Bitcoin worth continues to witness robust resistance across the $19,400 mark. Over the past 24 hours, the coin depreciated by 2.9%. Originally of this month, Bitcoin worth had staged a quick restoration nevertheless it was met with promoting stress.

After the coin began hovering close to the $18,000 worth mark, this stage attracted consumers on the chart. Quickly after that, BTC moved up on its chart two weeks in the past. The technical outlook of the coin indicated that the bears hadn’t given up but.

The bulls might return to the chart if the coin broke previous its instant resistance mark. Shopping for energy was decrease on the chart, and solely a rise in shopping for energy might transfer BTC upwards.

If the bulls handle to stay round over the following buying and selling classes, then BTC can transfer above the $20,000 worth mark. The prospect to rally close to the $22,000 worth stage can also’t be known as not possible as soon as the bulls clear the $20,000 stage.

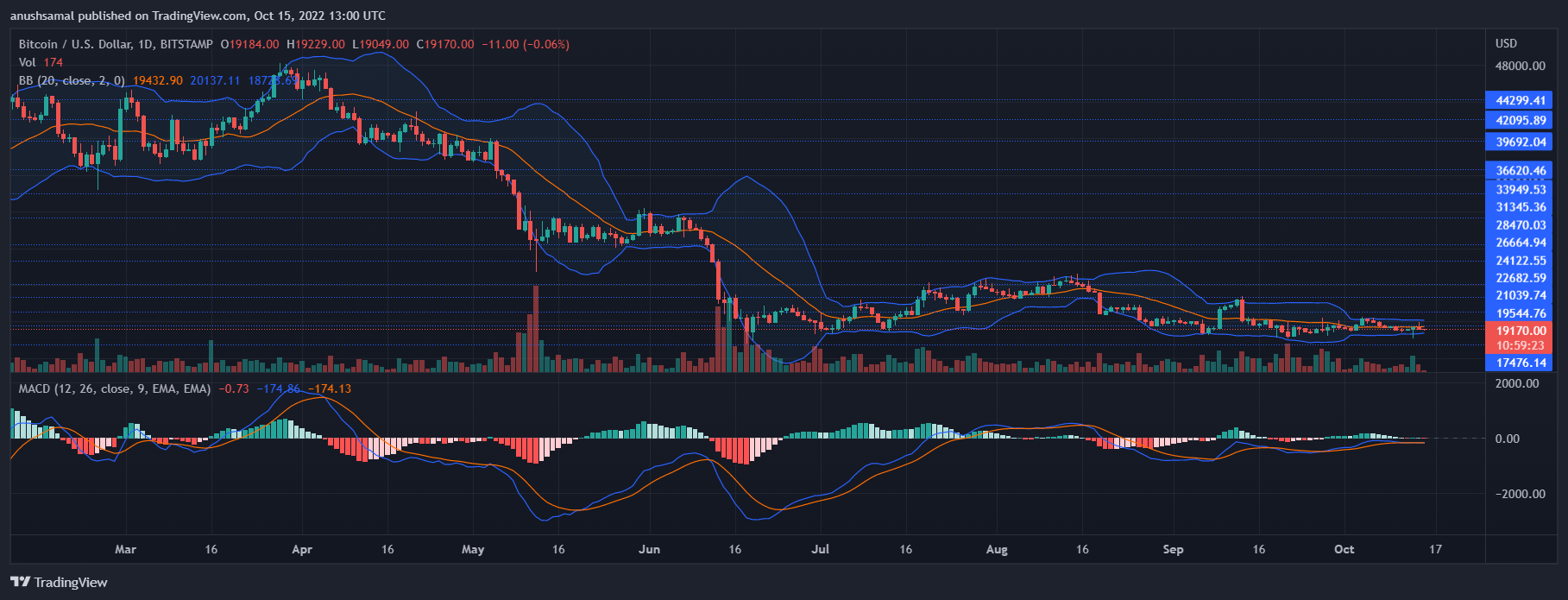

Bitcoin Worth Evaluation: One-Day Chart

BTC was buying and selling at $19,190 on the time of writing. The coin had witnessed vital resistance on the $19,400 worth mark. Shifting previous that stage will assist the coin achieve momentum to maneuver close to the $21,000 resistance mark.

As soon as Bitcoin worth touches the $20,000 stage, the bulls might assist BTC rally additional. Alternatively, help for BTC was at $18,000 and a fall from that may push the coin to $17,400. If consumers don’t resurface over the following buying and selling classes, a fall to the $18,000 worth zone appears to be like possible.

Over the previous buying and selling classes, the quantity of Bitcoin traded dropped, indicating a slowdown in shopping for stress.

Technical Evaluation

The coin depicted that because it struggled to maneuver above the instant resistance, consumers began to lose confidence and sellers took over. The Relative Power Index was parked beneath the half-line, which meant that purchasing energy remained low on the chart.

If consumers choose up the tempo, then Bitcoin can problem its subsequent worth resistance stage. In accordance with the identical studying, the worth of the asset was beneath the 20-SMA line and that was a sign that sellers had been driving the worth momentum available in the market on the time of writing.

On the time of writing, BTC was being dominated by the sellers The coin began to show a promote sign, indicating that it might be attainable for the worth to drop additional.

Shifting Common Convergence Divergence reveals the worth’s momentum and course, MACD underwent a bearish crossover and began to indicate tiny purple histograms, which had been promote sign.

Bollinger Bands depict the volatility of the asset. The bands had fully narrowed, which is a sign of explosive incoming worth motion.