Bitcoin has seen a pullback however to not the extent that bears have been anticipating. However, because of this, plenty of merchants have incurred large losses because of Bitcoin staging one other surprising restoration. The loss volumes have shortly risen to $190 million in in the future as uncertainty stays the order of the day.

Crypto Liquidations Attain $190 Million

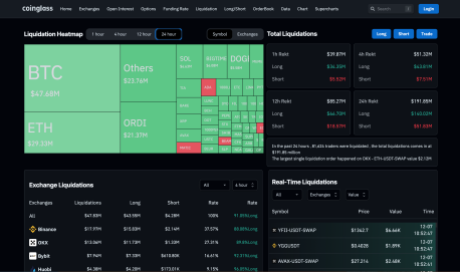

Based on knowledge from Coinglass, the 24-hour crypto liquidation volumes shortly rose above $190 million as Bitcoin accomplished a shakeout. This started with the value pullback to the $43,600 territory. After which a speedy rise again towards $44,000 accomplished the transfer.

Following this, merchants on each side shortly discovered themselves holding loss positions, and the liquidations pilled up. In complete, over 81,000 merchants had been caught within the purple, resulting in greater than $190 million in losses. Apparently, nearly all of these had been from lengthy trades who had been betting on the value to proceed to rise.

Supply: Coinglass

Coinglass places 73.74% of the entire liquidations prior to now day to be from lengthy merchants, which means that round 45,000 merchants had been lengthy this time round. The only largest liquidation occasion was recorded on the OKX crypto alternate throughout the ETH-USDT-SWAP pair which was valued at $2.12 million on the time of the liquidation.

There was additionally a brand new entrant into the highest 3 by way of liquidation volumes. Naturally, Bitcoin and Ethereum led the pack with liquidation volumes of $47.12 million and $29.16 million. Nonetheless, ORDI got here in third place with $21.64 million in liquidations in 24 hours.

Lengthy Merchants In Hassle As Bitcoin Tanks

Lengthy merchants have continued to undergo the brunt of the liquidations within the final day, and the tides are nonetheless but to show in opposition to the bears. As Bitcoin’s worth has briefly plunged beneath $43,000 and recovered again up towards $43,400 as soon as extra, the lengthy liquidations are nonetheless piling up.

On the time of this writing, quick liquidations made up 91.05% of the roughly $47.83 million in liquidations which were recorded within the final 4 hours. This 4-hour liquidation development can also be being led by the identical prime three together with Bitcoin, Ethereum, and ORDI, all of which have seen plenty of volatility within the final week. If Bitcoin’s restoration continues to point out excessive volatility, these liquidation volumes will proceed to rise.

Nearly all of the liquidations have taken place on each the Binance and OKX exchanges with $82.56 million and $60.51 million, respectively. ByBit alternate snags third place with $27.05 million in liquidations within the final day.

Bitcoin is at the moment struggling to take care of help above $43,000, which explains why there was an uptick within the liquidation development in the previous few hours. Nonetheless, bulls are nonetheless forward and proceed to dominate as sentiment stays firmly in greed.

BTC displays excessive volatility | Supply: BTCUSD on Tradingview.com

Featured picture from Coin Tradition, chart from Tradingview.com