Within the final 4 days, the Bitcoin worth has plummeted over 15%, with a major 7.8% drop occurring in simply the previous 24 hours. From a excessive of practically $72,000 in early June, the worth of BTC has now declined by virtually 25%. Listed below are the important thing components behind yesterday’s dramatic fall in worth.

#1 Mt. Gox’s Bitcoin Repayments

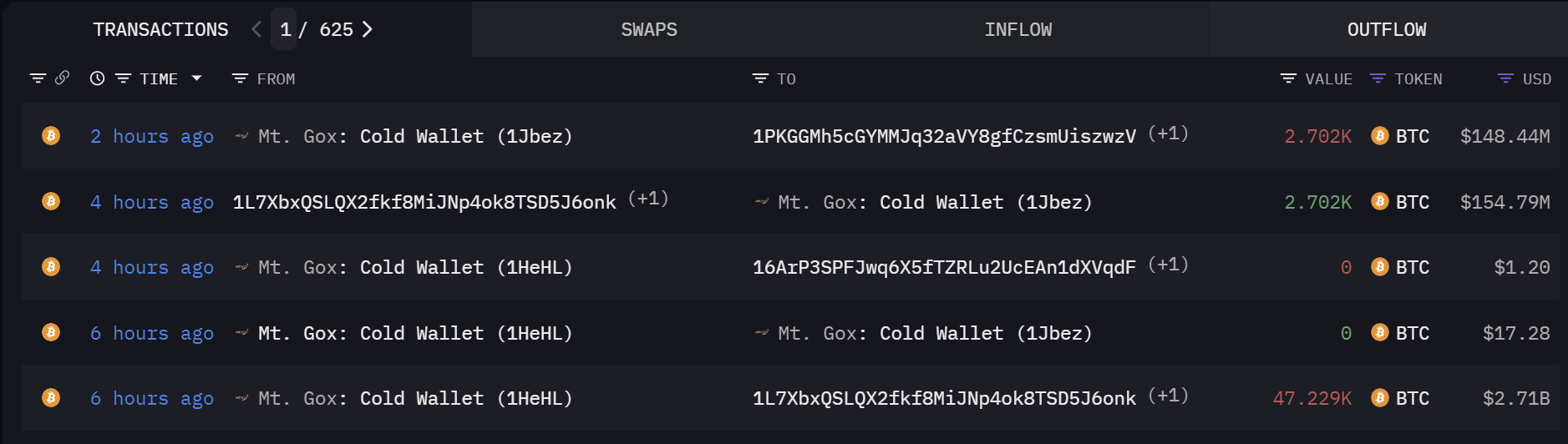

The approaching distribution of 142,000 BTC by the defunct crypto trade Mt. Gox has considerably stirred market nervousness. This quantity, representing 0.68% of the full Bitcoin provide, is slated for distribution among the many collectors of the trade, which ceased operations in 2014 as a result of a significant hacking occasion.

The distribution course of has already seen massive transfers, with 52,633 BTC moved in latest hours, suggesting that preparations are underway for a large-scale disbursement. Market observers and analysts are intently monitoring these actions, because the potential for large promoting by these collectors may inject appreciable volatility into the market.

The psychological influence of this distribution has presumably led to preemptive promoting amongst Bitcoin holders, additional amplifying market jitters.

#2 German Authorities

The German authorities’s determination to start liquidating its Bitcoin holdings has despatched ripples by the market as nicely, with transactions recorded on main exchanges reminiscent of Bitstamp, Coinbase, and Kraken.

Associated Studying

Over a fortnight, the federal government diminished its holdings from 50,000 BTC to 42,274 BTC. Market contributors are understandably nervous {that a} steady sell-off by a significant holder like a authorities may result in downward worth stress.

#3 Large Lengthy Liquidations

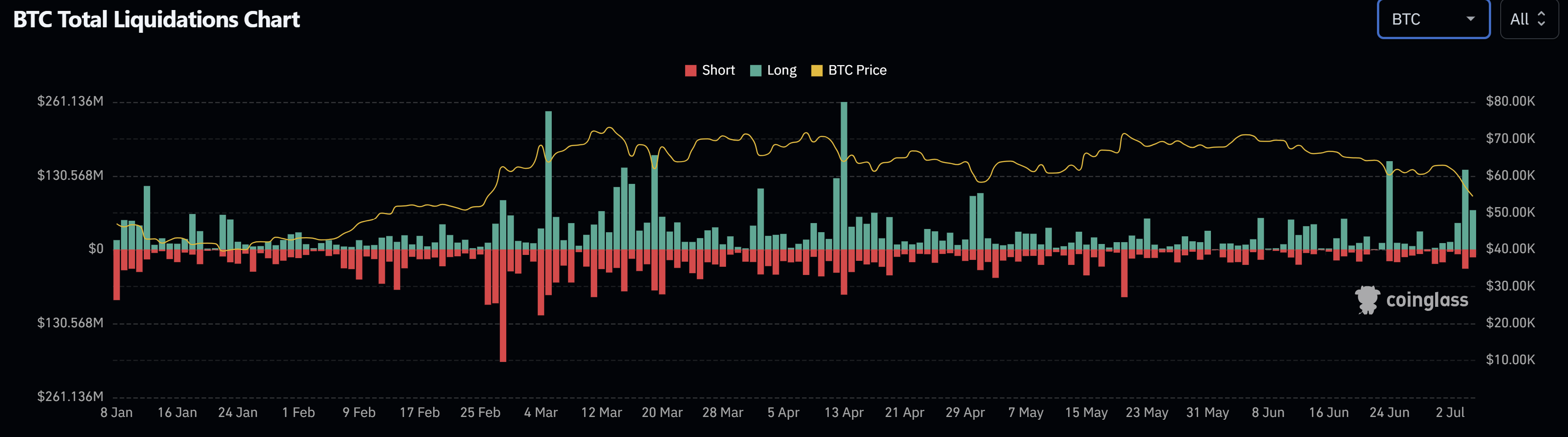

The Bitcoin market has skilled a pointy improve within the liquidation of lengthy positions, with a file $212 million price of BTC liquidated simply prior to now 48 hours. This liquidation is essentially the most important since April 13, when $261 million price of BTC longs have been liquidated, resulting in a steep decline in Bitcoin’s worth from $68,500 to $61,600.

Such liquidations usually set off a sequence response, resulting in compelled sell-offs and additional worth declines. These liquidations are indicative of a extremely leveraged market the place traders is perhaps overextended, contributing to heightened market volatility.

#4 BTC Miner Capitulation

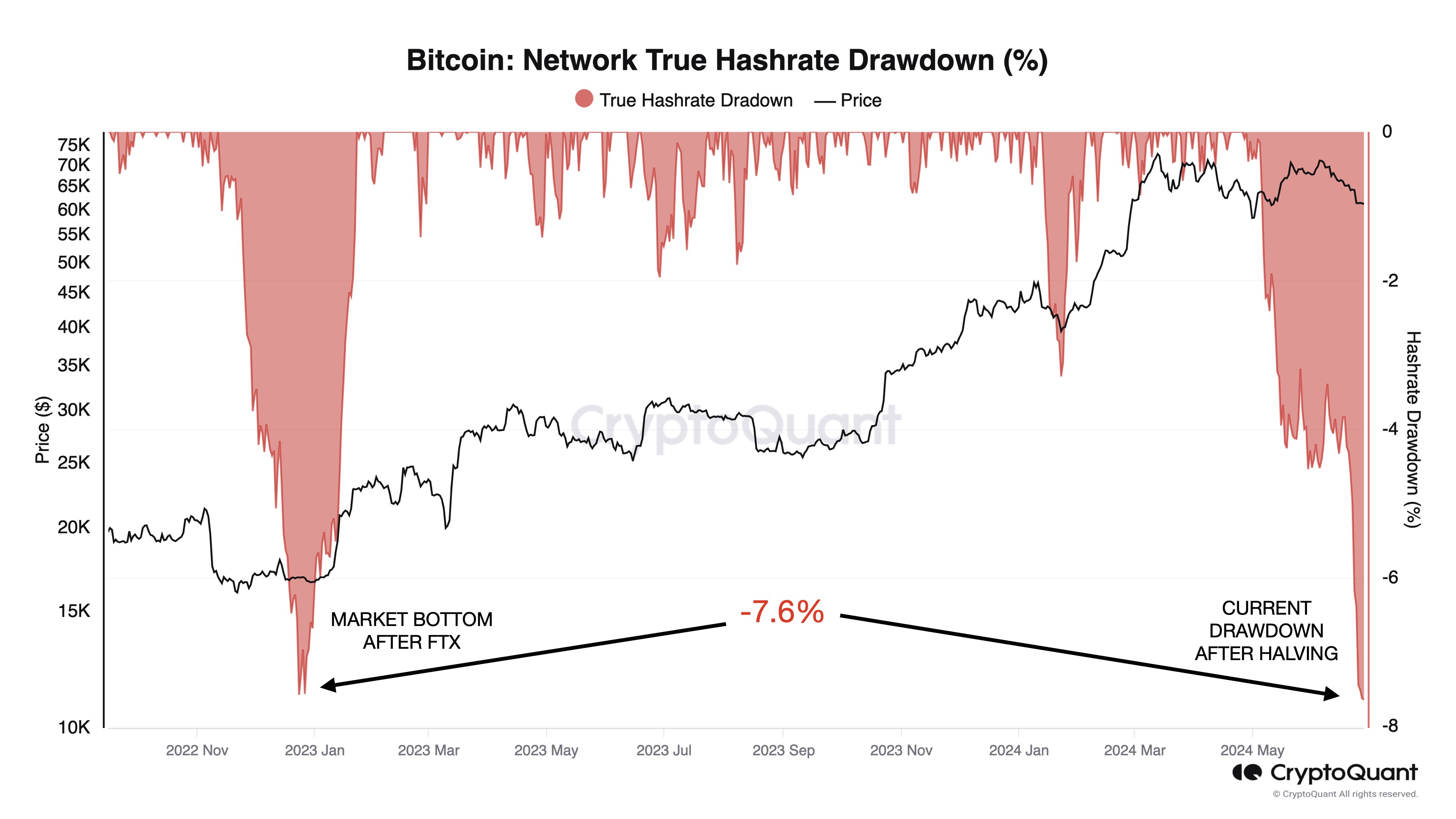

Publish the Bitcoin halving occasion on April 20, 2024, the mining reward was halved from 6.25 to three.125 BTC, escalating financial pressures on miners. This reward discount was anticipated to extend Bitcoin’s worth, however the improve didn’t materialize, leaving miners with diminishing returns.

Associated Studying

The present capitulation amongst miners is akin to earlier market bottoms, such because the one seen following the FTX collapse, researchers from CryptoQuant just lately revealed. Indicators of miner misery, together with a major 7.7% drop in hashrate and a plummet in mining income per hash to close all-time lows, signifies that many miners have been compelled to show off their gear and promote the BTC stash.

#5 Slowdown In US Spot Bitcoin ETF Exercise

Opposite to expectations of a buoyant market pushed by institutional investments by spot Bitcoin ETFs, there was a noticeable slowdown on this sector. The anticipated “second wave” of institutional cash has didn’t materialize to this point, resulting in subdued exercise within the ETF area. As an alternative, the spot ETFs are presently experiencing a summer time lull.

The passion surrounding Bitcoin ETFs has been unable to counteract the overwhelmingly unfavourable market sentiment; nonetheless, its direct influence stays comparatively minor. Main on-chain analyst James “Checkmate” Verify just lately estimated that solely 20% of the spot quantity is attributable to identify ETFs, with the rest stemming from conventional spot markets. Over latest weeks, long-term BTC holders have been promoting off their holdings in important numbers, which has been the first driver of the downward stress available on the market.

At press time, BTC traded at $54,434.

Featured picture created with DALL·E, chart from TradingView.com