The Bitcoin value has risen as excessive as $38,012 (on Binance), recording a touch increased excessive. Listed here are the principle causes for the most recent surge in BTC value.

#1 Euphoria Over Potential ETF Approvals

The crypto market has been electrified by the potential of the US Securities and Trade Fee (SEC) approving a number of spot Bitcoin ETFs. With the approval window having opened on November 9 till Friday (November 17), consultants like James Seyffart and Eric Balchunas from Bloomberg estimate a 90% likelihood of approval for a number of filings by January 10, 2024, the ultimate deadline for Ark Make investments’s submitting.

Remarkably, the SEC is going through a big deadline cluster, with three purposes for spot ETFs from Franklin Templeton and Hashdex (due November 17), and GlobalX (due November 21) awaiting choices. Amidst this tense backdrop, Hashdex emerged as the primary to come across a delay, because the SEC postponed their resolution on the conversion from a futures ETF to an ETF that holds each futures and spot.

This information momentarily jolted the market, leading to a pointy however transient decline in BTC’s value, which plummeted from $37,400 to $36,780 in a swift five-minute span. Nevertheless, the market’s resilience was shortly demonstrated as Bitcoin not solely recovered however exceeded its pre-announcement value inside 25 minutes.

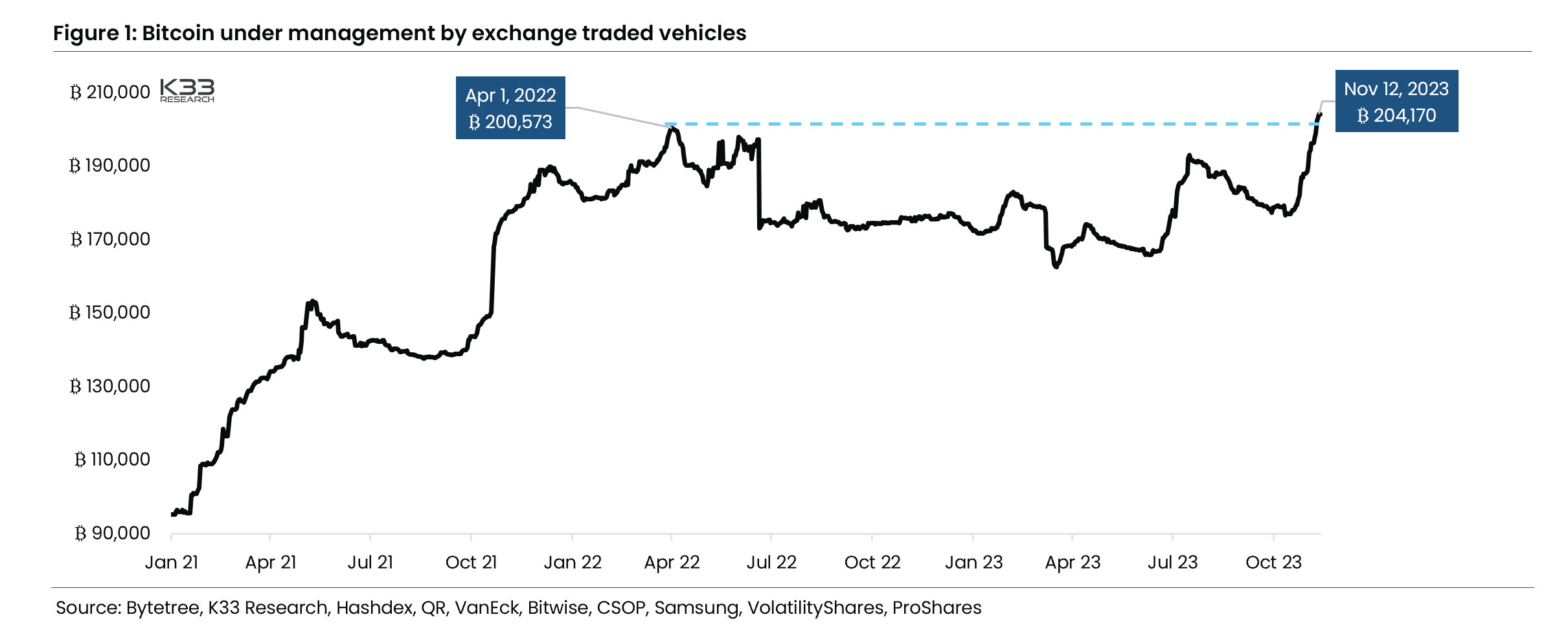

#2 Unprecedented Institutional Curiosity In Bitcoin

Institutional demand for Bitcoin has reached new heights, significantly by means of exchange-traded merchandise (ETPs). The current BlackRock Bitcoin spot ETF submitting considerably contributed to this surge. “The Belongings Beneath Administration by way of ETPs have elevated by 27,095 BTC, bringing the overall to a report 204,170 BTC, equal to roughly 7.4 billion {dollars},” reports K33 analysis. This development signifies a rising institutional embrace of Bitcoin as a viable funding asset.

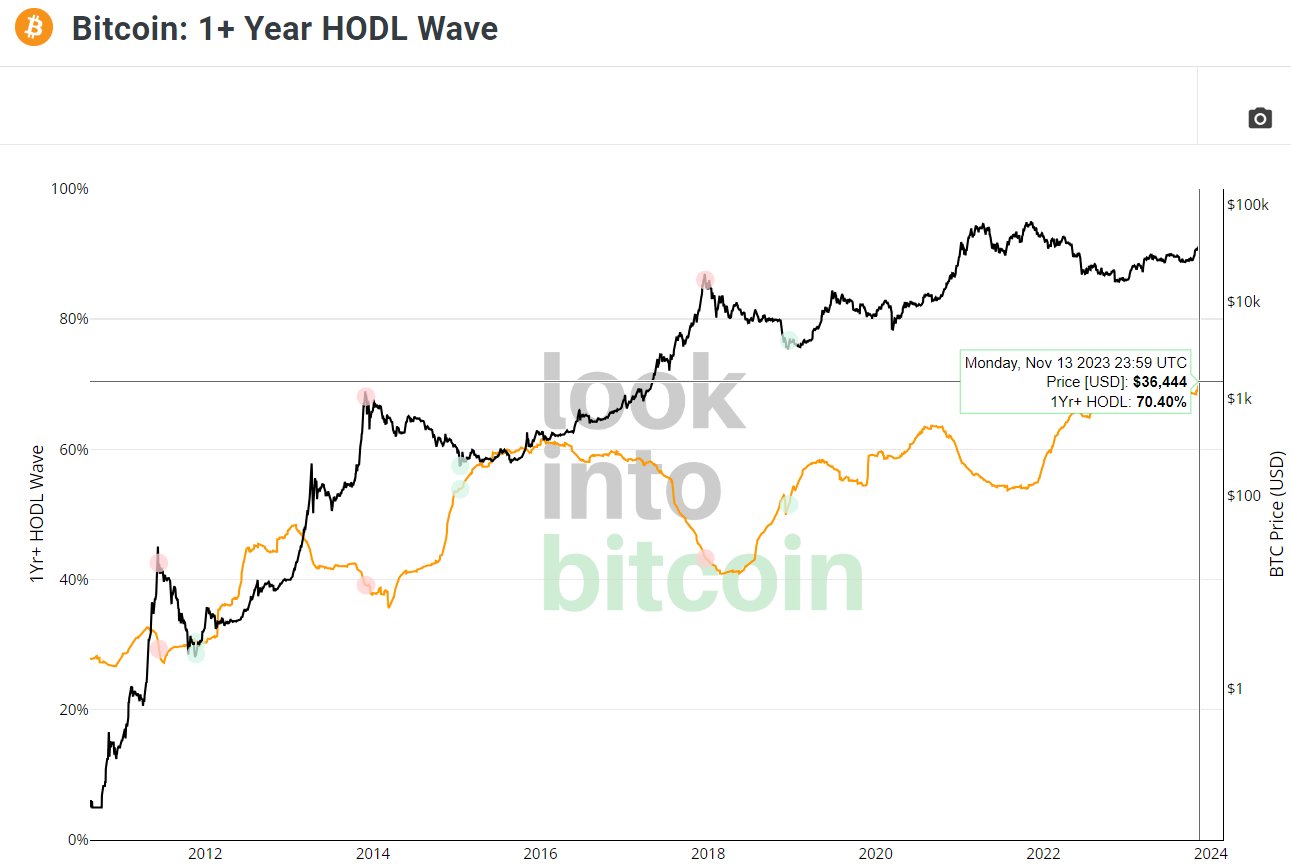

#3 Provide And Demand Dynamics

Knowledge from LookIntoBitcoin highlights a exceptional development: over 70% of Bitcoin has not been moved for at the very least one yr. “It is a historic second that underscores the power of Bitcoin’s tokenomics,” the info supplier shared. They additional elaborated, “So long as this HODL Wave continues to climb, it suggests a bullish market outlook with long-term buyers displaying no indicators of promoting their holdings. That is significantly important contemplating the upcoming Bitcoin Halving occasion and the rising institutional curiosity.”

#4 Liquidity Injections By The Fed

Arthur Hayes, co-founder of BitMEX, commented on the numerous liquidity being injected into the market and its impression on cryptocurrencies. “Hold your eye on the prize. Nearly $200 billion in liquidity has been added since November’s begin, impacting belongings like Bitcoin. This means a possible ongoing rise for cryptocurrencies,” Hayes acknowledged. He emphasizes the significance of understanding the RRP and TGA dynamics in predicting market actions.

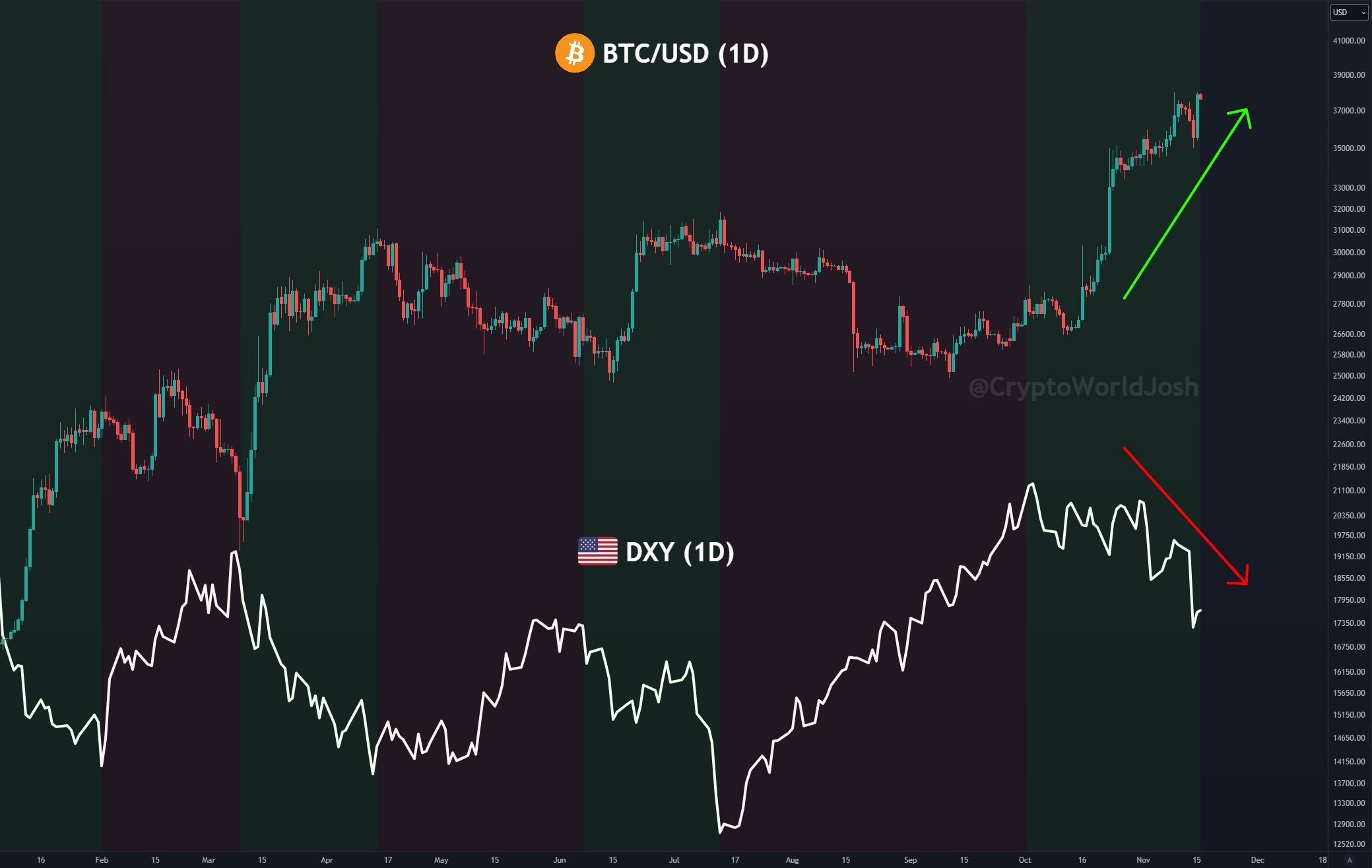

#5 Inverse Correlation With The DXY

The inverse correlation between Bitcoin and the U.S. Greenback Index (DXY) has been a notable think about Bitcoin’s current value enhance. Because the DXY confronted resistance and started to fall, Bitcoin’s worth conversely elevated. Crypto analyst Josh stated, “Bitcoin PUMPS whereas the DXY DUMPS!”

At press time, BTC traded at $37,467 after failing to interrupt out of the ascending development channel.

Featured picture from iStock, chart from TradingView.com