Bitcoin costs are hovering close to $70,000, bouncing from a important dynamic help line, evident within the each day chart. Though bulls have but to breach $72,000 and break above March 2024 highs, merchants are optimistic about what lies forward.

Bitcoin Bulls In Cost: Analyst Targets $85,000

Taking to X, one analyst believes the world’s Most worthy coin is getting ready for a decisive breakout above the native resistance ranges and all-time highs at round $74,000. In a put up, the analyst notes that Bitcoin has been consolidating, shifting sideways and even decrease for the previous three months since mid-March.

Associated Studying

If consumers succeed, the close to 100-day consolidation may set the bottom for costs to spike, ushering a “subsequent leg greater” that may possible take BTC to $85,000. Nonetheless, even amid the optimism, merchants needs to be cautious.

Technically, the upside momentum has been fizzling. Even with good points on June 3, consumers’ failure to verify the good points of Could 20 is slowing down the uptrend. To date, the $72,000 stage on the higher hand have to be conquered for any hopes of additional good points. On the decrease finish, help lies at $66,000.

Even so, the dynamic 20-day shifting common is rising as a worthy help. Any breakout in both route, most ideally in alignment with Q1 2024 good points, can be essentially pushed.

Inflation, Spot BTC ETF Inflows Fanning Demand

Taking a look at elementary information streaming from the USA, the stage is being set for optimistic consumers. Cooling inflation and the uptick in M2 cash provide may trace that consumers are preparing.

The USA Federal Reserve has carefully monitored inflation, amongst different metrics. With inflation dropping, the Fed might resolve to slash rates of interest, fueling a bull run prefer it did in 2021.

Associated Studying

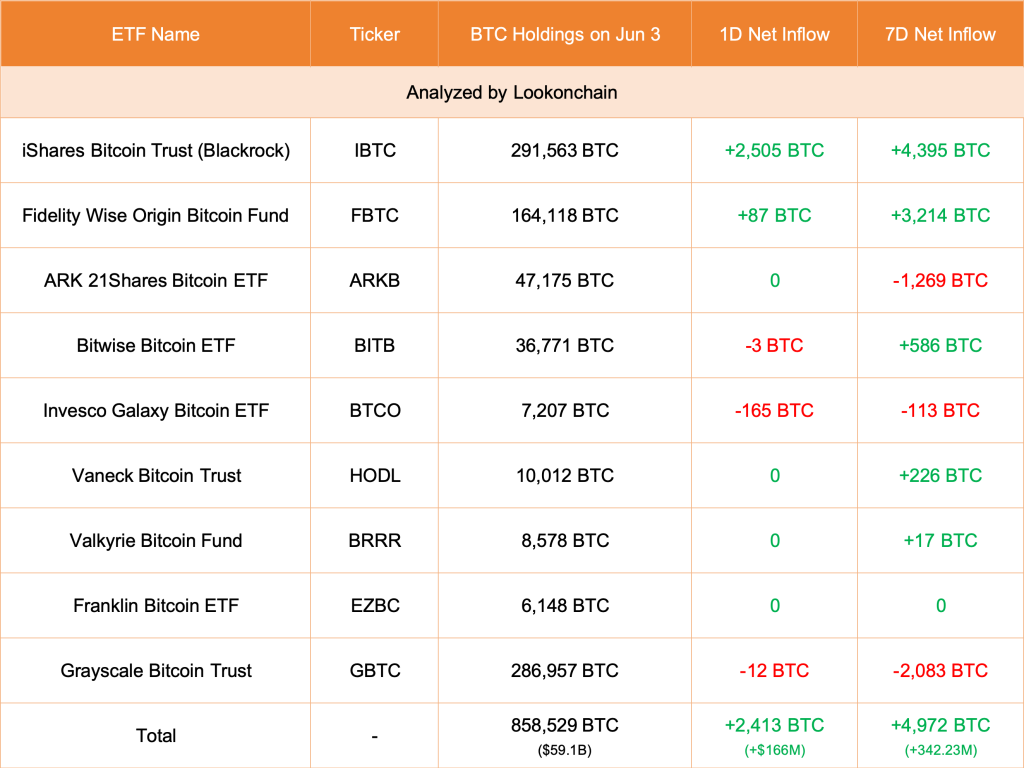

Different key drivers would come with the encouraging movement into spot Bitcoin ETFs. As BTC soared to register March 2024 highs, influx spiked, pushed mainly by institutional demand. After costs broke greater on Could 20, inflows have picked up momentum.

On June 3, Lookonchain information revealed that spot BTC ETF issuers in the USA added 2,413 BTC. Grayscale’s GBTC lowered simply 12 BTC.

Launching the Monochrome Bitcoin ETF (IBTC) in Australia and the same product in Hong Kong and globally will solely improve the demand for BTC. The newly launched IBTC spot ETF in Australia will instantly maintain BTC, which will likely be below the custody of Coinbase.

Function picture from DALLE, chart from TradingView