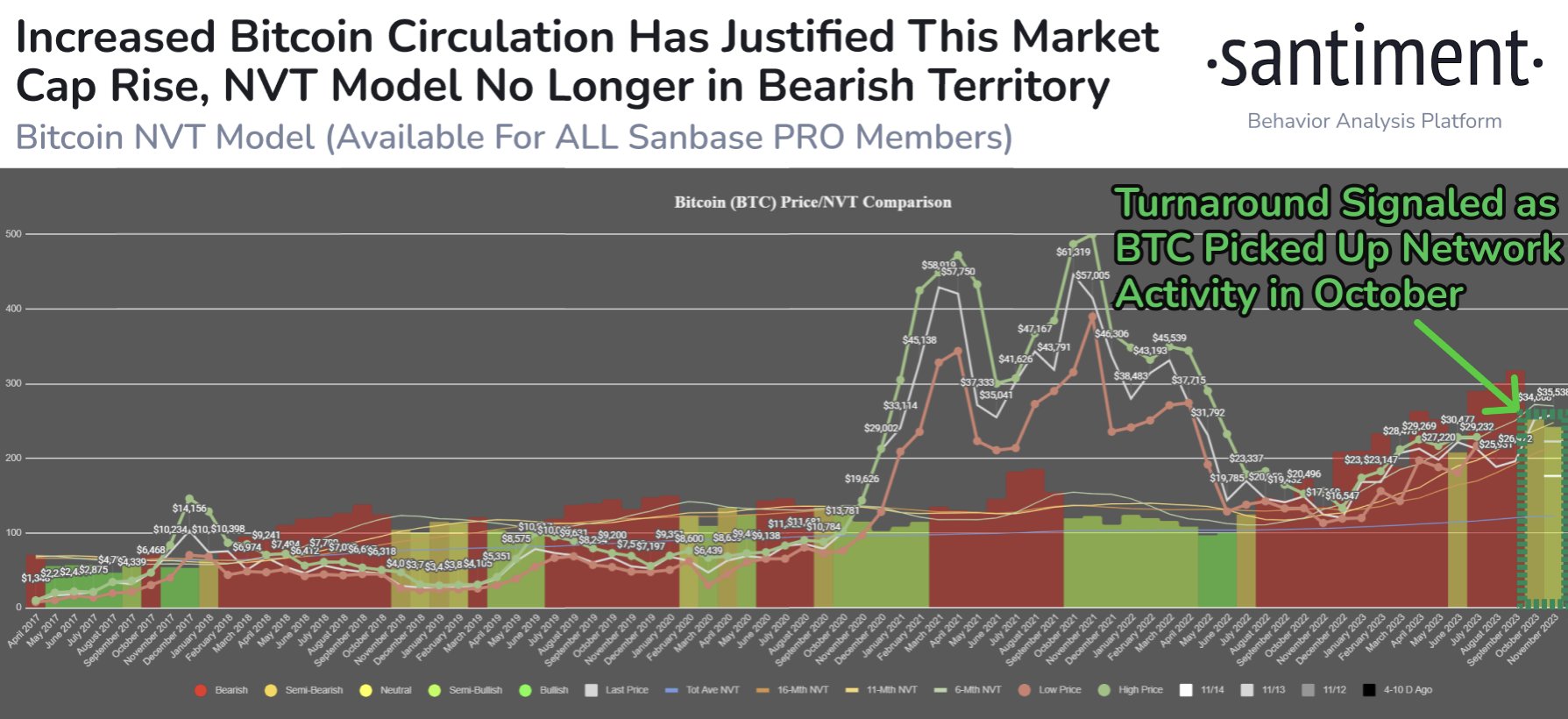

On-chain knowledge reveals the Bitcoin Community Worth to Transactions (NVT) ratio is above the bear zone, implying the current value development might need been wholesome.

Bitcoin NVT Ratio Has Remained Outdoors Pink Since October

Based on knowledge from the on-chain analytics agency Santiment, the NVT ratio has seen a major enchancment just lately. The related indicator right here is the “NVT ratio,” which retains observe of the ratio between the Bitcoin market cap and day by day circulation.

The market cap right here is of course the full worth of the asset, whereas circulation refers back to the variety of distinctive tokens observing some motion on the community inside a 24-hour rolling interval.

Another analytics web sites use transaction quantity rather than circulation, however Santiment’s model makes use of the latter as a result of the quantity usually accommodates noise that’s not related to the market (like relay transactions of the identical cash, that are counted a number of occasions within the quantity, however solely as soon as in circulation).

When the worth of the NVT ratio is excessive, it implies that the value of the asset is excessive in comparison with the blockchain’s skill to transact cash proper now. Such a development can recommend the coin could also be overvalued in the intervening time.

Alternatively, the metric being low implies the cryptocurrency could be underpriced at the moment as its transaction quantity is at wholesome ranges in comparison with the market cap.

Now, here’s a chart that reveals the development within the Bitcoin NVT ratio over the previous couple of years:

Seems like the worth of the metric has been inexperienced in current days | Supply: Santiment on X

As displayed within the above graph, the Bitcoin NVT ratio exited the historic bearish territory again in October and has continued to be outdoors it within the weeks since then.

The metric hasn’t precisely returned to the bullish zone correct but; it has been extra leaning in the direction of impartial. Nevertheless, the truth that the indicator has improved inside this era regardless of the cryptocurrency’s market cap additionally seeing a major increase on the similar time is definitely a optimistic improvement, because it means that the community exercise development has been outweighing the rise within the value.

On the present values of the ratio, the transaction exercise of Bitcoin is justifying its market cap, so on the very least the asset might not be in speedy hazard of a correction.

This naturally implies that the rally ought to have the ability to proceed for some time till the ratio returns again into the bearish territory (which can not even occur if the circulation continues to enhance, because it has been throughout the value surge thus far).

BTC Value

After seeing a pullback to as little as $35,000 earlier, Bitcoin has efficiently recovered again above $37,000 throughout the previous day.

The worth of the asset has registered a robust rise throughout the previous day | Supply: BTCUSD on TradingView

Featured picture from Jievani Weerasinghe on Unsplash.com, charts from TradingView.com, Santiment.web