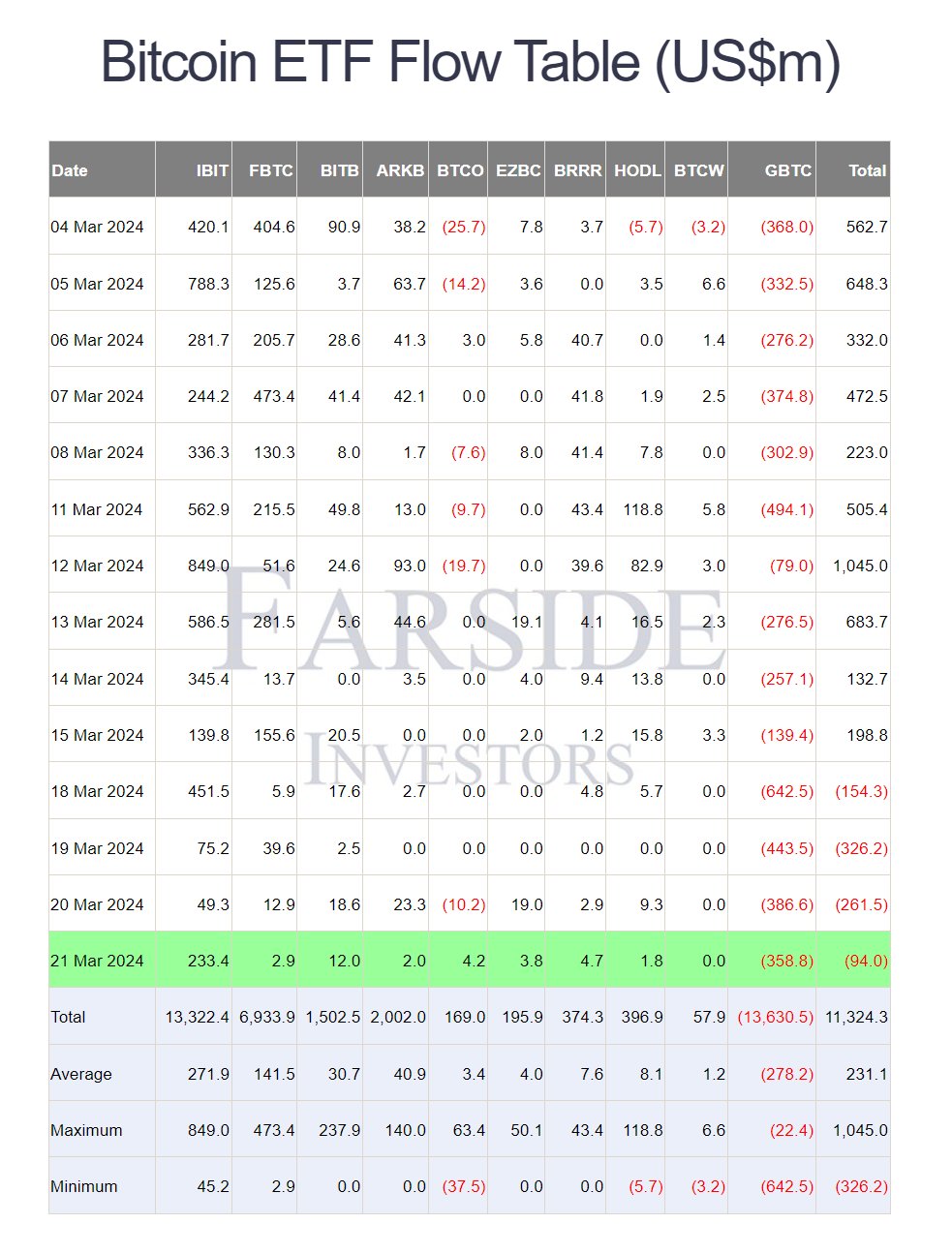

Regardless of a steady four-day streak of internet outflows from Bitcoin spot exchange-traded funds (ETFs) totaling $93.85 million, the Bitcoin value has impressively climbed to reclaim the $66,000 mark. In response to knowledge from Farside Buyers, Grayscale ETF GBTC skilled a big outflow yesterday, with a single-day internet outflow of $358 million, culminating in a historic internet outflow of $13.63 billion for GBTC alone.

In stark distinction, the BlackRock Bitcoin spot ETF (IBIT) witnessed a substantial internet influx of $233 million yesterday, elevating IBIT’s whole internet influx to $13.32 billion. That is barely beneath the typical for BlackRock, which has seen $271.9 million in inflows since its launch on January 11.

Different ETFs haven’t fared as nicely in latest days. Constancy’s FBTC, the second-largest ETF, has so far achieved a mean each day influx of $141.5 million, however skilled a disappointing $2.5 million in inflows yesterday.

The third-largest, Ark Make investments’s spot Bitcoin ETF, has seen common inflows of $40.9 million thus far, with yesterday’s inflows at simply $2.0 million. Bitwise’s BITB, rating fourth, has collected $30.7 million on common, with a modest $12 million in inflows yesterday.

Throughout the board, all spot Bitcoin ETFs, together with GBTC, have recorded a mean of roughly $230 million in each day inflows since January 11.

Bitcoin Worth Stagnates: Purpose To Fear?

CryptoQuant CEO Ki Younger Ju provided insights on the state of affairs by way of X, stating, “Bitcoin spot ETF netflows are slowing. Demand might rebound if the BTC value approaches essential assist ranges. New whales, primarily ETF patrons, have a $56K on-chain value foundation. Corrections sometimes entail a max drawdown of round 30% in bull markets, with a max ache of $51K.”

Crypto analyst WhalePanda highlighted the pattern, noting, “Yesterday’s ETF flows: One other damaging day, that’s 4 in a row […] Actually stunned by how large the outflows are from GBTC. One other $358.8 million and that makes a complete of $1.83 billion in simply 4 days.” WhalePanda additionally touched on Genesis’ function, suggesting the corporate’s “in-kind” sale of GBTC shares for BTC would possibly clarify the big outflows with out corresponding market dumps.

Thomas Fahrer, founding father of Apollo, offered a bullish perspective, “I do know it’s forbidden to put up something bullish on #Bitcoin ETFs proper now, however I’m gonna do it anyway. GBTC promoting is short-term. Monetary advisors and establishments have barely begun shopping for. $100 BILLION inflows are coming subsequent 1-2 years. Persistence.”

Charles Edwards, founding father of Capriole Investments, commented on the Grayscale state of affairs, “Grayscale Bitcoin ETF holdings falling off a cliff. Down 50%, or about $20B at present BTC value. We should be days/weeks away from them slashing charges to cease the bleeding. Blackrock holdings anticipated to overhaul Grayscale earlier than the Halving!”

Though the previous couple of days have been fairly disappointing, it’s value noting that the outflows are coming (virtually) solely from Grayscale’s GBTC, whereas different traders are holding on tight to their Bitcoin investments. Which means it is just a matter of time earlier than Grayscale’s outflows cease, and even small inflows from the opposite ETFs make a big effect (with out the outflows).

At press time, BTC traded $66,203.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site completely at your personal threat.