An analyst has defined how Bitcoin appears to be exhibiting an excellent setup to succeed in escape velocity based mostly on the pattern on this indicator.

Bitcoin VWAP Oscillator Has Been Displaying A Bullish Divergence

As defined by analyst Willy Woo in a brand new post on X, a bullish divergence has gave the impression to be forming within the Quantity-Weighted Common Worth (VWAP) oscillator of the cryptocurrency.

The VWAP is an indicator that calculates a median value for any given asset, taking into consideration not solely the value but additionally the quantity. Extra formally, it’s calculated because the cumulative value sum multiplied by the quantity divided by the cumulative quantity.

This metric places the next weight on the value at which extra quantity is traded. Normally, the exchange-reported quantity is used to search out the metric, however for a cryptocurrency like Bitcoin, the whole transaction historical past is seen to the general public due to blockchain information. Woo has used on-chain quantity as an alternative to calculate the VWAP for BTC.

The VWAP oscillator, the precise indicator of curiosity right here, is a ratio between the asset’s spot value and VWAP. Right here is the chart shared by the analyst that exhibits the pattern on this metric over the previous couple of years:

The worth of the metric appears to have been on the decline in current days | Supply: @woonomic on X

As displayed within the above graph, the Bitcoin VWAP oscillator has been within the adverse territory for the previous month however has not too long ago proven a turnaround.

Though the metric is heading up, it’s nonetheless very a lot contained contained in the pink zone. Similtaneously this rise, the cryptocurrency’s value has been heading down as an alternative.

In response to Woo, it is a bullish divergence forming for the asset and it’s additionally one which has a “lot of room to run,” since tops within the coin have usually occurred when the oscillator has reached a degree of reversal at comparatively excessive ranges contained in the constructive zone, which ought to nonetheless be fairly far-off.

“Looks as if an excellent setup for BTC to succeed in escape velocity,” notes the analyst. It stays to be seen whether or not the bullish divergence will find yourself bearing fruits for the asset.

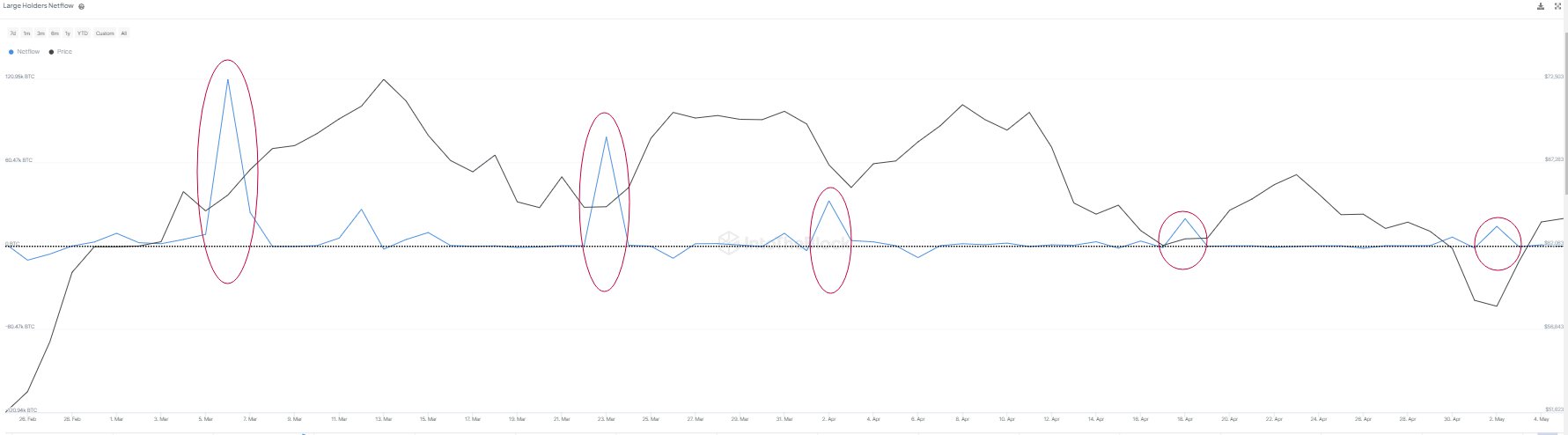

In another information, the Bitcoin whales (buyers carrying 1,000 BTC or extra) participated in shopping for across the current lows of the asset. Nonetheless, market intelligence platform IntoTheBlock has revealed that the buildup sprees from these giant buyers have been displaying an total downtrend.

The pattern within the netflow of the BTC whales over the previous couple of months | Supply: IntoTheBlock on X

From the chart, it’s seen that the Bitcoin whales have been shopping for at every of the dips in the previous few months, but it surely’s additionally seen that the size of this shopping for has been diminishing with every one.

This may very well be an indication that the urge for food for getting amongst these buyers, though nonetheless current, is getting smaller with every dip.

BTC Worth

When writing, Bitcoin is buying and selling at round $63,500, up over 1% within the final seven days.

Appears like the value of the asset has been going up over the previous few days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, IntoTheBlock.com, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site fully at your personal threat.