Este artículo también está disponible en español.

Bitcoin (BTC) has seen a powerful 8% surge since Monday, solidifying $100K as a powerful help stage. After weeks of volatility and uncertainty, BTC has now reclaimed key ranges and is pushing towards an all-time excessive (ATH) retest. Traders and analysts alike are carefully watching Bitcoin’s subsequent transfer, as bullish momentum continues to construct.

Associated Studying

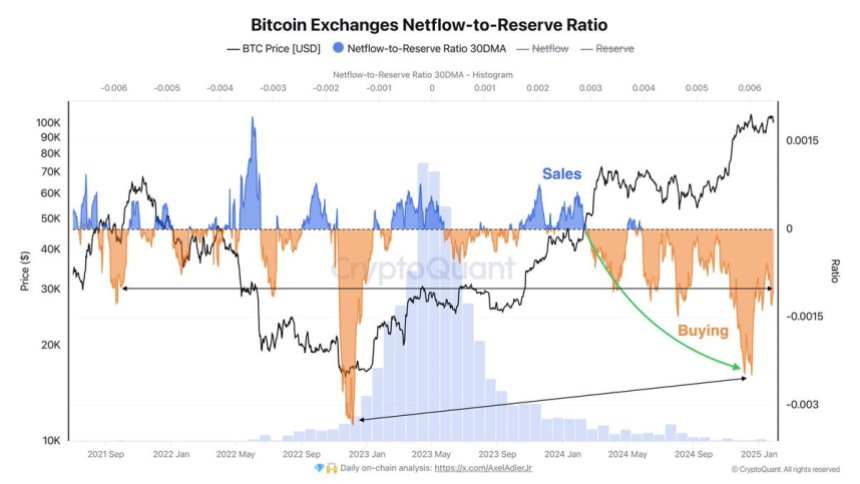

Prime analyst Axel Adler shared insights revealing that Bitcoin continues to stream out of exchanges, an indication that long-term holders are accumulating. This development is lowering accessible provide, which traditionally has been a key driver for value appreciation in bull cycles. With fewer BTC accessible for buying and selling, demand stress might speed up, doubtlessly fueling a breakout into value discovery.

Now that Bitcoin has regained vital resistance ranges, merchants are eyeing a push above ATH, which might affirm the subsequent main leg of the bull run. Nonetheless, market individuals stay cautious, as BTC should maintain above key ranges to maintain its uptrend. The approaching days will probably be essential in figuring out whether or not Bitcoin can proceed its climb or enter one other consolidation part earlier than making a decisive transfer.

Bitcoin Holds Sturdy Above $105K

Bitcoin (BTC) has skilled excessive volatility in current weeks, but robust value motion continues to defy unfavorable market sentiment. After testing key help ranges, BTC is now buying and selling above $105K, displaying resilience because it seems able to push above all-time highs (ATH). Traders stay optimistic about Bitcoin’s long-term trajectory, with many anticipating a bullish 12 months forward.

Associated Studying

Yesterday’s Federal Reserve assembly added to the optimistic market sentiment, giving BTC the momentum wanted to shift again into an upward trajectory. With institutional and retail demand rising, Bitcoin stays the main asset poised for one more breakout.

Crypto knowledgeable Axel Adler shared priceless insights on X, highlighting {that a} unfavorable Netflow-to-Reserve ratio is a bullish sign. He identified that the most important BTC outflow from exchanges occurred on the Bear Market backside in January 2023, marking robust shopping for exercise and the primary accumulation part of the bull cycle. In 2024, peak shopping for exercise was noticed on the $100K stage, reinforcing robust demand regardless of a slight decline in quantity.

The important thing takeaway is that Bitcoin continues to stream out of exchanges, lowering provide and fueling additional value appreciation. If demand stays robust, BTC might quickly break into value discovery, setting the stage for brand new all-time highs.

BTC Testing Final Resistance Under ATH

Bitcoin (BTC) is at present buying and selling at $105,200, displaying robust momentum because it inches nearer to a breakout above all-time highs. The subsequent key stage to clear is $106K, which might set off a transfer towards the extremely anticipated $110K mark. If BTC pushes previous ATH with conviction, it might affirm a bullish breakout, setting the stage for additional value discovery.

Nonetheless, bulls should defend the $103,600 stage to maintain the uptrend. This value zone has been a vital help, holding Bitcoin in a bullish construction. Dropping this stage might sign short-term weak point, doubtlessly sending BTC again to check the $100K mark.

Associated Studying

For now, Bitcoin’s value motion stays robust, and so long as $103,600 holds, momentum ought to proceed to favor the bulls. With demand rising and change provide reducing, BTC is in a first-rate place to push towards new highs. The approaching days will probably be essential, as merchants look ahead to a confirmed breakout or a possible retest of key help ranges.

Featured picture from Dall-E, chart from TradingView