For the longest stretch of days because the cryptocurrency market was shaken by unrest in July, Bitcoin has dropped under US$20,000 for a sixth straight buying and selling session.

On Thursday, the worth of the largest cryptocurrency dropped as a lot as 3.1% to $19,577.

Bitcoin In Free Fall

The biggest cryptocurrency by market capitalization has been in free fall for the earlier ten days as considerations over Wednesday’s FOMC minutes drove its value under $20,000. Regardless of the latest decline, buyers appear to be rising their Bitcoin purchases, and sure key on-chain knowledge point out that the worth could also be on the brink of emerge from its most up-to-date low.

Market Analyst Jim Wyckoff foresaw the rise in volatility and cautioned in his morning Bitcoin temporary that “quieter sideways buying and selling continues, however in all probability not for for much longer. Historical past demonstrates that the monetary markets can expertise volatility in September.

BTC/USD trades at $20k. Supply: TradingView

Wyckoff predicted that it would final for a while so long as bears proceed to outnumber bullish merchants.

“Within the instant future, count on elevated cryptocurrency volatility. To interrupt the worth decline that’s nonetheless seen on the each day chart for bitcoin, albeit narrowly, bulls have to display higher energy, in response to Wyckoff.

Bitcoin common funding charges. Supply: Santiment

The cryptocurrency analytics firm Santiment, which revealed the next chart displaying the rise in BTC common funding charges, revealed that the sentiment towards Bitcoin remains to be unfavorable.

Concern Overtakes Hope

Lower than US$1 trillion, or roughly a 3rd of its peak market worth reached in November, is now the dimensions of the cryptocurrency business. Coin values had been shaken midyear by the collapse of the Terra ecosystem, the demise of Three Arrows Capital, the chapter of dealer Voyager, and the failure of lender Celsius after coming off the highs amid a common enhance in threat aversion.

Stephane Ouellette, chief government of FRNT Monetary Inc. stated:

“There’s a variety of concern that if we make new lows on BTC (as a proxy for the market), there will likely be one other wave of crypto firm defaults.”

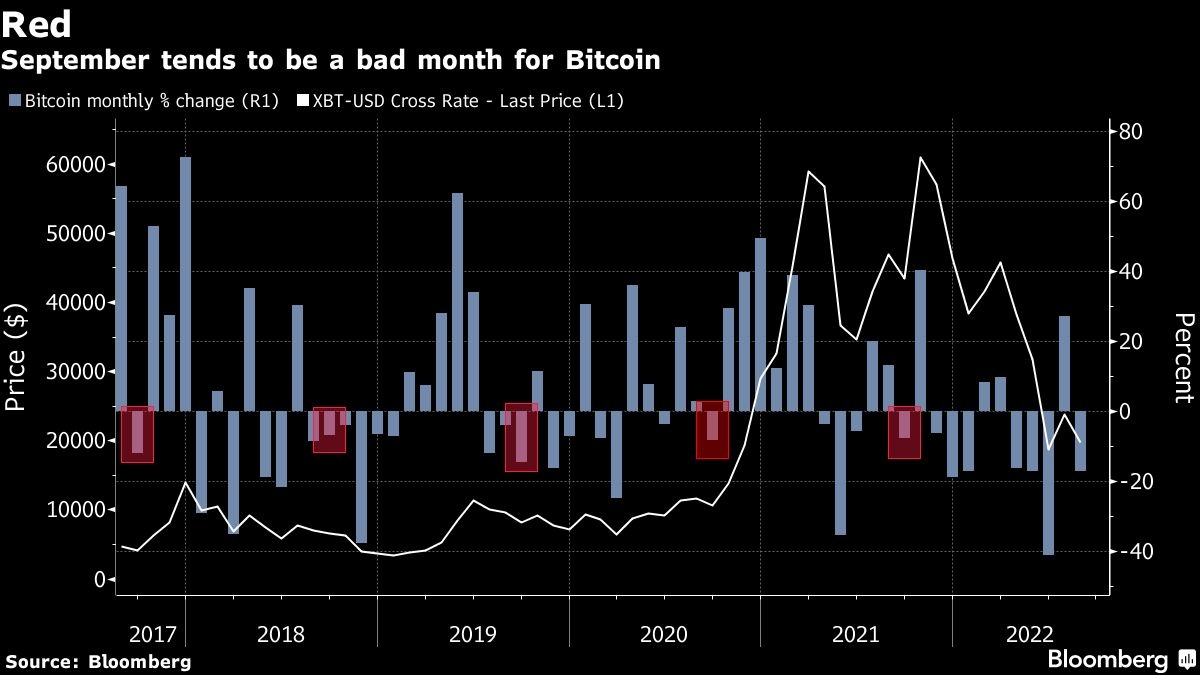

Supply: Bloomberg

The autumn on September’s first day is unfavorable for the bellwether forex. Since 2017, each September has seen a decline within the value of Bitcoin, making it historically one of many worst months of the 12 months. In keeping with Bespoke Funding Group, over the previous 5 years, the month-to-month decline within the worth of Bitcoin has averaged 8.5%.

The general cryptocurrency market cap now stands at $967 billion, and Bitcoin’s dominance price is 39%.

Featured picture from UnSplash and chart from TradingView.com, Bloomberg, and Santiment