Bitcoin (BTC) just lately hit a 10-month low of $29K as extra liquidation engulfed the market.

Market analyst Ali Martinez believes a bearish image is being painted within the BTC market as a result of it has damaged the historic trendline. For this to be invalidated, the main cryptocurrency must reclaim $36K.

Martinez pointed out:

“Bitcoin has damaged its historic trendline. The final two instances this occurred BTC retraced by 37.67% and 41.32%, respectively. Comparable value motion might see costs crash by 40.59% to $20,000. BTC must reclaim $36,000 to invalidate this bearish thesis.”

Supply: TradingView

The main cryptocurrency was hovering across the $30,744 stage throughout intraday buying and selling, in line with CoinMarketCap. On its strategy to $36K, Bitcoin should breach vital resistance on the $34,700 space. Martinez added:

“Bitcoin seems to be rebounding, however discover that it faces stiff resistance at $34,700 the place over 668,000 addresses purchased practically 376,000 BTC.”

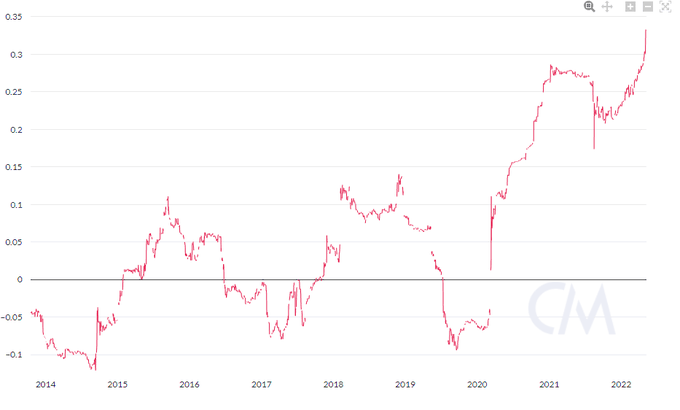

Bitcoin’s correlation with S&P 500 reaches historic highs

As extra institutional buyers proceed leaping on the crypto bandwagon, the correlation between cryptocurrencies and shares turns into stronger.

For example, the three most majorly adopted inventory indexes within the U.S. – the S&P 500, Dow Jones Industrial Common, and Nasdaq Composite – fell to their lowest stage since 2020.

“Bitcoin correlation with the S&P 500 has reached a brand new irritating all-time excessive,” Mati Greenspan, the CEO of Quantum Economics, said.

Supply: Mati Greenspan

Comparable sentiments had been shared by JoeDiPasquale, the CEO of crypto hedge fund supervisor BitBull Capital. He famous:

“The financial coverage tightening is inflicting buyers to scale back their publicity to danger belongings and BTC’s present correlation to the S&P 500 has led it to additionally drop as we speak.”

In the meantime, Edward Moya, a senior market analyst at foreign exchange alternate firm Oanda, believes the drop in crypto costs relies on the sell-off witnessed in tech shares. Subsequently, stability within the Bitcoin market will happen when buyers cease panic promoting and the massacre on Wall Road ends.

Picture supply: Shutterstock

![PROJECT [C4] Is A ‘Genre-Defining RPG’ From Disco Elysium Studio ZA/UM PROJECT [C4] Is A ‘Genre-Defining RPG’ From Disco Elysium Studio ZA/UM](https://www.psu.com/wp/wp-content/uploads/2025/03/ProjectC4-min.jpg)