Knowledge reveals the Bitcoin drop beneath the $27,000 degree has made most buyers fearful for the primary time this month.

Bitcoin Worry & Greed Index Is Pointing At “Worry” Proper Now

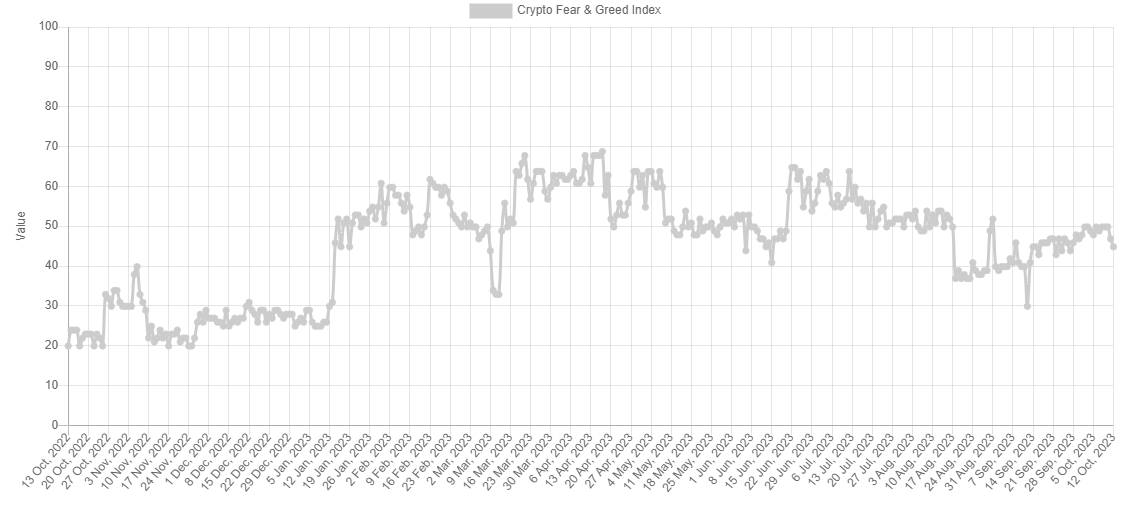

The “worry and greed index” is an indicator that tells us in regards to the basic sentiment amongst buyers within the Bitcoin and broader cryptocurrency market. Various created the metric, and in line with the web site, it’s primarily based on these elements: volatility, buying and selling quantity, social media sentiment, market cap dominance, and Google Developments information.

The indicator makes use of a numeric scale from zero to hundred to symbolize the sentiment. When the index has a price better than 54, it implies that the common investor is grasping proper now, whereas it being beneath 46 implies a fearful mentality is dominant.

The area between these two thresholds naturally signifies a impartial sentiment among the many holders. Till at the moment, the sector had been caught inside this area because the final couple of days of September, because the buyers had been break up in regards to the trajectory of Bitcoin.

The chart beneath reveals that the market sentiment has worsened with the most recent drop within the cryptocurrency’s worth beneath the $27,000 degree.

It seems like the worth of the metric has registered some decline in current days | Supply: Various

After this newest drop in sentiment, the worry and greed index has hit a price of 45, that means that investor sentiment has simply entered the worry area.

The worth of the metric appears to be 45 proper now | Supply: Various

Traditionally, the market has tended to maneuver in a method that’s reverse to what the vast majority of the buyers imagine. The probability of such a opposite transfer taking place will increase as this imbalance within the sentiment rises.

Whereas the holders are leaning in direction of one facet (worry), the imbalance is small, because the worry and greed index is barely contained in the territory. As such, the likelihood of a rebound can be fairly excessive proper now (a minimum of primarily based on the sentiment).

Moreover the core sentiments mentioned earlier than, there are additionally two particular zones, known as “excessive worry” (at or beneath values of 25) and “excessive greed” (at or above values of 75).

These areas are the place the cryptocurrency has typically circled up to now. Naturally, bottoms have occurred within the former zone, whereas tops have shaped within the latter space.

If the Bitcoin worry and greed index continues declining within the coming days and reaches values close to the intense worry area, a bounce might change into an actual chance.

For now, one signal pointing to the possibilities of a rebound could also be that the big buyers have been shopping for just lately, as an analyst on X pointed out.

The BTC sharks have elevated their holdings just lately | Supply: @ali_charts on X

For the reason that begin of October, Bitcoin buyers holding between 100 and 1,000 cash have bought a mixed 20,000 BTC price round $533.6 million on the present trade fee.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $26,700, down virtually 5% up to now week.

BTC has skilled some downtrend just lately | Supply: BTCUSD on TradingView

Featured picture from Bastian Riccardi on Unsplash.com, charts from TradingView.com, Santiment.web