The value of Bitcoin has not had probably the most easy efficiency in 2024 regardless of a robust begin to the 12 months. The flagship cryptocurrency has spent many of the final two quarters in consolidation, fluctuating throughout the $50,000 and $70,000 vary.

This uninspiring efficiency has sparked conversations concerning the present cycle, with a number of analysts and specialists predicting whether or not the bull run remains to be on. Amongst the newest to remark is the CryptoQuant CEO, who provided an fascinating on-chain perception into the cycle.

Why Are Whales Taking Much less Revenue This Cycle?

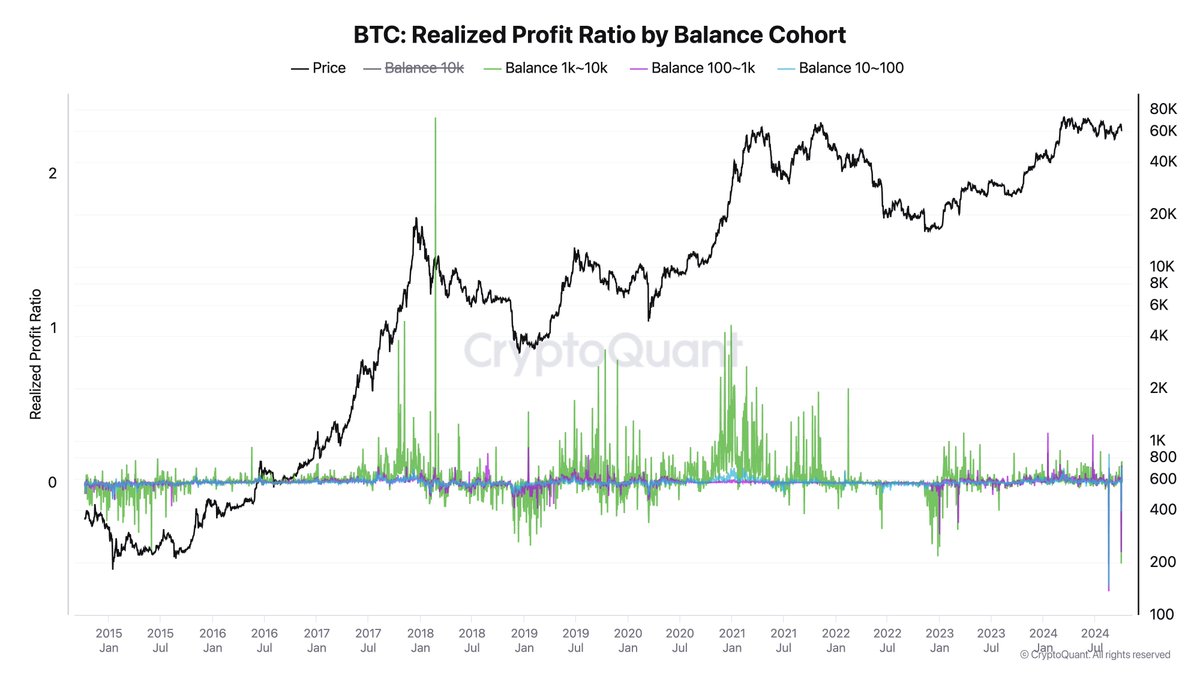

In a put up on the X platform, CryptoQuant CEO Ki Younger Ju revealed that the Bitcoin whales have held onto their property this cycle. Because of this, the big traders have set the document for the least profit-taking in comparison with different cycles if the present bull run ends now.

This on-chain revelation is predicated on the Realized Revenue Ratio by Steadiness Cohort metric, which measures the ratio of cash bought at a revenue by an investor class relative to the overall cash bought at a given time. It principally evaluates the profitability of various cohorts of Bitcoin holders.

Sometimes, when the Realized Revenue Ratio of whales is excessive, it implies {that a} sell-off is probably going ongoing, with the big traders believing that costs have peaked. Then again, a low Realized Revenue Ratio typically signifies a low stage of profit-taking, that means that traders aren’t chopping their losses or anticipating additional value features.

The present on-chain information factors to a development the place the big holders have taken the least quantity of earnings throughout any bull cycle. This might imply that the Bitcoin whales nonetheless think about Bitcoin’s long-term potential. In the end, this implies that the present bull run is much from the top, and there’s the potential of the Bitcoin value uptrend resuming.

Bitcoin ‘Dolphin’ Addresses On The Rise Once more: Santiment

In a put up on X, Santiment revealed that the Bitcoin’s “Dolphin” cohort, holding between 0.1 to 10 BTC, have been rising steadily over the previous few months. The analytics reported that this tier of traders largely bought for revenue within the first half of the 12 months.

Nonetheless, addresses holding between 0.1 and 10 BTC have been on the rise since early July. Particularly, the 0.1 – 1 BTC wallets have elevated by 25,671 extra addresses, whereas the 1 – 10 BTC wallets have climbed by about 4,000 addresses.

This means that small-scale traders may be returning to the market, which could possibly be constructive for the Bitcoin value over the approaching months. As of this, the premier cryptocurrency is valued at $61,94, reflecting a 1.7% improve previously day.