In a current surge of on-line dialogue, famend crypto analyst and entrepreneur Willy Woo has made headlines along with his optimistic prediction for Bitcoin’s future on Elon Musk’s social media platform, X.

Woo means that Bitcoin, already gaining traction amongst conventional monetary circles as an rising asset class, may see exponential progress.

He argued that if Bitcoin continues to be perceived on the scale of main asset courses, historically valued within the tens of trillions of {dollars}, it may doubtlessly improve in worth tenfold within the coming years.

Associated Studying

Present Market Dynamics and Predictions

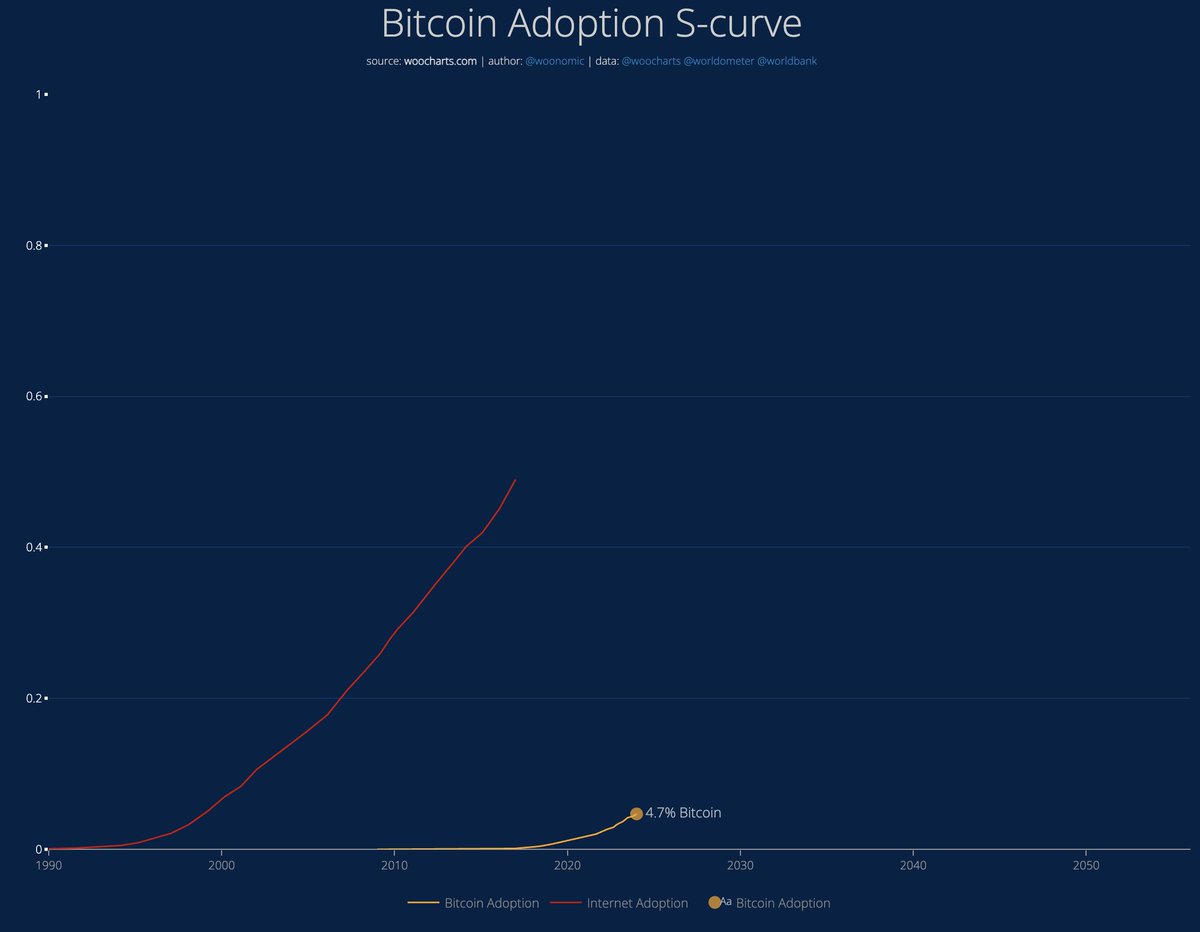

Woo’s perception comes at a important time for Bitcoin, which at present faces fluctuating market situations. Regardless of the downturn, he initiatives that Bitcoin may rival the US greenback and emerge as a world reserve asset by the 2030s, aligning with a projected 25-40% international adoption price.

His stance is rooted within the rising recognition of Bitcoin on Wall Road, highlighting a major shift in how conventional monetary markets are starting to view digital currencies.

Everybody asking “when?”

I’d say once we into the vary of 25-40% world adoption.

I.e. 2030s pic.twitter.com/Sdsw5PNrZM

— Willy Woo (@woonomic) June 25, 2024

Regardless of Woo’s long-term optimism, Bitcoin’s quick trajectory stays challenged, with current knowledge indicating a decline. Over the previous week, Bitcoin has seen a discount of 5.3% in worth, with a slight 0.1% drop within the final 24 hours, stabilizing at a market value of $61,486.

Keith Alan, Co-founder of TeamBlacknox, stays cautiously optimistic, noting that whereas Bitcoin may retest its lows, the broader pattern may stay “intact” if month-to-month closures keep between $56.5k and $61.8k.

Gauging Bitcoin Potential Rebound and Future Development

Including to the discourse, CryptoQuant analyst Gustavo Faria highlighted indicators that Bitcoin might need reached a neighborhood backside. The evaluation identified a discount in open curiosity within the futures market and a drop in funding charges for perpetual contracts, suggesting a steadiness restoration between consumers and sellers.

This equilibrium is essential for sustaining a wholesome market construction with out extreme optimism that sometimes results in sharp corrections.

Indicators of a Native Backside?

After a 15% correction, #Bitcoin reveals potential indicators of a neighborhood backside. Open curiosity has declined, funding charges are close to zero, suggesting a extra balanced market. Essential U.S. financial knowledge incoming. Is the tide turning? – By Gustavo Faria

Full put up… pic.twitter.com/nRCDVawmFa

— CryptoQuant.com (@cryptoquant_com) June 26, 2024

The continued dialogue round Bitcoin’s future additionally considers broader financial indicators akin to upcoming US macroeconomic knowledge, together with GDP, preliminary jobless claims, and inflation knowledge. These components are poised to affect market sentiment considerably within the close to time period.

Moreover, Bitcoin’s positioning on the Bitcoin Rainbow Chart, which at present signifies a “Purchase” zone, and historic value cycles following Halving occasions recommend additional potential for progress.

Associated Studying

Analysts anticipate that these technological and market cycles may propel Bitcoin’s value to as excessive as $260,000 by round September-October 2025.

Featured picture created with DALL-E, Chart from TradingView