The Bitcoin market dynamics have not too long ago taken an attention-grabbing flip, suggests Alex Thorn, Head of Firmwide Analysis at Galaxy. In line with his latest thread on X, the choices market makers in BTC are presently working able that might considerably amplify any upward motion in its worth.

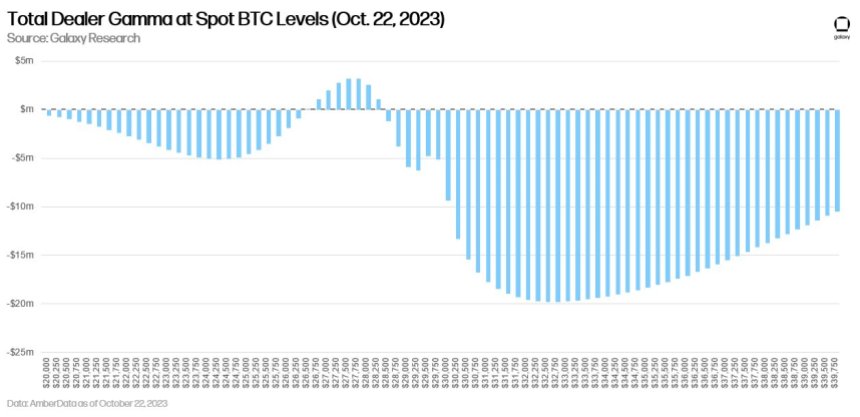

“Choices market makers in Bitcoin are more and more brief gamma as BTC spot worth strikes up. […] This could amplify the explosiveness of any short-term upward transfer within the close to time period,” Thorn notes.

This means that because the spot worth of Bitcoin rises, these market makers have to purchase again extra of the cryptocurrency to keep up their positions, a phenomenon that might doubtlessly amplify worth surges.

The Biggest Present On Earth: Bitcoin

Furthermore, he highlighted that knowledge from Amber signifies that sellers are more and more shifting into a brief gamma place, particularly when the BTC worth is above $28.5k. In additional specific phrases, Thorn explains, “At $32.5k, market makers want to purchase $20 million of delta for each subsequent 1% transfer greater.” Such positioning means that market makers might need to make substantial purchases of Bitcoin because the spot worth continues to ascend.

Nevertheless, it’s not simply upward actions which can be impacted. Thorn sheds mild on the flip aspect of the coin as properly. “Sellers are lengthy gamma within the $26,750-28,250 vary. Whenever you’re lengthy gamma & spot declines, you even have to purchase again spot to remain delta impartial,” he feedback. Which means any minor downward adjustment in worth may discover resistance as choices sellers make essential purchases to realign their positions.

For bullish buyers, these dynamics current a gorgeous panorama. Thorn elucidates, “This can be a nice setup for bulls as a result of if spot strikes reasonably greater, brief gamma protecting may make it rip a lot greater fairly rapidly, but when it strikes decrease, lengthy gamma protecting may present some assist and restrict near-term draw back.”

Highlighting potential catalysts that may set the Bitcoin spot worth in movement, Thorn pointed to the rising anticipation surrounding Bitcoin ETF approvals. Most not too long ago, famend personalities and establishments similar to Cathie Wooden, Paul Grewal, JP Morgan, and several other analysts from Bloomberg Intelligence have expressed constructive sentiments on the chances for approval.

Eric Balchunas and James Seyffart of Bloomberg predict that the chances of a spot Bitcoin ETF are 75% by the tip of this yr and 95% by the tip of 2024. Moreover, Thorn mentions the latest surge in Bitcoin’s worth above $31,000, suggesting it surpassed final month’s highs following the pretend information of an ETF approval.

Past market sentiments and speculations, basic provide, and liquidity dynamics additionally play a job. Thorn mentions, “Bitcoin’s presently constrained provide and liquidity may additionally serve to amplify upward strikes.” Notably, trade balances of Bitcoin have plummeted to ranges not seen since 2018.

Concurrently, smaller entities are accumulating Bitcoin, whereas bigger holders, typically termed “whales,” seem like lowering their positions. He underscores the power of the Bitcoin group with a word on hodlers: “70% of provide has not transacted in 1+ years, 30% in 5+ years… ATHs each.”

With all these dynamics at play, Thorn aptly sums up the present state of the Bitcoin market: “The following a number of months will likely be very attention-grabbing — Bitcoin is the best present on earth.”

At press time, BTC traded at $30,676.

Featured picture from LinkedIn, chart from TradingView.com