Bitcoin has proven some spectacular power above the $34,000 mark regardless of a excessive quantity of profit-taking from short-term holders.

Bitcoin Brief-Time period Holders Are Promoting, Whereas Lengthy-Time period Holders Are Nonetheless Quiet

As defined by analyst James V. Straten in a brand new post on X, the short-term holders are at present collaborating in one of many strongest profit-taking occasions of the previous couple of years.

The “short-term holders” (STHs) right here seek advice from all these Bitcoin buyers who’ve been holding onto their cash since lower than 155 days in the past. This group contains one of many two major divisions of the BTC market, with the opposite being known as the “long-term holders” (LTHs).

Statistically, the longer an investor retains their cash dormant, the much less seemingly they turn out to be to promote them at any level. Due to this motive, the STHs are usually the weak-minded fingers of the sector, whereas the LTHs are the robust, persistent holders.

Every time the sector goes via any important FUD or FOMO, the STHs budge and take part in no less than some quantity of promoting. The LTHs, however, often present little response.

For the reason that Bitcoin worth has loved a pointy rally not too long ago that has taken its worth above the $34,000 degree, the STHs would naturally be promoting now. One approach to monitor whether or not this Bitcoin group is promoting their cash might be by monitoring the amount that they’re transferring to exchanges.

Within the context of the present dialogue, Straten has determined to decide on the model of this indicator that particularly tracks the transactions from buyers who’re in revenue, as profit-taking is usually the habits of focus throughout rallies. In distinction, loss transactions play a better function in worth slumps.

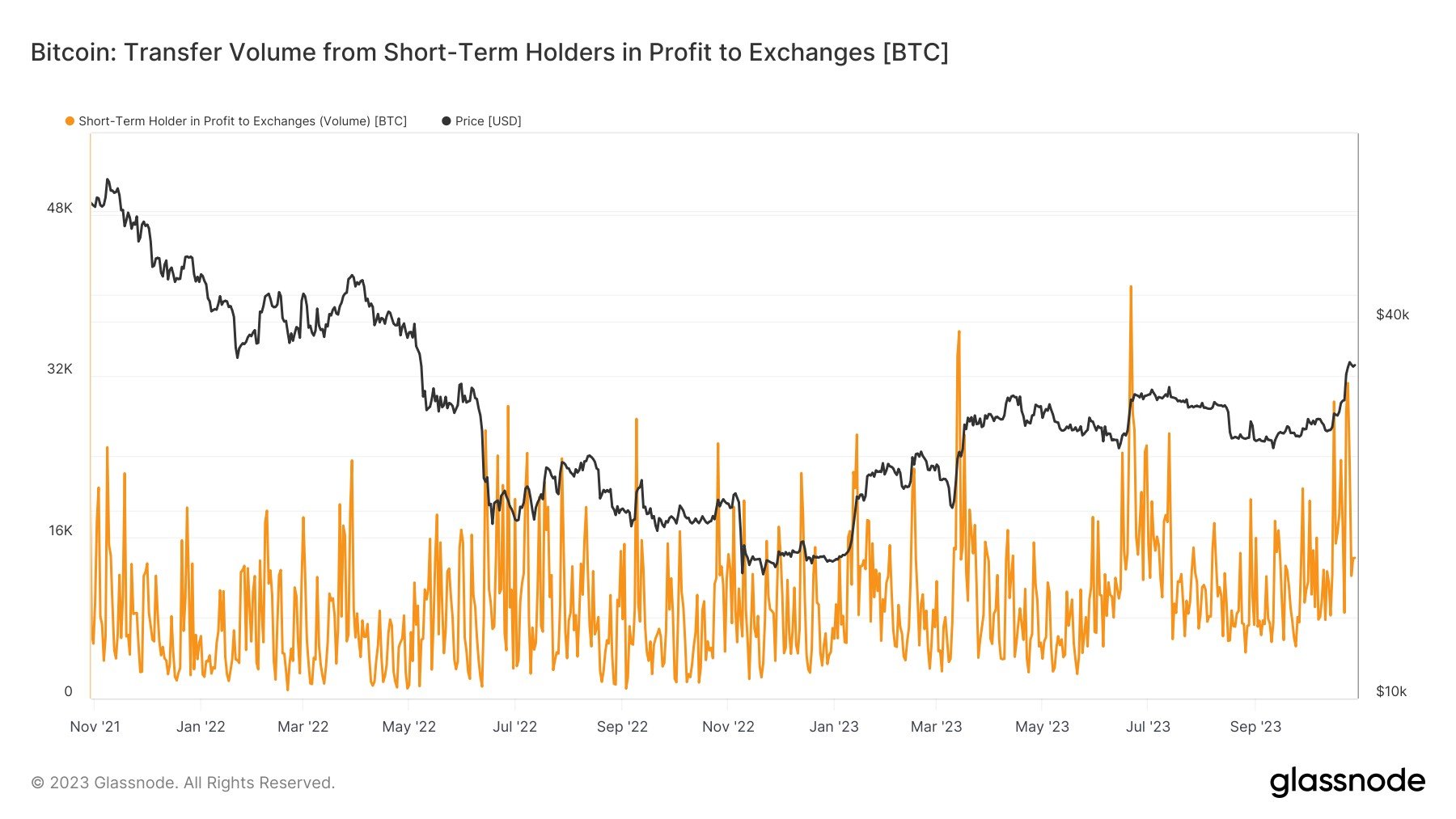

Now, here’s a chart that exhibits the pattern within the metric for the Bitcoin STHs over the previous two years:

Appears to be like like the worth of the metric has been fairly excessive in latest days | Supply: @jimmyvs24 on X

As proven within the above graph, the Bitcoin STHs in revenue have despatched giant quantities to those centralized platforms for the reason that newest rally within the asset.

This confirms that these weak fingers have been promoting not too long ago. As talked about earlier than, it’s common for such a factor to occur, however the scale of the profit-taking this time round is especially important.

From the chart, it’s seen that there have solely been a number of occasions up to now couple of years the place the STHs in revenue have transferred comparable or greater volumes to exchanges. Given this selloff, it’s spectacular that Bitcoin has been capable of maintain on above the $34,000 degree throughout the previous few days.

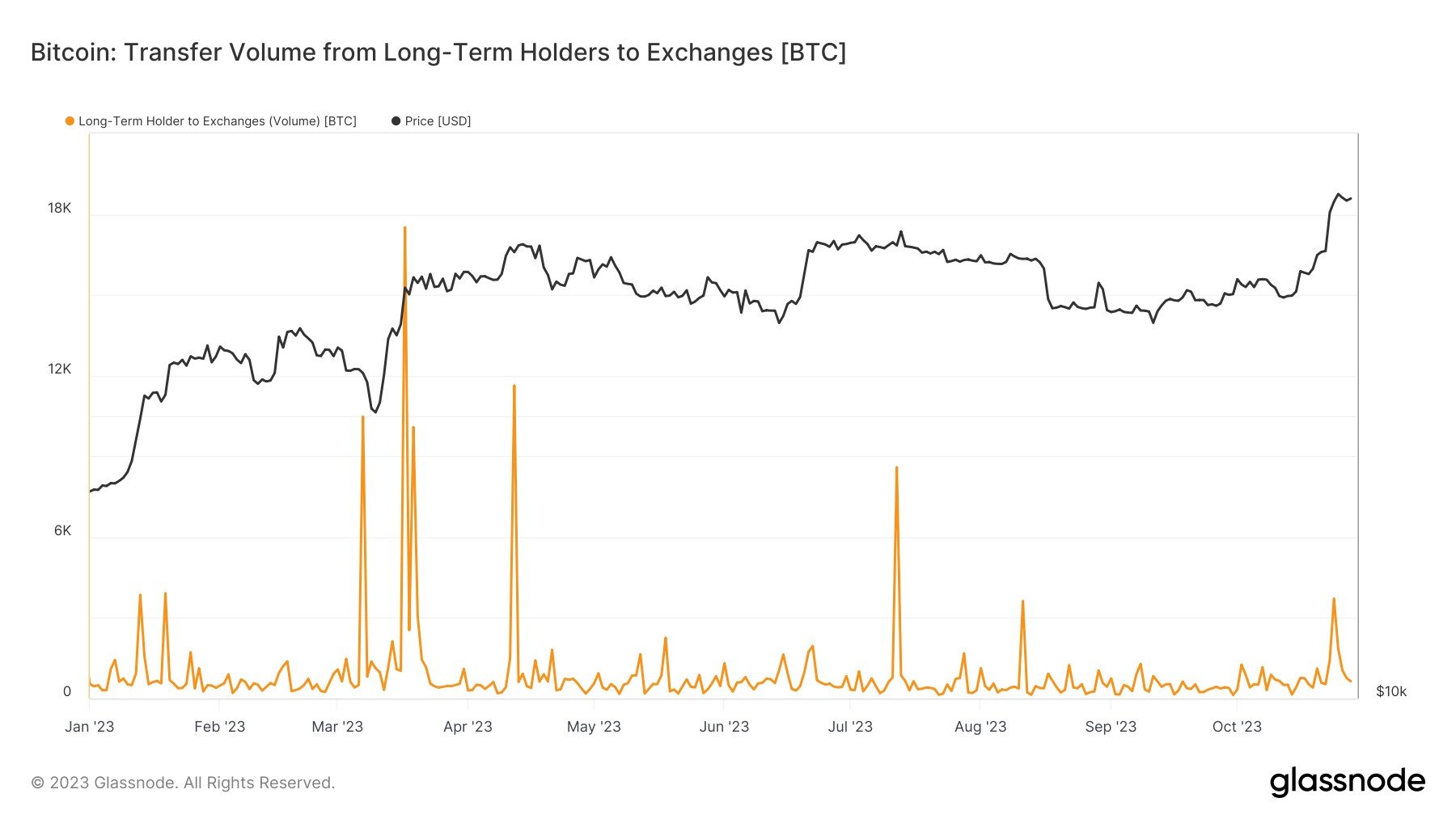

As anticipated from the LTHs, they haven’t offered a lot regardless of the rally.

The metric has seen a small spike not too long ago | Supply: @jimmyvs24 on X

The metric is at present at its sixth-largest worth for this yr, however as is obvious from the above graph, the dimensions of this selloff remains to be not that a lot in pure phrases.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $34,700, up 13% up to now week.

BTC has slowed down a bit since its sharp rally | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com