Este artículo también está disponible en español.

Bitcoin began the month of October on a destructive notice, deviating from what many buyers had anticipated main as much as the month. Bitcoin, which had been on a notable value enhance earlier, began to face setbacks as September ended, main as much as the primary 24 hours of October.

The primary 24 hours of October have been riddled with outflows from the crypto business. Bitcoin, specifically, fell under $61,000, based on Coinmarketcap, as tensions began to rise within the Center East. Going by this decline, it has raised questions as to the outlook for Bitcoin in the remainder of the month.

Present Bitcoin Worth Motion

The excitement main into October centered round expectations that Bitcoin would lengthen its bullish momentum and break by key resistance ranges. Based on value information, Bitcoin ended the month of September 7.11% above the place it began, even peaking above $66,000 at one level.

Associated Studying

Nonetheless, on the time of writing, Bitcoin has fallen by virtually 7% from the September peak. Moreover, Coinmarketcap information reveals that Bitcoin has been down by 3.6% prior to now 24 hours. The swift downturn has altered the market’s sentiment, with the once-bullish outlook giving strategy to concern and uncertainty. The Worry and Greed Index, which gauges the market’s feelings and threat urge for food, now reads 39 and alerts “Worry.” It will appear crypto buyers at the moment are panicking, with crypto analyst Kaleo even calling this to consideration on social media platform X.

After spending 5 minutes scrolling by the timeline you’d assume we’re by no means going to see a inexperienced candle once more

— Okay A L E O (@CryptoKaleo) October 1, 2024

Bitcoin’s value motion is extremely delicate to occasions on this planet. Notably, the current decline within the value of Bitcoin may be attributed to geopolitical conflicts within the Center East. Its current efficiency within the face of geopolitical turmoil casts doubts on its function as a protected haven asset.

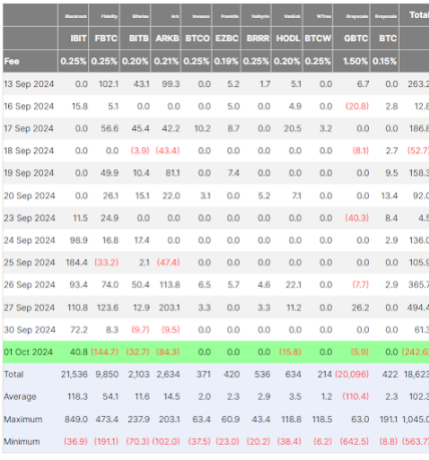

Spot Bitcoin ETFs, which are supposed to prop up the Bitcoin spot value, additionally ended eight consecutive days of inflows with huge outflows on October 1, more than likely in response to the Center East tensions. Based on Spot Bitcoin ETF circulation information from Farside Traders, institutional buyers pulled out $246.2 million yesterday.

Is Uptober A Fantasy?

The optimistic outlook appears to have light rapidly amongst many crypto buyers. Nonetheless, many members are nonetheless holding on to the bullish outlook, particularly contemplating the month nonetheless has a protracted strategy to go earlier than its conclusion.

Associated Studying

Historical past reveals, as a rule, that October has at all times been a optimistic month for Bitcoin. Most significantly, the optimistic efficiency was principally within the second half of the month. Contemplating the month is just at its starting, it’s extra logical to attend and look at how the value motion performs out for the remainder of the week earlier than drawing any conclusion on Uptober.

Within the face of those tensions, Bitcoin’s potential function as a protected haven asset much like gold might rise amongst market members in the remainder of the month and past.

Featured picture created with Dall.E, chart from Tradingview.com