Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin (BTC) recorded slight positive aspects because the Client Worth Index (CPI) inflation price for February got here in decrease than anticipated. The softer inflation studying fuelled hopes of rate of interest cuts by the US Federal Reserve (Fed), probably benefiting risk-on property.

Bitcoin Jumps As Inflation Cools

Based on information from the US Bureau of Labor Statistics, the CPI elevated by 0.2% in February on a seasonally adjusted foundation, bringing the annual inflation price all the way down to 2.8%. This determine not solely fell beneath economists’ projection of two.9% but in addition marked a decline from January’s 0.5% month-to-month enhance.

Associated Studying

Moreover, the core CPI – an inflation measure excluding meals and vitality costs – rose 0.2% month-over-month, underperforming most forecasts of 0.3%. On an annual foundation, core CPI got here in at 3.1%, barely beneath the three.2% consensus.

The lower-than-anticipated inflation information has reignited investor optimism, with hopes the Fed might pivot to a extra dovish financial coverage by slicing rates of interest to spice up market liquidity. Decrease rates of interest sometimes favor risk-on property like shares and cryptocurrencies.

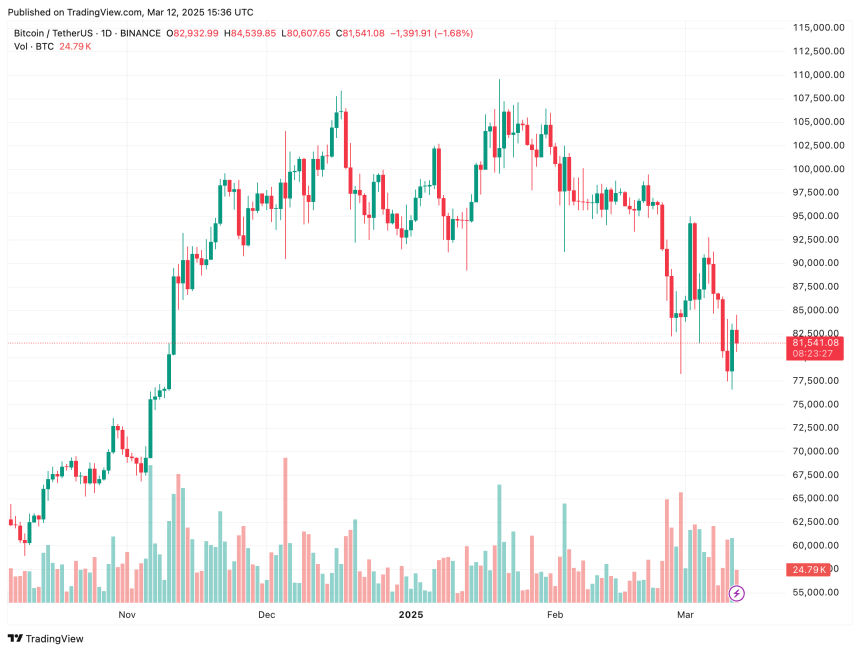

Following the information launch, BTC posted modest positive aspects, climbing from roughly $81,000 to $84,500. Main memecoin Dogecoin (DOGE) additionally noticed a 2.9% rise prior to now 24 hours.

It’s price noting that final month, BTC declined after CPI information got here in hotter than anticipated. Since then, US President Donald Trump’s financial insurance policies – notably excessive commerce tariffs on international locations like Canada, Mexico, and China – have additional hindered bullish momentum for digital property.

Earlier this month, BTC skilled one in all its sharpest declines, dropping from round $94,700 on March 2 to as little as $76,800 on March 11. Over the identical interval, the whole crypto market cap shrank by roughly $600 billion, falling from $3.2 trillion to roughly $2.6 trillion on the time of writing.

BTC Worth Projected To Make Restoration

Whereas the present bearish development has dragged BTC and different cryptocurrencies to multi-month lows, trade specialists imagine digital property are prone to rebound within the later quarters of 2025.

Associated Studying

As an example, crypto entrepreneur Arthur Hayes just lately recommended that whereas BTC might face additional declines within the brief time period, central banks will seemingly resort to quantitative easing to stabilize inventory markets – a transfer that might additionally assist risk-on property get well their losses.

Equally, latest evaluation by CryptoQuant contributor ibrahimcosar forecasts that regardless of the present downturn, BTC is poised to achieve $180,000 by 2026. A weakening US greenback can be prone to hasten the value restoration. At press time, BTC trades at $81,541, reflecting a 0.6% acquire over the previous 24 hours.

Featured picture created with Unsplash, charts from TradingView.com