Fast Take

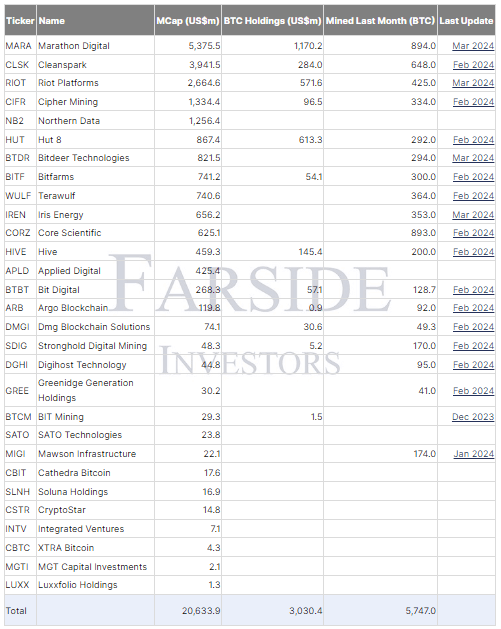

The Bitcoin mining business has reached a big milestone, surpassing a market capitalization of $20 billion, now standing at $20.6 billion, in accordance with Farside knowledge.

This milestone emphasizes the rising significance of public miners inside the Bitcoin ecosystem, contributing roughly 28% of the worldwide hash price. They’re valued at round 1.55% of Bitcoin’s present market capitalization of roughly $1.327 trillion.

Regardless of this vital milestone, quite a few mining firms have confronted challenges this yr when it comes to share value returns.

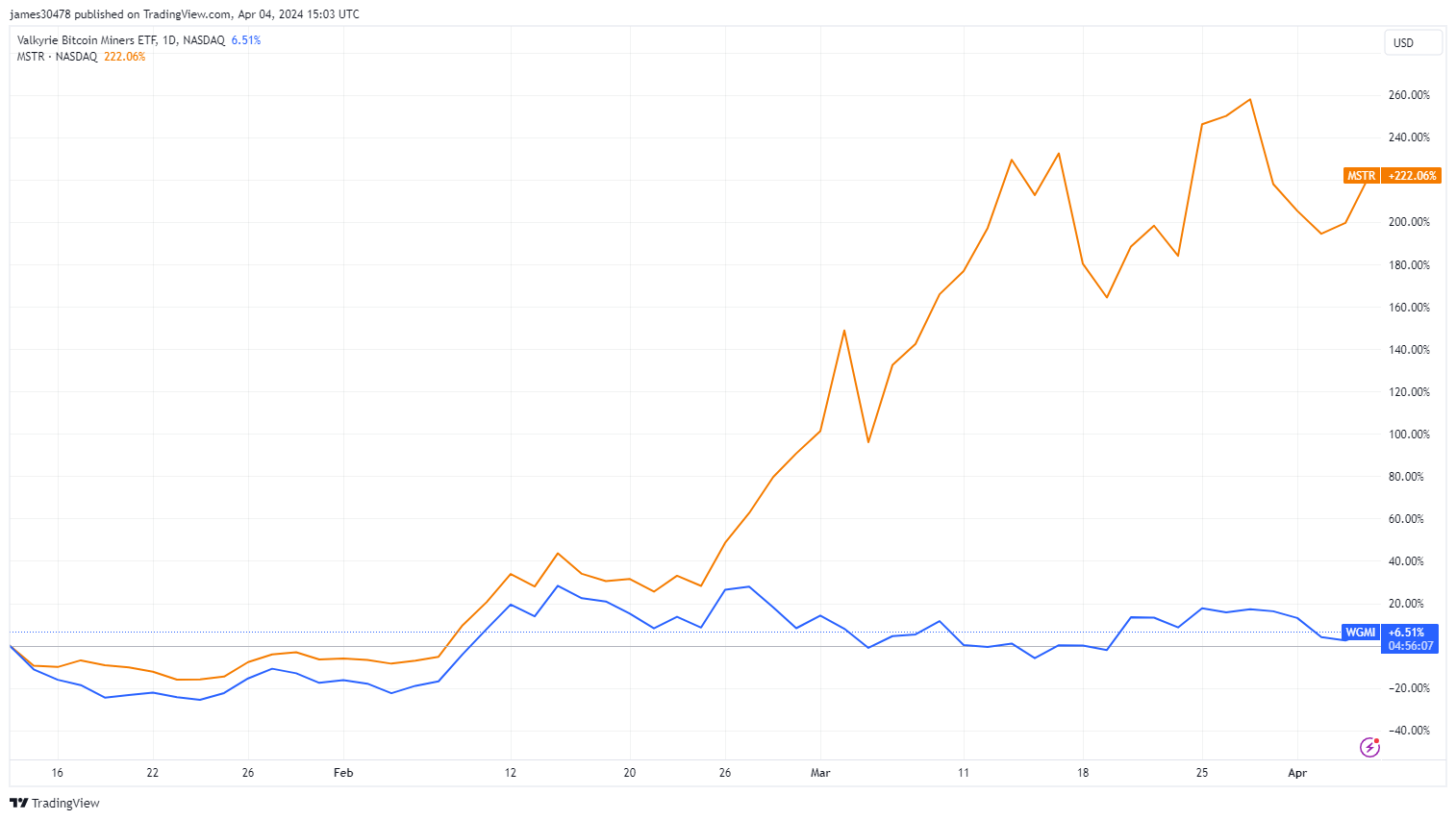

Notably, CleanSpark stands out as an exception, boasting a exceptional 51% improve year-to-date. Apparently, the WGMI Bitcoin mining proxy ETF has seen a 4% decline year-to-date.

Opposite to earlier speculations, the introduction of Bitcoin ETFs hasn’t negatively impacted Bitcoin proxy equities. That is evident from MicroStrategy’s spectacular 222% surge since its introduction.

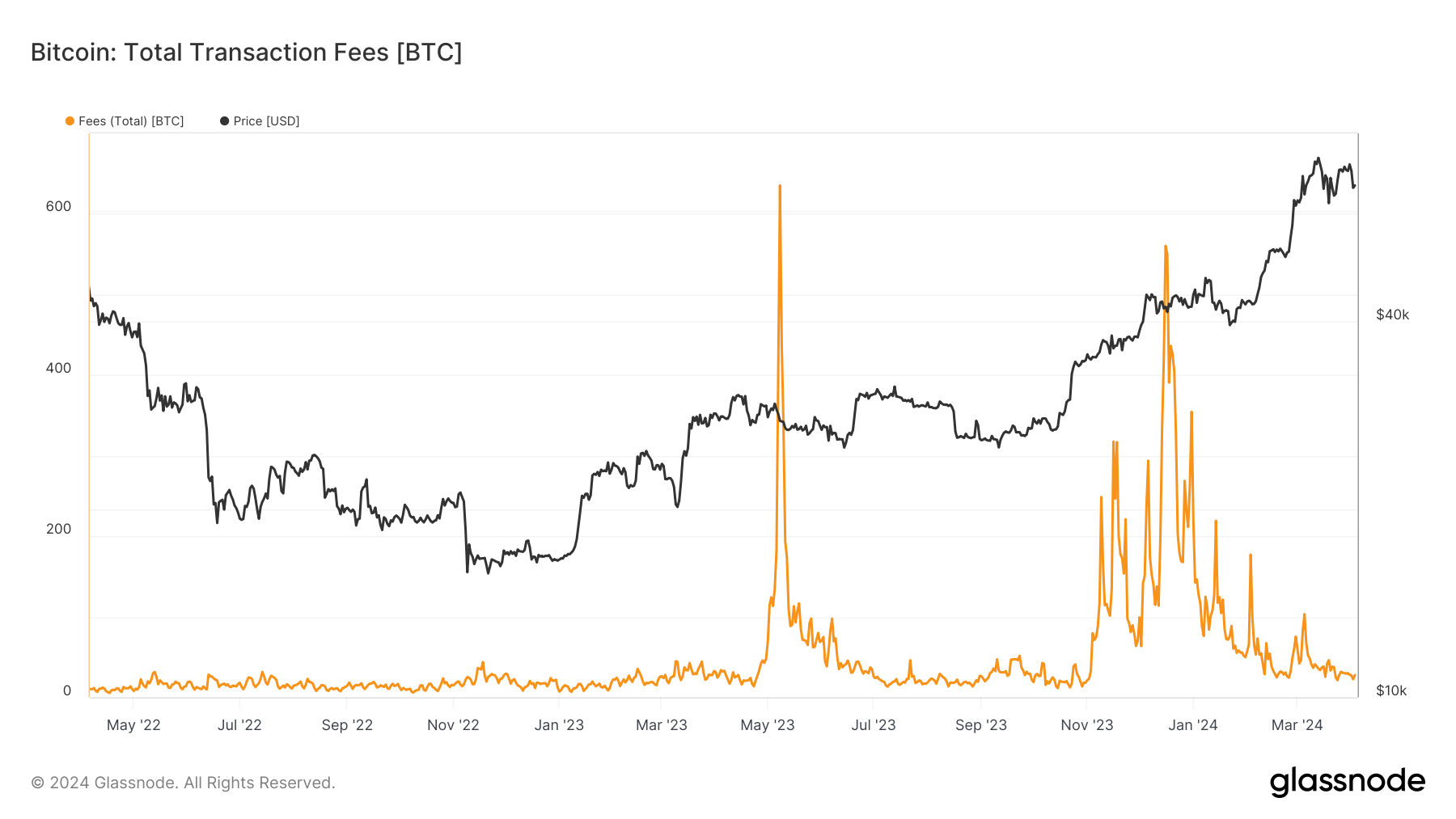

One vital issue contributing to the bearish value motion for miners is the approaching Bitcoin halving occasion, slated to cut back block rewards from 6.25 to three.125 BTC.

Regardless of Bitcoin’s 50% value improve YTD, transaction charges for miners—important income sources—have remained low, publish the inscription frenzy earlier in 2023. Preserving a detailed eye on transaction payment ranges shall be crucial for gauging the mining business’s future prospects.

The publish Bitcoin mining market cap eclipses $20 billion as business continues rising amid challenges appeared first on CryptoSlate.