Regardless of a 9.95% enhance final week and the all-time excessive issue, bitcoin’s hashrate has averaged round 305 exahash per second (EH/s) over the previous 30 days. Based on present knowledge, the hashrate has been round 308 EH/s over the previous 2,016 blocks. The subsequent issue change, set to happen on March 10, is estimated to extend once more, as block occasions have been sooner than the 10-minute common, coming in at 8 minutes and 30 seconds to 9 minutes and 41 seconds per block.

Bitcoin’s Community Issue Projected to Rise; Hash Value Stays Above Hash Worth

Bitcoin’s computational energy has remained excessive regardless of a 9.95% issue enhance on Feb. 24, 2023, at block top 778,176. Statistics present that on Sunday, March 5, the problem is estimated to extend by greater than 3% through the subsequent issue retarget on March 10. Whereas the problem is a staggering 43.05 trillion hashes and the associated fee to mine is increased than the present spot worth, the 300 EH/s vary or increased has been the norm because the final retarget.

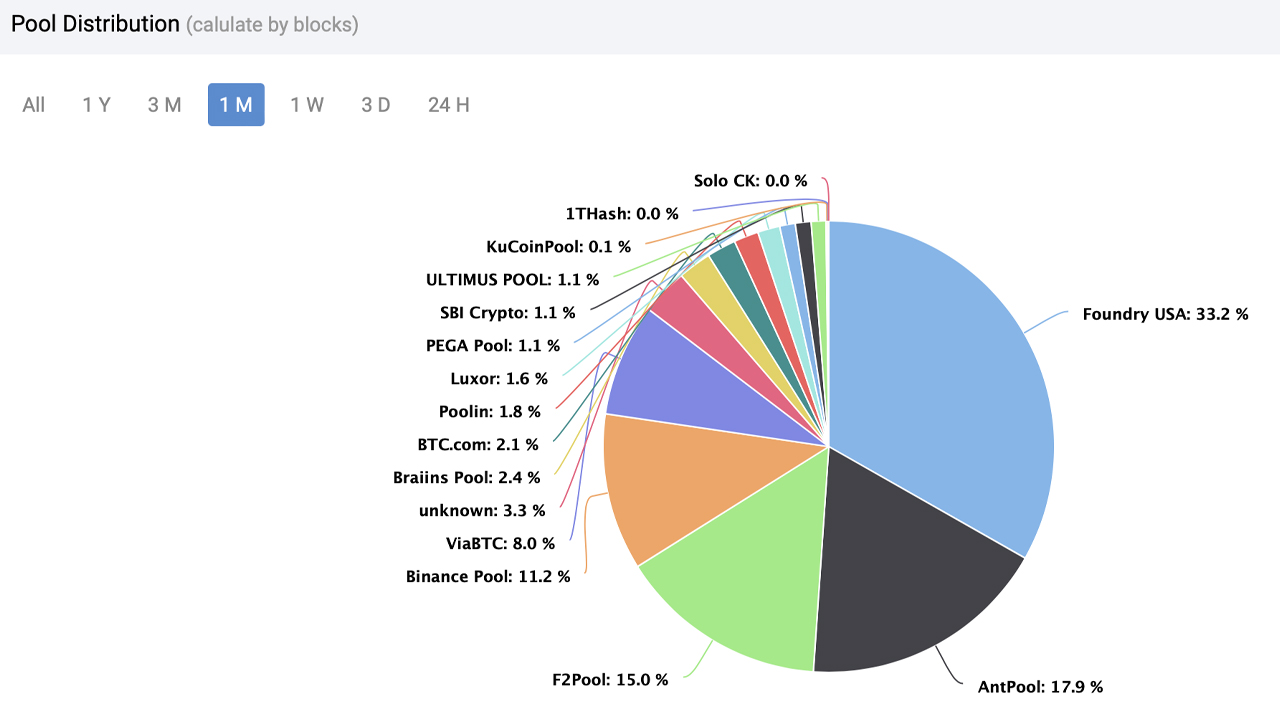

Presently, greater than 60,000 blocks are left to mine till the following halving, and over the previous 30 days, 4,557 blocks had been mined, with Foundry USA discovering 1,514 of them. Foundry instructions 34.44% of the worldwide hashrate, or 113.45 EH/s over the previous 24 hours. Out of the 151 blocks mined, Foundry found 52, and three-day statistics present the pool has acquired 163 blocks.

Thirty-day, three-day, and 24-hour statistics point out that Antpool is the second-largest mining pool throughout these intervals. Out of the 4,557 blocks mined since Feb. 5, 2023, Antpool found 815 blocks, accounting for 17.88% of the worldwide hashrate in a month’s time. Foundry and Antpool had been adopted by F2Pool (14.99%), Binance Pool (11.24%), and Viabtc (8.03%).

Bitcoin miners have been coping with decrease BTC spot costs as the worth has dropped greater than 8% over the previous two weeks. Miners had been incomes extra charges (the associated fee to ship transactions) from the Ordinal inscription pattern as charges jumped to three.5% of a block reward worth on Feb. 16. Bitcoin community charges dropped to 1.5% of a block reward 4 days later.

Information exhibits that community charges equate to 2.1% of a block reward on the time of writing. Regardless of the challenges, many bitcoin mining swimming pools have remained robust and contributed to a rise within the world hashrate. Nevertheless, the upper price of manufacturing in comparison with the present spot market worth and the continuous enhance in issue might dissuade some mining operations from taking part.

What do you suppose the longer term holds for bitcoin miners, given the anticipated enhance in issue and the present market uncertainty? Share your ideas about this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss brought on or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.