Yesterday’s weekly shut of the Bitcoin value under the $26,000 mark has raised issues amongst analysts and merchants. This transfer may probably sign an additional decline for the main cryptocurrency, because it seems to be step one to confirming a double high formation on the weekly chart.

Rekt Capital, a distinguished determine within the crypto evaluation sphere, took to Twitter to share his insights, stating, “BTC has formally Weekly Closed under the ~$26,000 help. Technically, BTC has begun step one within the means of validating this Double High formation. Flip $26,000 into new resistance and the breakdown will seemingly be confirmed.”

How Low Can The Bitcoin Worth Drop?

Remarkably, this isn’t the primary time Rekt Capital has voiced issues about this value degree. Already on August 7, the analyst warned, “If BTC drops to $26,000 by mid-September then a Double High could also be forming. A breakdown from $26,000 would validate the Double High.”

Diving deeper into potential value actions, Rekt Capital has speculated {that a} breach of the $26,000 base may see Bitcoin tumble in direction of the $22,000 area. The analyst emphasised the significance of observing the worth motion this week, noting, “if we see a weekly shut under $26,000, adopted by a rejection from $26,000, then we in all probability see a confirmed breakdown from this double high.”

Nevertheless, it’s not all gloom and doom. Rekt Capital additionally highlighted the risks of getting overly bearish, advising merchants, “So it’s actually necessary to not get caught in these draw back wicks (under $26,000).” On a brighter notice, the analyst pointed to the inverse head and shoulders sample on Bitcoin’s weekly chart which performed out in mid-March this yr, suggesting {that a} retest of its neckline, round $24,000, would possibly point out the underside of Bitcoin’s upcoming transfer.

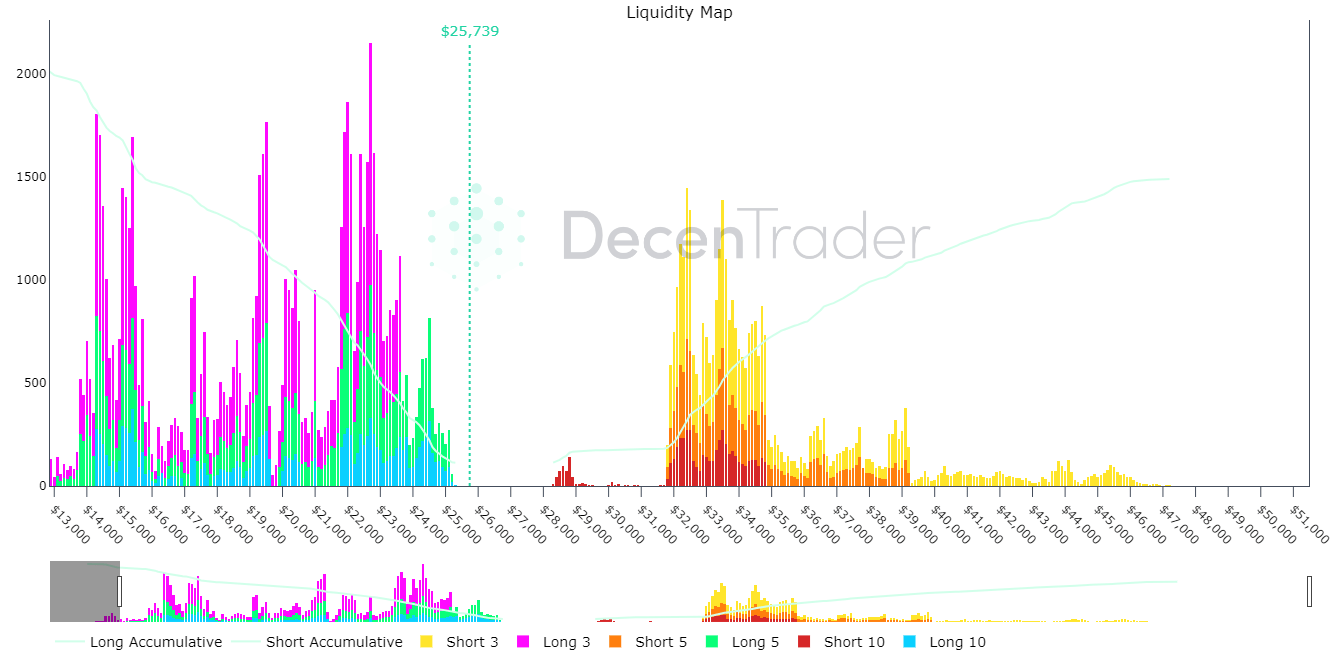

Decentrader, a crypto intelligence platform, weighed in on the present market situations, tweeting, “The market is presently experiencing probably the most sustained interval of #bitcoin on-chain losses because the bear market lows. Is that this a purchase the dip alternative or the beginning of a deeper pullback?”

They additional highlighted potential value actions, stating, “Bitcoin Liquidity Map: There’s a important quantity of 3x, 5x, 10x liquidity from $23,500 all the way down to $21,600. IF value did get all the way down to $23,500 we may see a reasonably swift liquidity escalation occasion that would transfer value down quick.”

Last Correction?

Michaël van de Poppe, one other esteemed analyst, offered a complete historic perspective. He emphasised the importance of September as a traditionally difficult month for Bitcoin, stating, “There’s a degree which #Bitcoin should maintain with a view to keep away from a big crash. Bitcoin is presently holding onto a big degree of help. It’s across the $25,500 barrier.”

Van de Poppe delved into the historic and cyclical features of Bitcoin’s value actions. He highlights that the months of August and September, particularly in a pre-halving yr, have historically been robust for Bitcoin. In August 2015, Bitcoin skilled a considerable correction in direction of the 200-EMA however managed to remain above it. The same sample was noticed in August 2019, with a big correction adopted by a smaller one in November 2019.

Drawing parallels between the present market cycle and that of 2015, van de Poppe steered that given the inflow of latest institutional members, the present market may very well be mirroring the 2015 cycle. If this correlation holds, the present downturn may very well be the ultimate correction earlier than a possible rebound.

At press time, BTC traded at $25,692.

Featured picture from iStock, chart from TradingView.com