Bitcoin has been trending decrease after failing to interrupt above $66,000 in early Might, deflating hopes of speedy value good points post-Halving. Taking to X, one analyst shared on-chain information that paints a extra nuanced image than a easy lack of confidence in current weeks.

Bitcoin Open Curiosity Stays Low: Bullish?

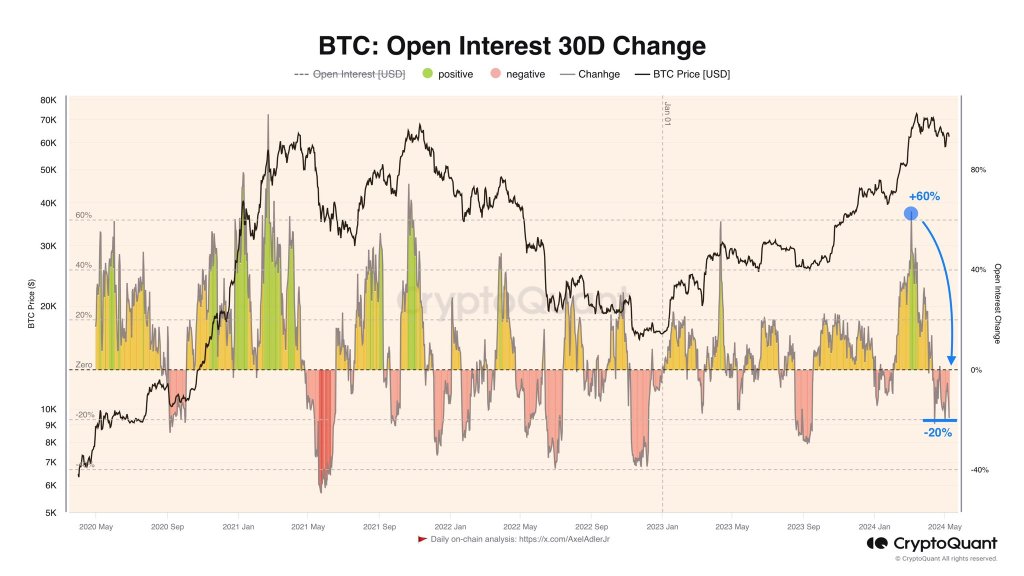

The analyst, pointing to CryptoQuant information, observes that leveraged merchants on perpetual buying and selling platforms like Binance look like closing their positions greater than opening new ones. The analyst notes that the studying is at -20% on the month-to-month change in Open Curiosity.

At this degree, it reveals that extra merchants are closing extra positions than opening new ones. This improvement suggests that almost all merchants undertake a strategic wait-and-see, watching costs evolve.

Associated Studying

Regardless of the lower in positions opening, it’s essential to notice that this isn’t an indication of BTC’s downfall or the invalidation of a possible surge. The analyst interpreted this contraction as a strategic transfer by merchants, who’re cautiously optimistic and never exiting the market resulting from bearish expectations.

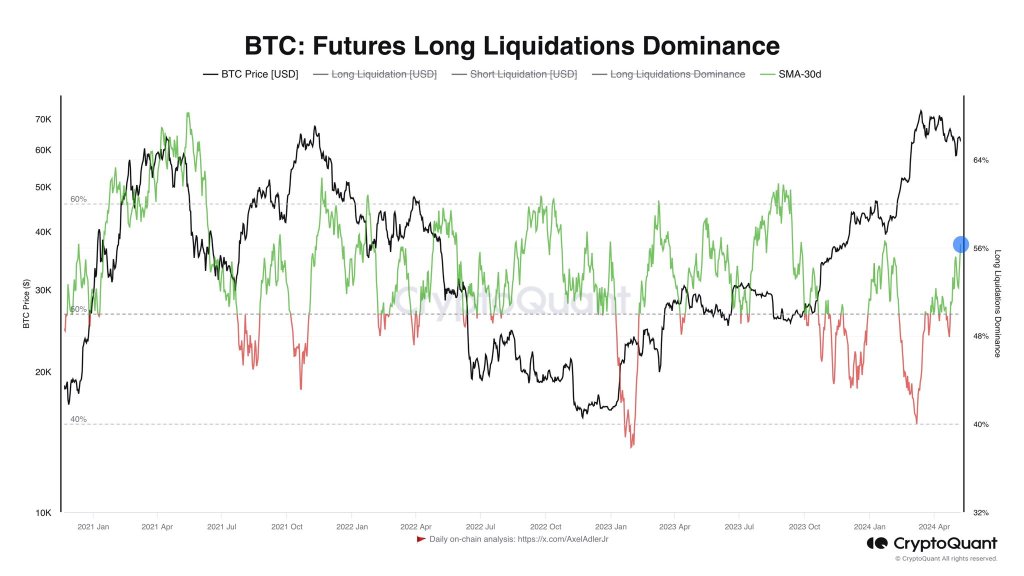

In a separate post, the analyst added that the Bitcoin market wants the present wave of liquidation and “negativity” for accumulating brief positions. All brief positions opened at spot ranges wager that BTC will proceed trickling decrease, even breaking beneath $56,500.

Nevertheless, the extra brief positions there are, the upper the potential for a “brief squeeze” forming. When this occurs, there will probably be a sudden value spike, liquidating shorts and forcing sellers to purchase again into the market to forestall additional harm.

BTC Inside A Commerce Vary: Will $60,000 Fail?

Regardless of the potential upside hinted by on-chain information, costs stay confined inside a slim vary. Final week, bulls failed to shut above $66,000, confirming the spectacular march from Might 3.

Bitcoin discovered resistance and is transferring decrease towards the psychological $60,000 degree. From value motion, losses beneath this line would possibly fast-track the collapse towards $56,500 registered in early Might.

Going ahead, merchants will intently monitor how costs evolve after the all-important Halving on April 20. Contemplating the approval of spot Bitcoin exchange-traded funds (ETFs) and the involvement of establishments, some analysts anticipated costs to shoot increased instantly.

Associated Studying

Nonetheless, this has not been the case. Costs proceed to hold amid fluctuating inflows to identify ETFs, and the US Federal Reserve continues to be not slashing rates of interest.

Characteristic picture from Shutterstock, chart from TradingView