After capitulating on March 19, Bitcoin recovered on March 20. Nevertheless, whereas the crypto group expects extra fast beneficial properties, even above the all-time highs of round $73,800, Willy Woo, an on-chain analyst, thinks the coin will doubtless consolidate within the days forward.

SOPR Peaked At An Unusually Excessive Stage: Revenue-Taking?

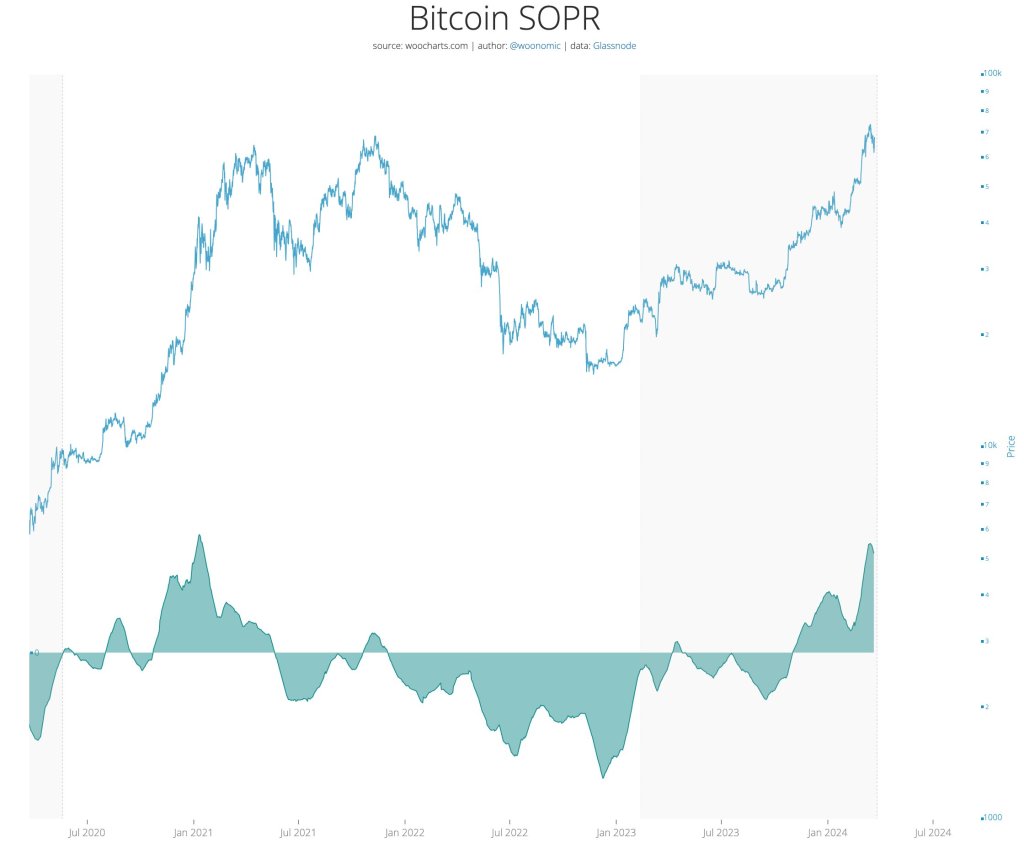

Taking to X, Woo listed a number of on-chain metrics, a few of which, whereas supporting costs, are countered by others that may decelerate the uptrend. On the prime of the checklist, the analyst notes how the Spent Output Revenue Ratio (SOPR) studying is printed out.

The SOPR is used to measure the profitability of Bitcoin transactions. When it’s, it means that extra BTc being moved round are in inexperienced. Whereas this studying has risen previously few buying and selling weeks, the way it peaked is a priority.

In Woo’s evaluation, there may be doubtless profit-taking for the reason that SOPR peaked at an unusually “excessive stage.” Accordingly, profit-taking interprets to holders exiting, which suggests promoting on the spot, presumably leading to a sideways consolidation.

Nevertheless, the analyst finds causes for optimism. Particularly, the latest fall from the swing excessive, at round $73,800, was round 20%. This dip tends to be extra extreme in comparison with historic cycles and, extra importantly, earlier than halving.

The analyst mentioned it fell by over 30% within the final cycle earlier than halving in 2020.

Moreover, the analyst views the present rise in “Macro threat sign,” a metric that compares inflows to dangerous asset costs like Bitcoin and crypto, as a optimistic signal. Although it’s rising and bullish, it could “freak out” buyers, shaking out some earlier than costs rally to new ranges.

Bitcoin To Consolidate, Altcoins To Pump?

What’s taking place to Bitcoin may also influence altcoins and leverage merchants. Particularly, the analyst thinks that altcoins will doubtless pump as Bitcoin consolidates in a technically bullish construction.

Even so, by Woo’s evaluation, the truth that leverage ratios on perpetual swap bets haven’t been reset means merchants needs to be cautious due to the anticipated volatility tagging place changes.

Whereas Woo is bullish, predicting potential uneven worth motion in April, merchants are bullish. Contemplating the latest wave of institutional demand, Halving would possibly drive costs greater within the coming periods.

Presently, BTC bulls have reversed losses of March 19. The coin is buying and selling above the 20-day transferring common. Optimistic merchants take a look at $73,800 because the short- to medium-term goal.

Function picture from DALLE, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site solely at your personal threat.