Macro Highlights

- U.S inflation is just too excessive for charge reduction however largely in keeping with expectations

- ECB raised an additional 50bps taking their deposit facility charge to three%

- Silicon Valley Financial institution information for chapter 11 chapter

- Credit score Suisse and First Republic Financial institution proceed to be supplied with liquidity

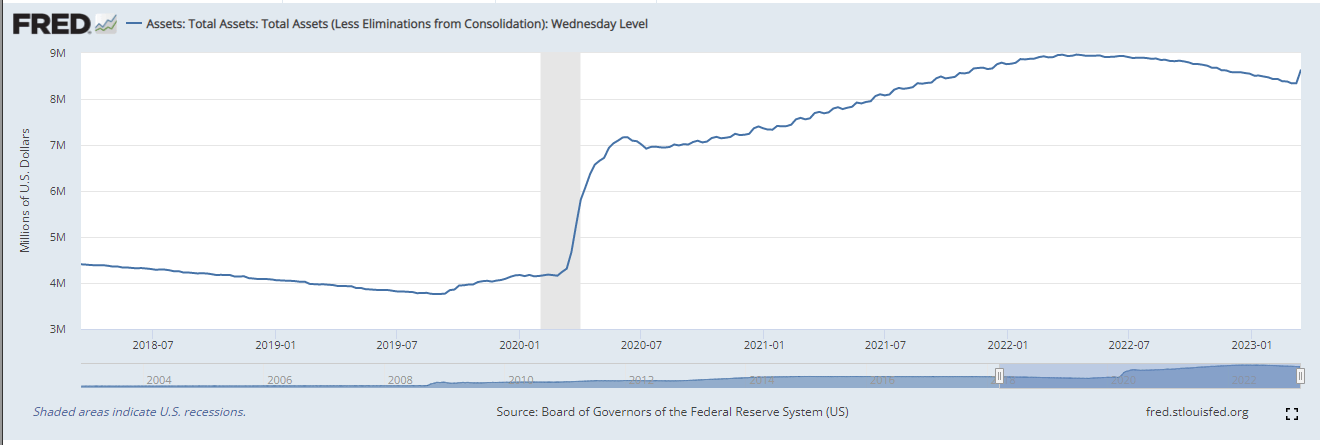

- Fed initiated stealth QE as stability sheet grows

Bitcoin Highlights

Stealth QE and bailouts

Stealth bailouts

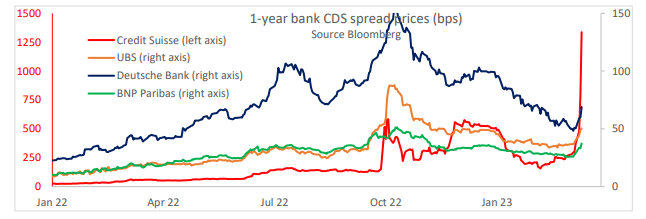

Credit score Suisse grabbed a liquidity lifeline thrown by the Swiss Nationwide Financial institution and borrowed as much as 50 billion CHF, the equal of 6.25% of the Swiss GDP. Credit score Suisse’s share worth has tanked roughly 20% this week whereas its default swaps proceed to blow out.

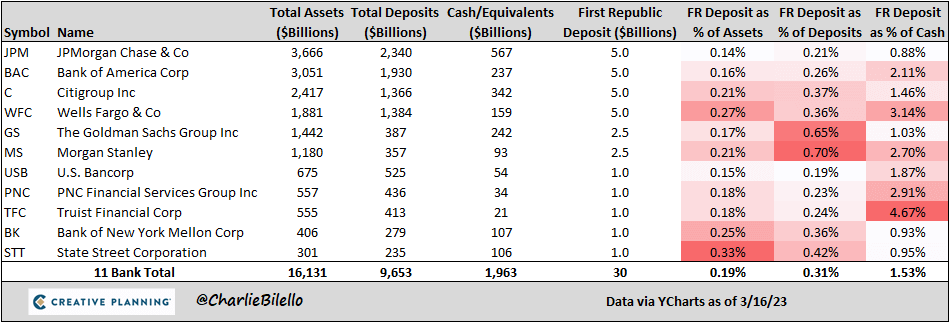

It’s not simply Credit score Suisse who have been offered a lifeline; First Republic Financial institution’s (FRB) share worth has dropped 78% up to now month. Information was introduced that 11 large banks have been serving to FRB as they pledged $30 billion. Nevertheless, the inventory continued to slip into Friday’s session.

Stealth QE

The fed stability sheet has elevated by over $300 billion this week, which has jumped to $8.69 trillion, wiping out half the quantitative tightening the fed has been doing for the previous yr.

The rise within the stability sheet is from this system BTFP; in layman’s phrases, this permits establishments to swap devalued belongings for full-value money. As well as, the fed’s low cost window went parabolic to $148 billion this week, the best stage since 2008. Once more, in layman’s phrases, distressed banks name for fed liquidity.

Stability sheet development

- Roughly +$148.3 billion – web low cost window borrowing.

- Roughly, +$11.9 billion – the brand new Financial institution Time period Funding Program

Subtotal: $160.2 billion

- Roughly +$142.8 billion – borrowing for banks seized by FDIC Whole:

This totals = $303 billion

ECB hikes 50bps ignores ahead steering

ECB hiked 50bps for the third consecutive session, rising its deposit facility charge to three%. Simply six months in the past, the deposit charge was at 0. Lagarde and the ECB stay agency of their “dedication to struggle inflation.”, which is “projected too excessive for too lengthy.”

Ahead steering was eliminated, and no understanding of future strikes, as a substitute reiterated, “the elevated stage of uncertainty reinforces the significance of a data-dependent method”.

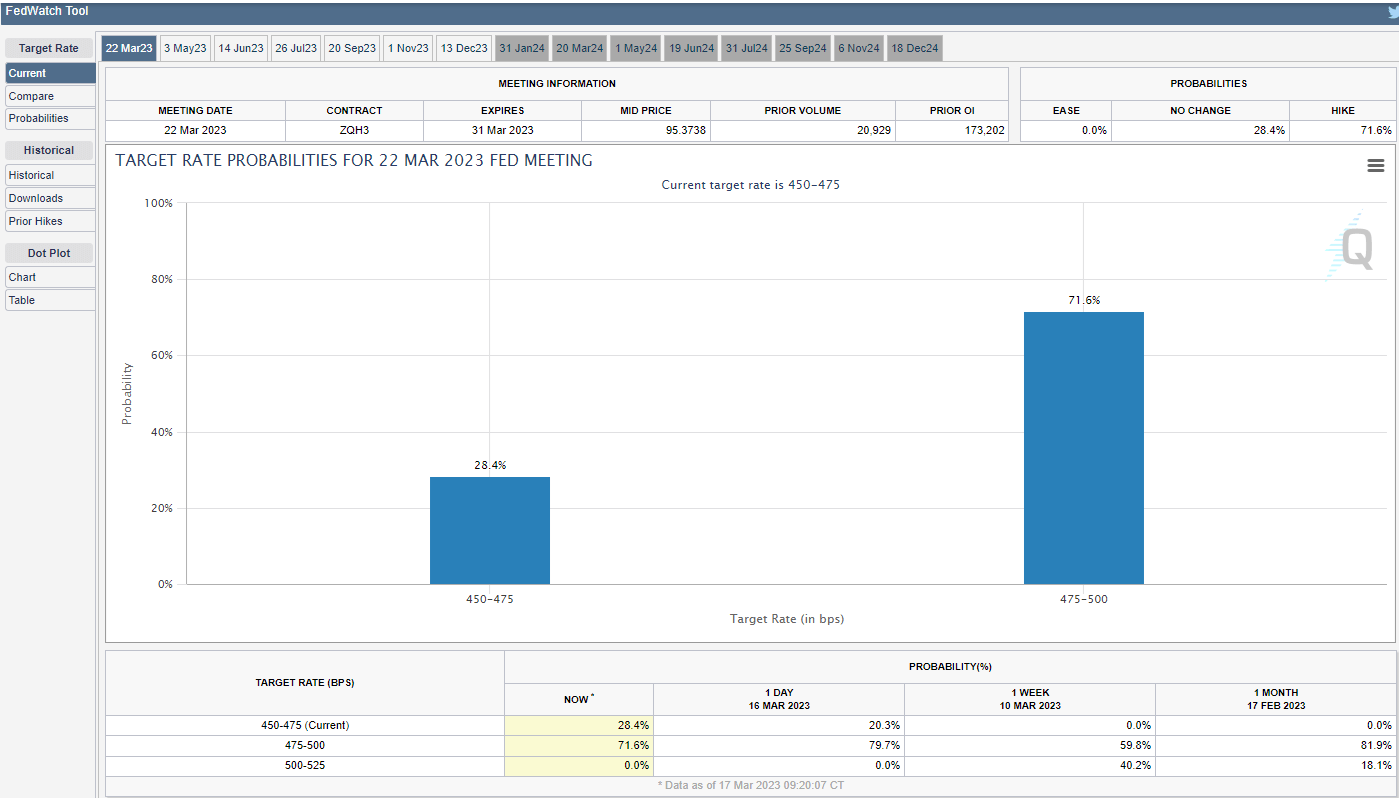

All eyes on the FOMC subsequent week

The following FOMC assembly is on March 22, and markets expect a 25bps charge hike, and assuming nothing else main breaks, I feel we are going to get it. After that, it’s anybody’s guess for the longer term path of the fed funds.

Powell goes into the assembly with a large alternative in both making an attempt to include inflation or saving a fragile monetary system.