Fast Take

Bitcoin’s mining issue is getting ready to its most vital downward adjustment because the FTX collapse in December 2022. Newhedge forecasts a discount of over 4% on Might 9, which might mark a considerable pattern shift after the Bitcoin halving. The community’s hash fee has already dropped by 10% from its peak on a seven-day transferring common.

In March, CryptoSlate precisely predicted this hash fee correction, citing the anticipated disruption attributable to lowered miner rewards post-halving. The delay within the correction’s onset is attributed to the elevated charges following the launch of Runes.

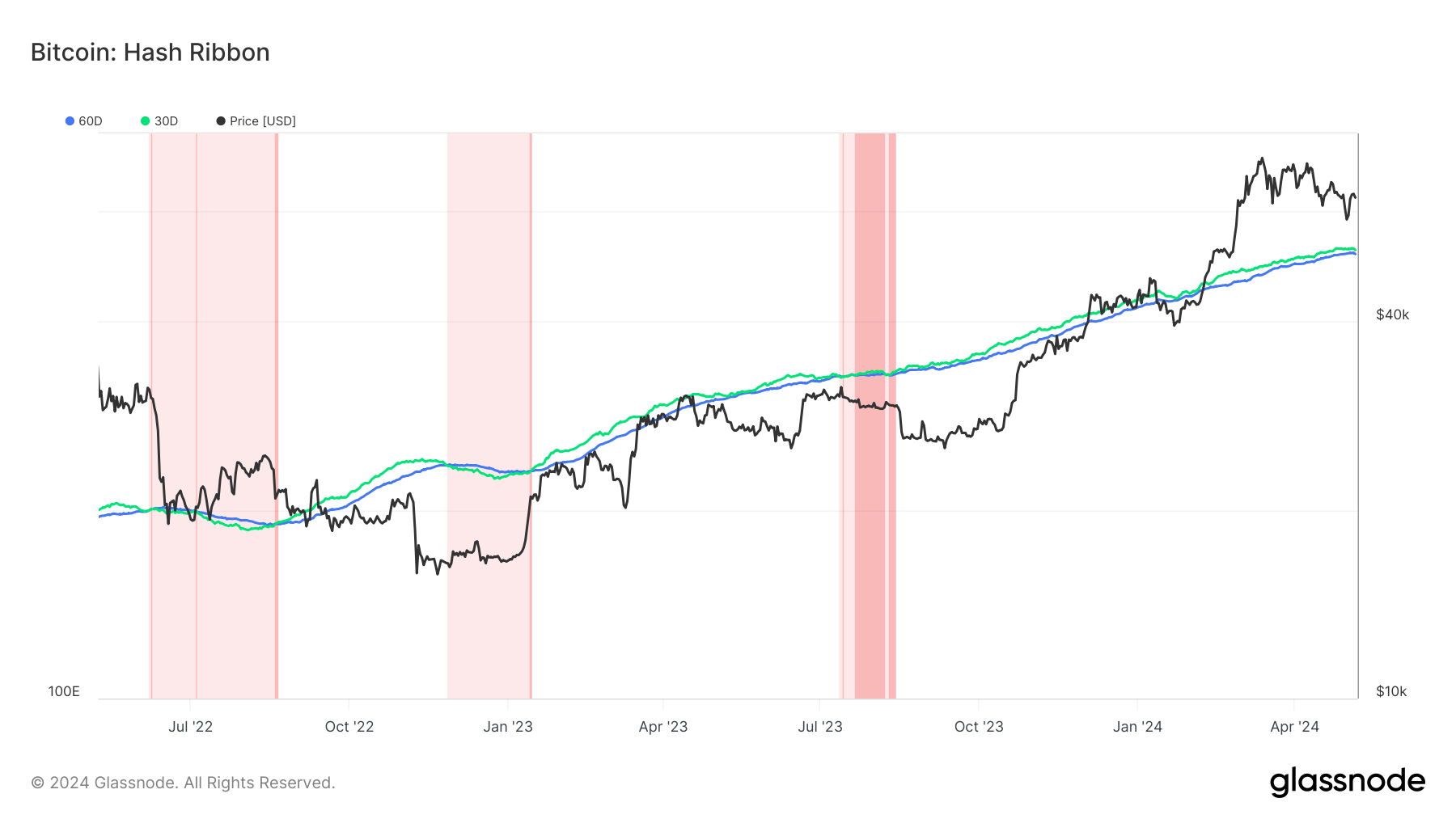

Regardless of these developments, Glassnode’s hash ribbon indicator hasn’t confirmed a miner capitulation occasion. This metric indicators a possible Bitcoin backside when mining bills outweigh earnings. Whereas the convergence of the 30-day and 60-day transferring averages reveals an elevated threat of miner capitulation, the indicator has not been triggered.

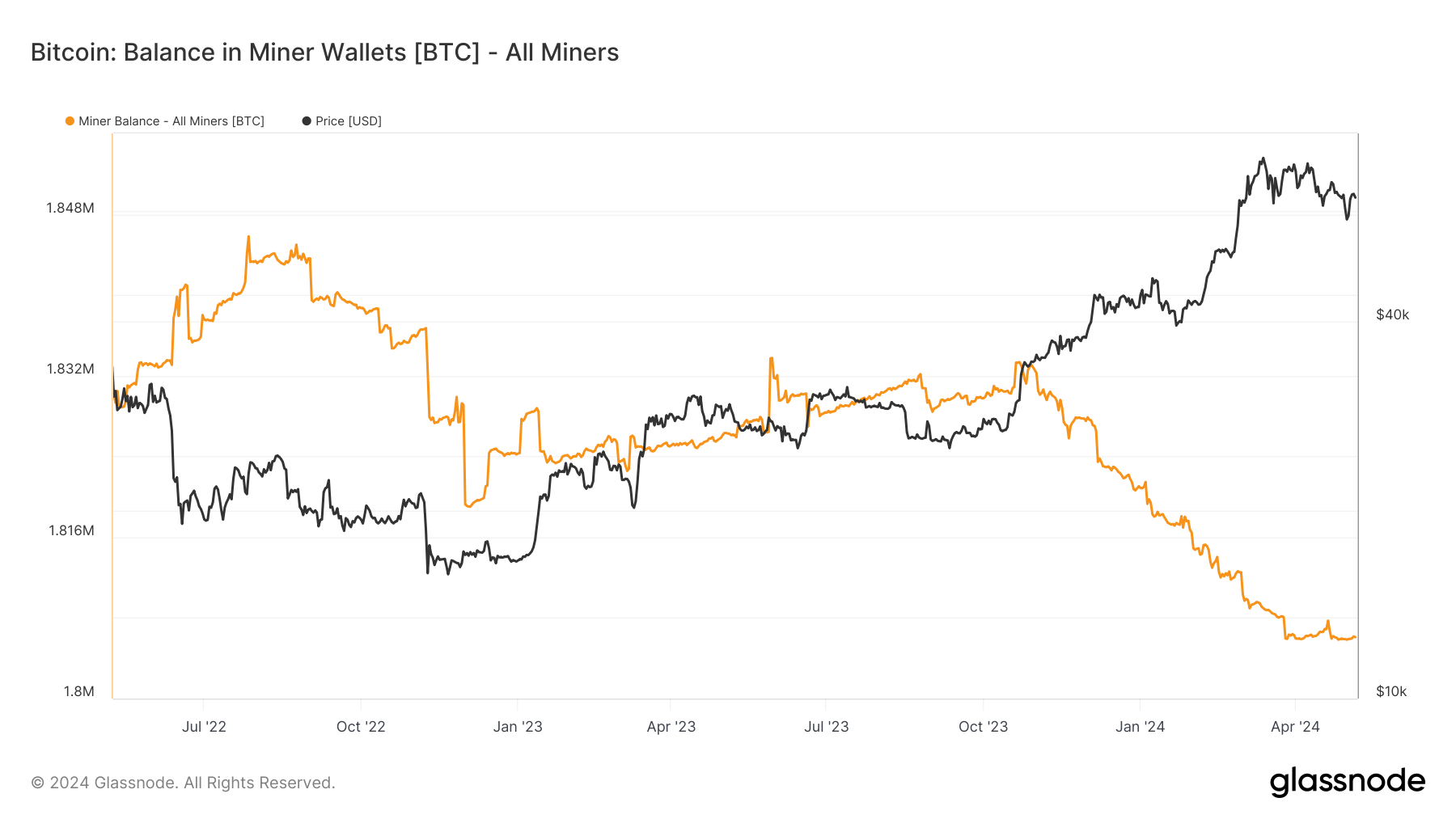

Then again, knowledge relating to miner balances suggests a possible resilience inside the community. Regardless of roughly 30,000 BTC being offloaded between October 2023 and March 2024, miner reserves have risen over the past 5 weeks. This means that weaker miners might have already exited the community, assuaging sell-side stress because the remaining individuals preserve their holdings.

The submit Bitcoin mining issue set for sharpest drop since FTX collapse appeared first on CryptoSlate.