Este artículo también está disponible en español.

Bitcoin (BTC) seems poised to document its finest September in a decade, surging previous $65,000. This uncharacteristic worth appreciation might be attributed to a number of key elements.

Causes Behind Bitcoin’s Spectacular September Features

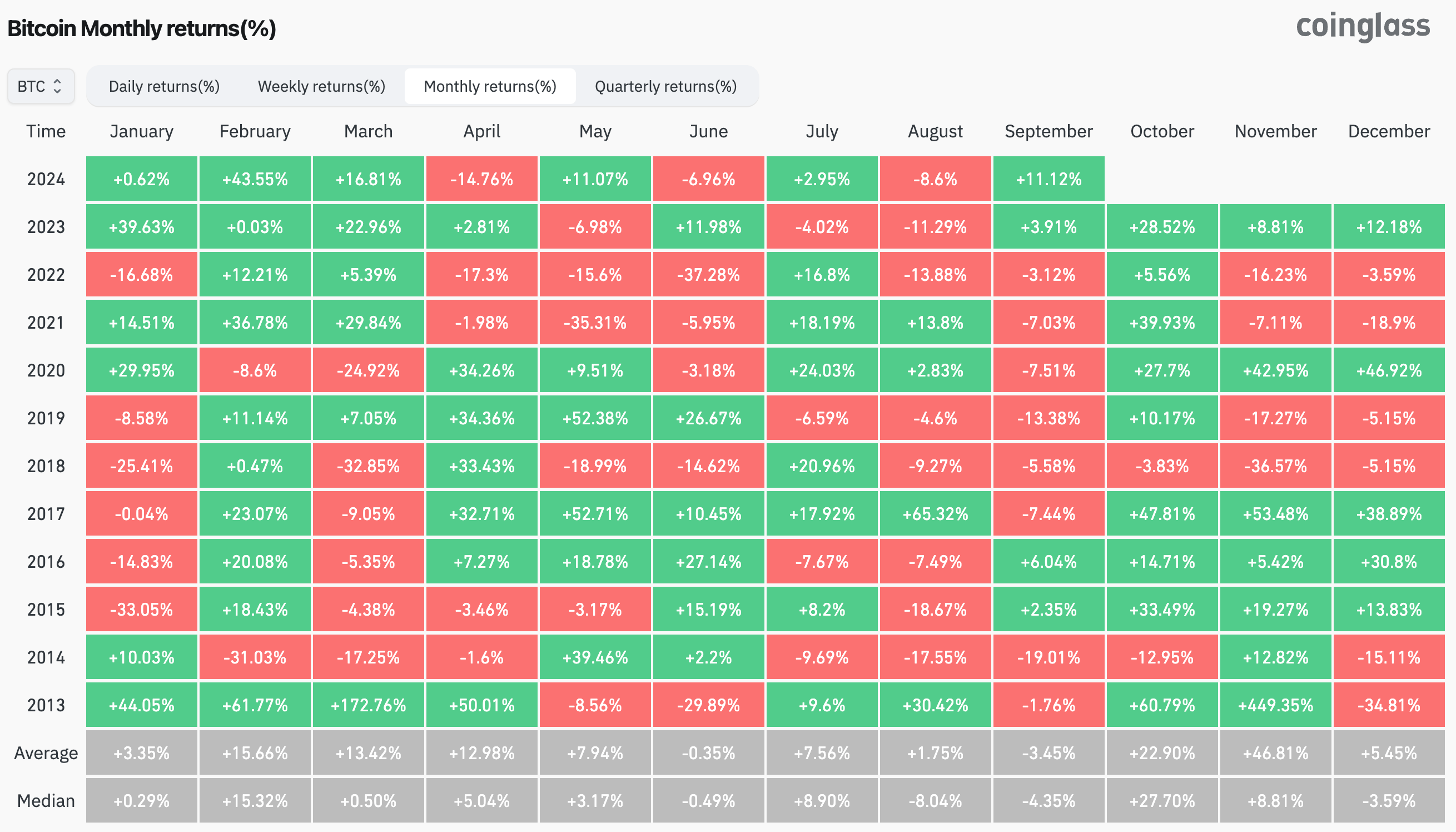

Traditionally, September has constantly been the worst month for BTC when it comes to worth efficiency. Nonetheless, the apex cryptocurrency is now on observe to submit its finest September in at the least a decade, pushed by a number of macroeconomic developments.

Associated Studying

On September 18, the US Federal Reserve (Fed) initiated its rate of interest lower cycle for the primary time in 4 years, slashing charges by 50 foundation factors (bps) in response to slowing inflation and rising unemployment.

The speed lower instantly impacted risk-on property, together with BTC, which has appreciated by over 10% because the lower. As compared, Bitcoin’s common worth decline in September over the previous decade has been 3.45%, in accordance with the chart under from CoinGlass.

In line with the Fed’s choice, the European Central Financial institution (ECB) and the Folks’s Financial institution of China (PBoC) lowered borrowing prices to stimulate their respective economies. This additional propelled BTC’s worth in the direction of its earlier highs.

Bitcoin halving is one other key issue that would now be beginning to present its impact on the digital asset’s worth motion. Bitcoin underwent its halving earlier this yr in April, lowering block affirmation rewards for miners from 6.25 BTC to three.125 BTC.

Previous information signifies that halving has sometimes been a bullish set off for Bitcoin because of the ensuing provide shortage. As an illustration, in Could 2020, BTC worth rose from roughly $8,900 earlier than the halving to greater than $64,000 by April 2021 – an 8x worth surge in lower than a yr.

In the meantime, US spot Bitcoin exchange-traded funds (ETFs) proceed to witness rising curiosity from retail and institutional buyers alike, as they recorded $365.57 million in complete web each day inflows on September 26, the biggest since late July. Since their launch, the cumulative web influx for Bitcoin ETFs now totals $18.31 billion.

Cautious Optimism Key To Using The BTC Wave

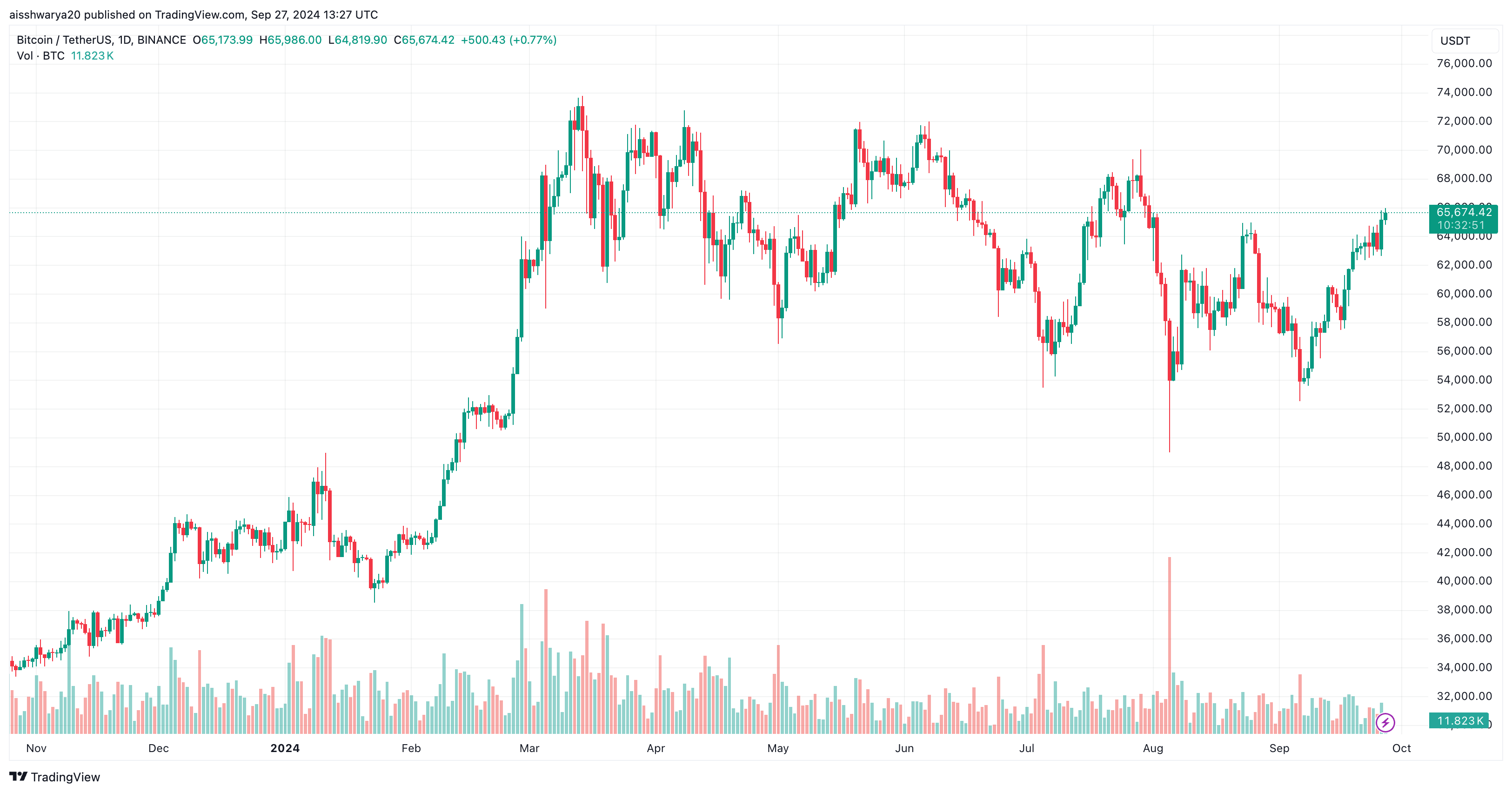

Whereas BTC seems to have shaken off its typical September stoop, it’s price highlighting that the main digital asset nonetheless wants to beat sure essential worth ranges earlier than hitting a brand new all-time-high (ATH).

Associated Studying

As beforehand reported, Bitcoin’s relative power index (RSI) fell under 80 on the month-to-month chart, signaling that the cryptocurrency’s bullish momentum would possibly fade after an enthusiastic shopping for spree.

As well as, a latest report by crypto alternate Bitfinex famous that regardless of Bitcoin’s latest upward motion, it should decisively overcome a robust resistance degree of $65,200 to proceed its optimistic momentum. The excellent news for bulls is that BTC is holding regular at $65,674, up 2% within the final 24 hours.

Featured picture from Unsplash, Charts from CoinGlass.com and Tradingview.com