Because the eagerly awaited Bitcoin (BTC) exchange-traded fund (ETF) verdict approaches, pleasure and anticipation proceed to develop within the cryptocurrency market.

In line with a report by K33 Analysis, the upcoming choice, anticipated between January 8 and January 10, has been a major issue behind Bitcoin’s optimistic momentum since October. Institutional demand stays sturdy, with conventional buyers strongly excited about including lengthy BTC publicity.

Bitcoin Set For Bullish December?

Bitcoin has displayed a notable tendency to surge increased within the lead-up to main occasions, creating a way of enthusiasm and driving costs upward. This phenomenon has been noticed throughout numerous vital milestones within the cryptocurrency’s historical past.

In line with the report, examples embrace Bitcoin’s peak coinciding with the launch of the Chicago Mercantile Trade’s (CME) BTC futures in 2017, its spike coinciding with Coinbase’s public itemizing in April 2021, and its peak on the day El Salvador declared Bitcoin authorized tender in September 2021.

Equally, Bitcoin reached its peak on the date of VanEck’s spot ETF deadline in November 2021. These situations spotlight the potential for Bitcoin to expertise vital value actions because the ETF verdict attracts close to.

The report emphasizes the substantial demand from institutional buyers searching for publicity to Bitcoin. BTC exchange-traded merchandise (ETPs) witnessed inflows of almost 40,000 BTC in November, whereas CME open curiosity reached and maintained all-time highs. Futures premiums have additionally surged to twenty%, indicating the sturdy curiosity from institutional gamers.

In distinction, retail participation has proven indicators of stagnation. Offshore flows have remained shallow, and Bitcoin-denominated open curiosity in BTC perpetual contracts is presently at yearly lows. These components counsel that institutional flows proceed to be the driving pressure behind Bitcoin’s strong market power.

Based mostly on the historic sample of event-driven value actions and the sustained institutional demand, the report maintains a optimistic outlook for Bitcoin in December.

Because the ETF verdict approaches, K33 Analysis’s report means that the narrowing time window is predicted to gasoline enthusiasm and drive costs increased. Nevertheless, it’s value noting that when the occasion happens, costs might expertise a short lived surge earlier than probably stabilizing, based on the report.

BTC’s Bull Run Indicator

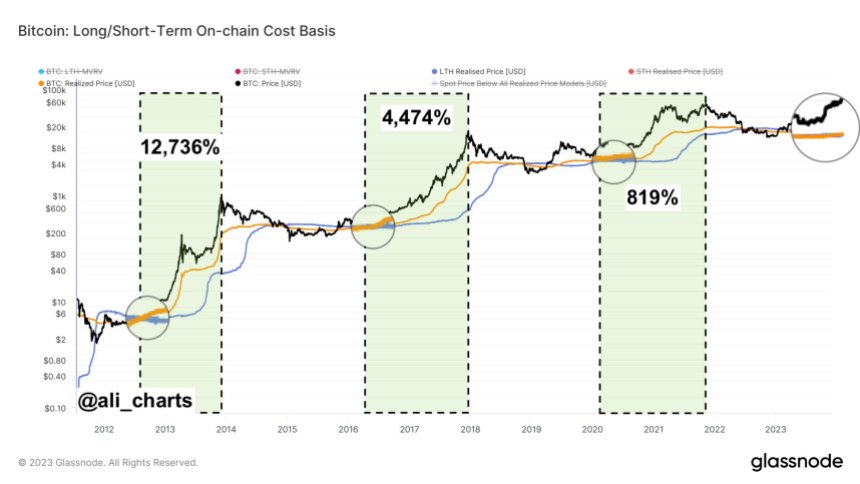

Famend crypto analyst Ali Martinez has recognized a major improvement within the Bitcoin market that implies a bullish outlook for the cryptocurrency.

In line with Martinez, the Realized Value of Bitcoin has surpassed the Lengthy-Time period Holder Realized Value, signaling a rise in market momentum and attracting new buyers keen to buy Bitcoin at increased costs.

Martinez’s evaluation highlights that related occurrences prior to now have preceded substantial value surges, additional fueling optimism concerning Bitcoin’s future efficiency.

The Realized Value of Bitcoin refers back to the common value at which all beforehand transacted cash had been acquired. It considers the worth at which every Bitcoin unit was final moved on the blockchain.

However, the Lengthy-Time period Holder Realized Value focuses particularly on cash held by long-term buyers, offering insights into their common acquisition value. When the Realized Value surpasses the Lengthy-Time period Holder’s Realized Value, it means that newer buyers are coming into the market and are keen to purchase Bitcoin at increased valuations.

As seen within the above chart, Bitcoin skilled vital positive aspects following this bullish sign on three separate events prior to now. Particularly, the cryptocurrency surged 12,736%, 4,474%, and 819%, respectively, following related occasions.

Along with Martinez’s bullish outlook for BTC, the most important cryptocurrency in the marketplace has demonstrated comparatively steady value motion above $44,000 prior to now hour.

This stability will increase the potential for continued upside and consolidation above key ranges, positioning Bitcoin for additional positive aspects and surges sooner or later. It stays to be seen if the cryptocurrency will see any corrections following its spectacular 16% surge over the previous few days.

Featured picture from Shutterstock, chart from TradingView.com