Este artículo también está disponible en español.

On-chain information exhibits that Bitcoin miners have been promoting for round a 12 months now. Right here’s how a lot they’ve offered up to now.

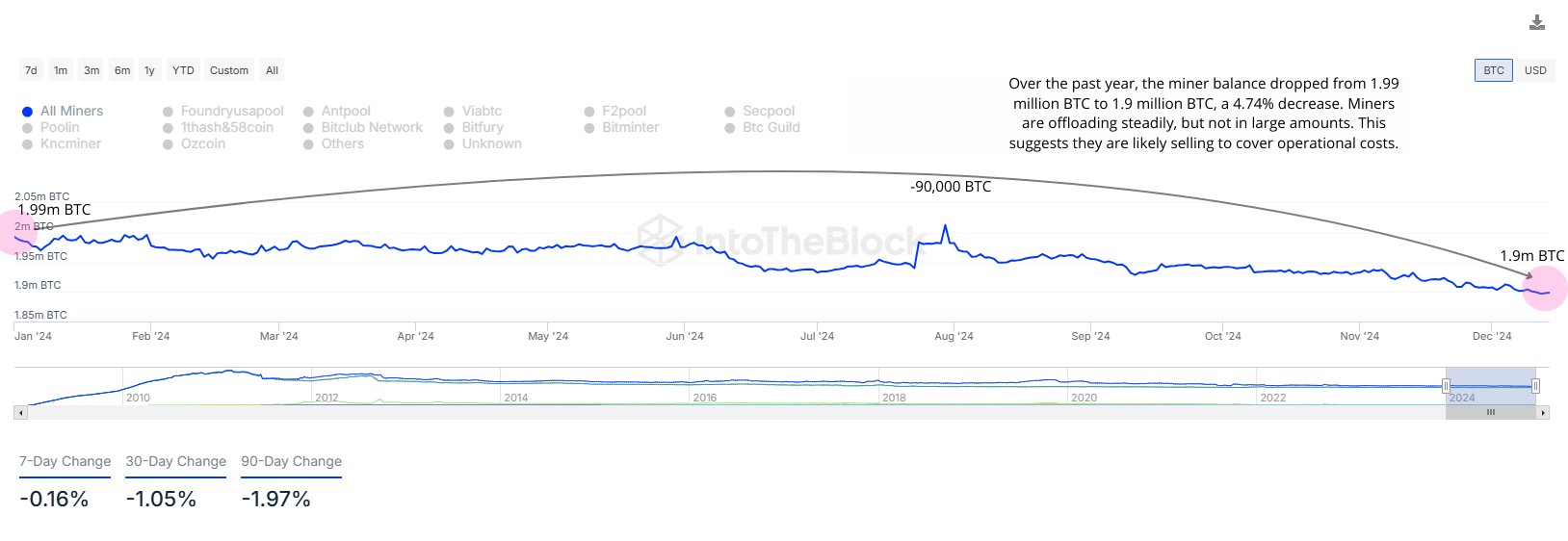

Bitcoin Miners Have Shed Over 4% Of Their Holdings In Previous Yr

As identified by CryptoQuant neighborhood analyst Maartunn in a brand new publish on X, the BTC miners have been in internet promoting mode for a big time frame. The on-chain metric of relevance right here is the “miner reserve,” which retains observe of the full quantity of cash that the miners as an entire are carrying of their wallets proper now.

Associated Studying

When the worth of this indicator rises, it means the chain validators are including a internet variety of tokens to their mixed holdings. Such a development could be a signal that this cohort is accumulating, which might naturally be bullish for the asset’s worth.

Alternatively, the metric observing a decline suggests the miners are withdrawing cash from their addresses. The principle motive why this group makes such transactions is for selling-related functions, so this type of development can have a bearish affect on BTC.

Now, here’s a chart that exhibits the development within the Bitcoin miner reserve over the previous 12 months:

As displayed within the above graph, the Bitcoin miner reserve has gone by a gradual downtrend throughout this window. There have been some temporary durations of deviation, however the general trajectory has remained towards the draw back.

Traditionally, the miners have had a presence as constant sellers on the community. The rationale behind that is the truth that these chain validators have fixed operating prices within the type of electrical energy payments, which they repay by promoting their BTC rewards for fiat.

Typically, although, regardless of being common sellers, miners don’t pose an excessive amount of of a risk to the worth, as their promoting tends to be of a scale that may readily be absorbed by the market. That mentioned, the instances that they do take part in a significant selloff might be to be careful for.

Through the begin of this 12 months, the Bitcoin miners held a complete of 1.99 million BTC of their reserve. As we speak, the identical metric stands at 1.90 million BTC, implying the miners have offered 90,000 BTC (about $9.3 billion on the present trade charge) or 4.74% of their holdings.

Associated Studying

This can be a notable quantity by itself, however when contemplating the context that this promoting has come over some size of time reasonably than inside a slim window, the selloff stops being too attention-grabbing.

“Miners are offloading steadily, however not in massive quantities,” notes the analyst. “This implies they’re probably promoting to cowl operational prices.” As such, it’s attainable that Bitcoin wouldn’t really feel any main bearish results from this miner selloff.

The miner reserve may nonetheless be to regulate within the close to future, nonetheless, as any sharp modifications within the metric may probably spell a brand new end result for Bitcoin.

BTC Value

Bitcoin set a brand new all-time excessive past the $106,000 mark earlier within the day, however the coin seems to have seen a pullback since then because it’s now buying and selling round $104,000.

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com