatively, low values counsel miners are spending comparatively little quantities at present.

The beneath chart exhibits the pattern within the Bitcoin miner promoting energy over the previous few years:

The worth of the metric appears to have taken a plunge in current days | Supply: CryptoQuant

Because the above graph shows, at any time when the Bitcoin miner promoting energy has reached excessive values and set an area peak, the worth of the crypto has seen some downtrend. This pattern is sensible as highs within the metric counsel elevated promoting strain from these chain validators.

Lately, the indicator once more confirmed such a formation, and BTC reacted with a decline this time as effectively, as its value went from greater than $18,000 to the present $16,000 stage. Nonetheless, since this current peak, the miner promoting energy has been quickly happening and has now set a brand new low.

This muted promoting strain from miners could not essentially be bullish by itself, nevertheless it does imply that if Bitcoin exhibits any bullish momentum now, miners wouldn’t present any impedance to it in the intervening time.

An attention-grabbing long-term pattern to note within the miner promoting energy chart is that the metric has been on an total downtrend within the final 5 years or so. Because of this over time, miners have been promoting lesser and lesser BTC in comparison with their reserves, suggesting that they’ve been accumulating and rising their provide as a substitute.

BTC Worth

On the time of writing, Bitcoin’s value floats round $16,800, up 1% within the final week.

BTC continues to show boring value motion | Supply: BTCUSD on TradingView

Featured picture from Jievani Weerasinghe on Unsplash.com, charts from TradingView.com, CryptoQuant.com