Glassnode information analyzed by CryptoSlate confirmed a divergence between tremendous whales and retail, with the previous remaining in aggressive accumulation mode going into the brand new yr.

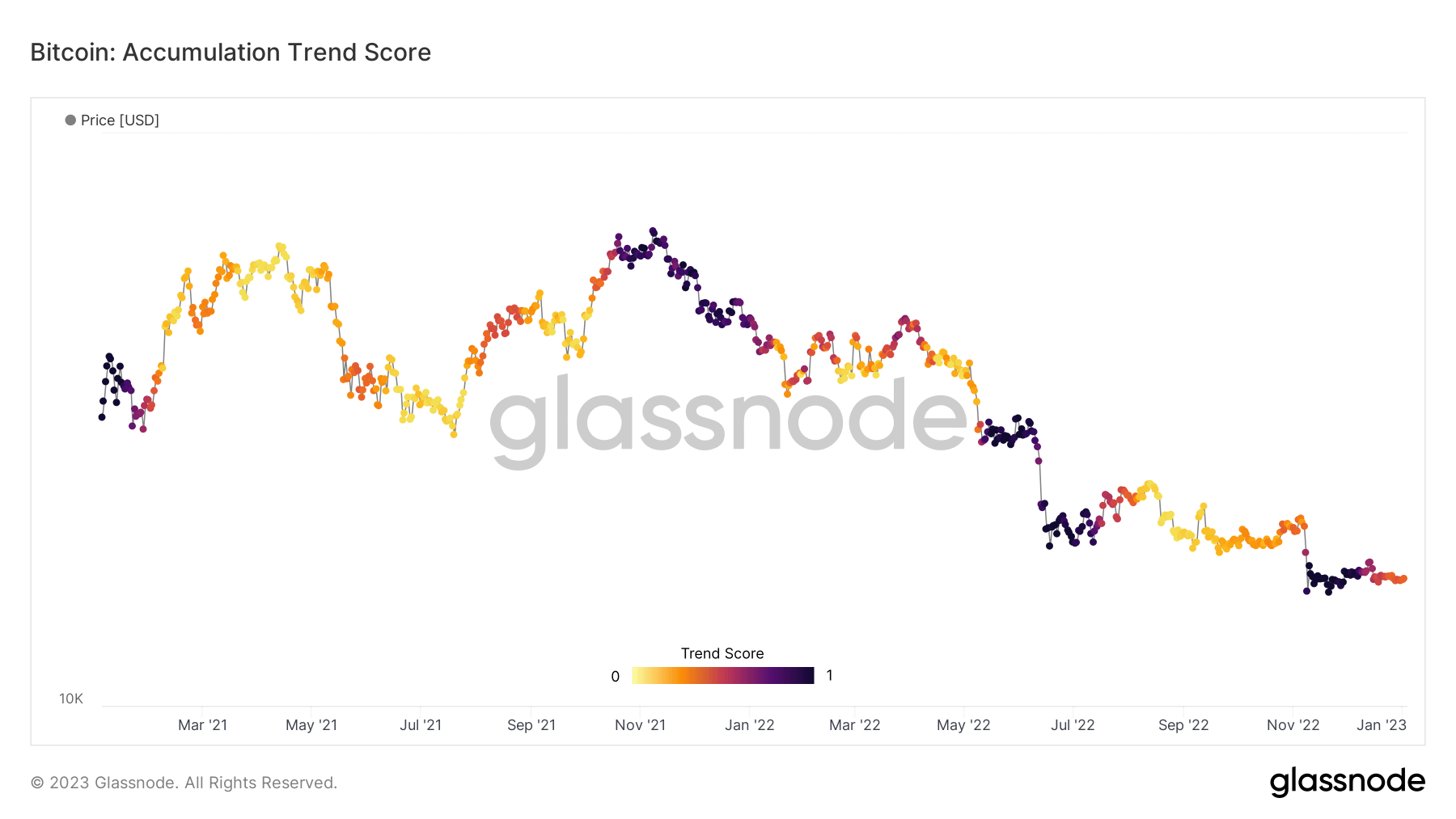

Bitcoin Accumulation Development Rating

The Accumulation Development Rating (ATS) seems to be on the relative dimension of entities which can be actively accumulating or distributing their Bitcoin holdings.

The ATS metric makes use of a spectrum between 0 to 1. A studying nearer to 0 signifies distribution or promoting. Whereas a rating nearer to 1 exhibits accumulation or shopping for.

Evaluation of the chart under confirmed that substantial accumulation occurred throughout the FTX collapse round early November 2022, even because the Bitcoin worth reacted negatively to the information.

This implies that traders, as a complete, noticed worth in shopping for at discounted costs.

The ATS has since turned extra impartial, with distribution bias, reflecting lingering macro uncertainties going into 2023.

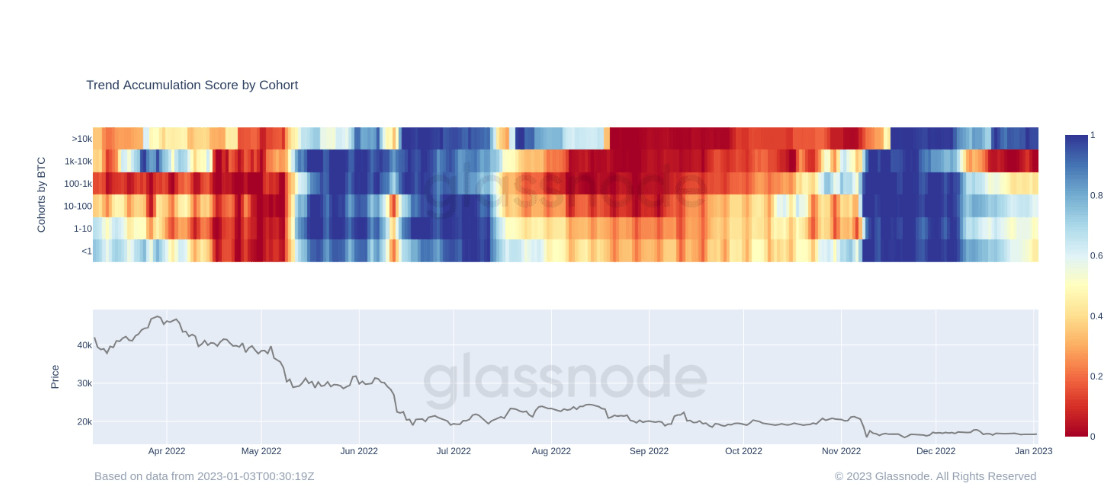

Cohort evaluation

Cohort evaluation offers a graphical illustration of accumulation and distribution throughout six cohorts, starting from minnows with lower than one BTC to tremendous whales holding greater than 10,000 BTC.

Because the FTX saga was blowing up, all cohorts have been accumulating aggressively. This constant pattern ended round mid-December 2022 when whales (entities holding between 1,000 and 9,999 BTC) started closely distributing.

The change in whale sentiment unfold throughout different cohort teams, which additionally started distributing, however to not the identical extent because the whales. Conversely, all through this era to the current, tremendous whales remained internet accumulators to a powerful diploma.

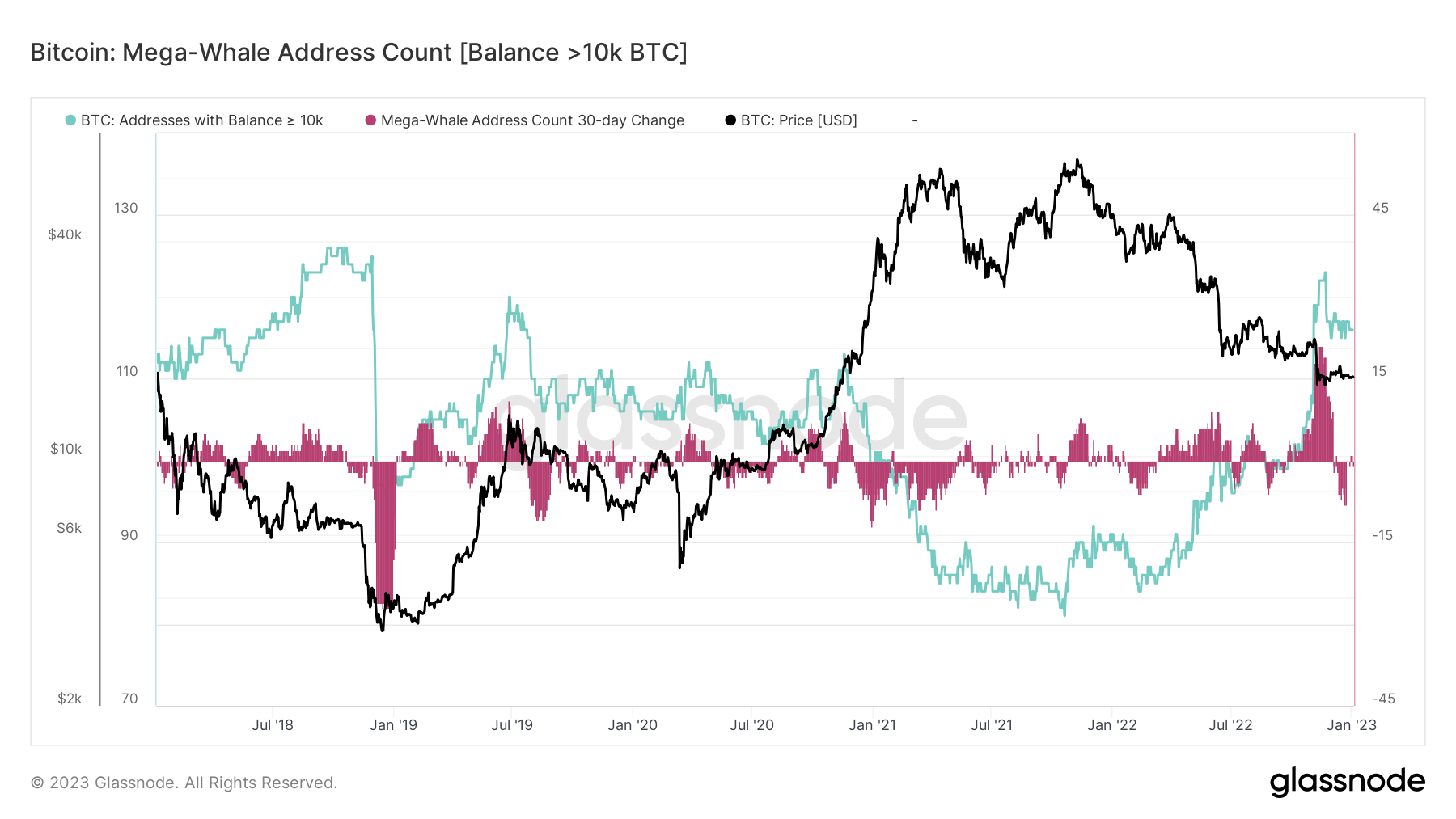

Mega-Whale Deal with Rely

Evaluation of the Bitcoin Mega-Whale Deal with Rely Stability confirmed entities with greater than 10,000 BTC surpassed 120 addresses on the tail finish of final yr. This encompassed a 30-day change of over 20 extra addresses, marking the quickest progress price since 2018.

Coupled with the above charts detailing aggressive tremendous whale accumulation, it’s honest to conclude sensible cash traders have been shopping for the dip.