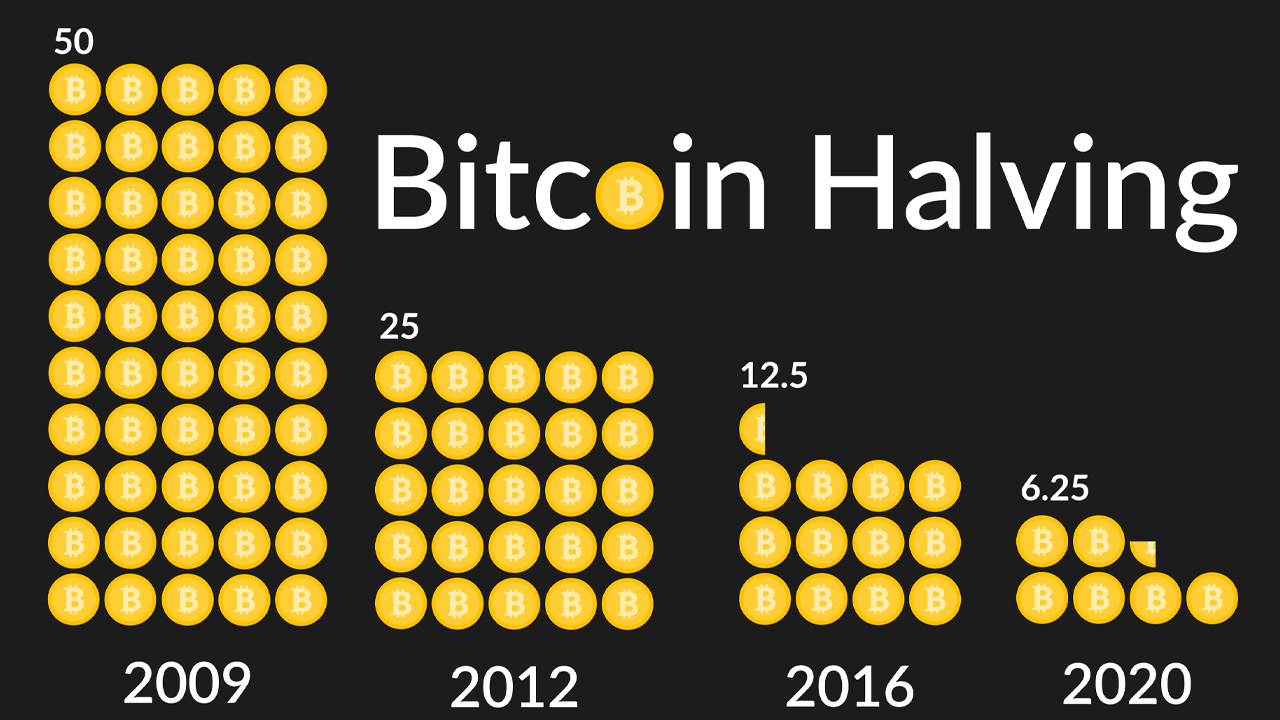

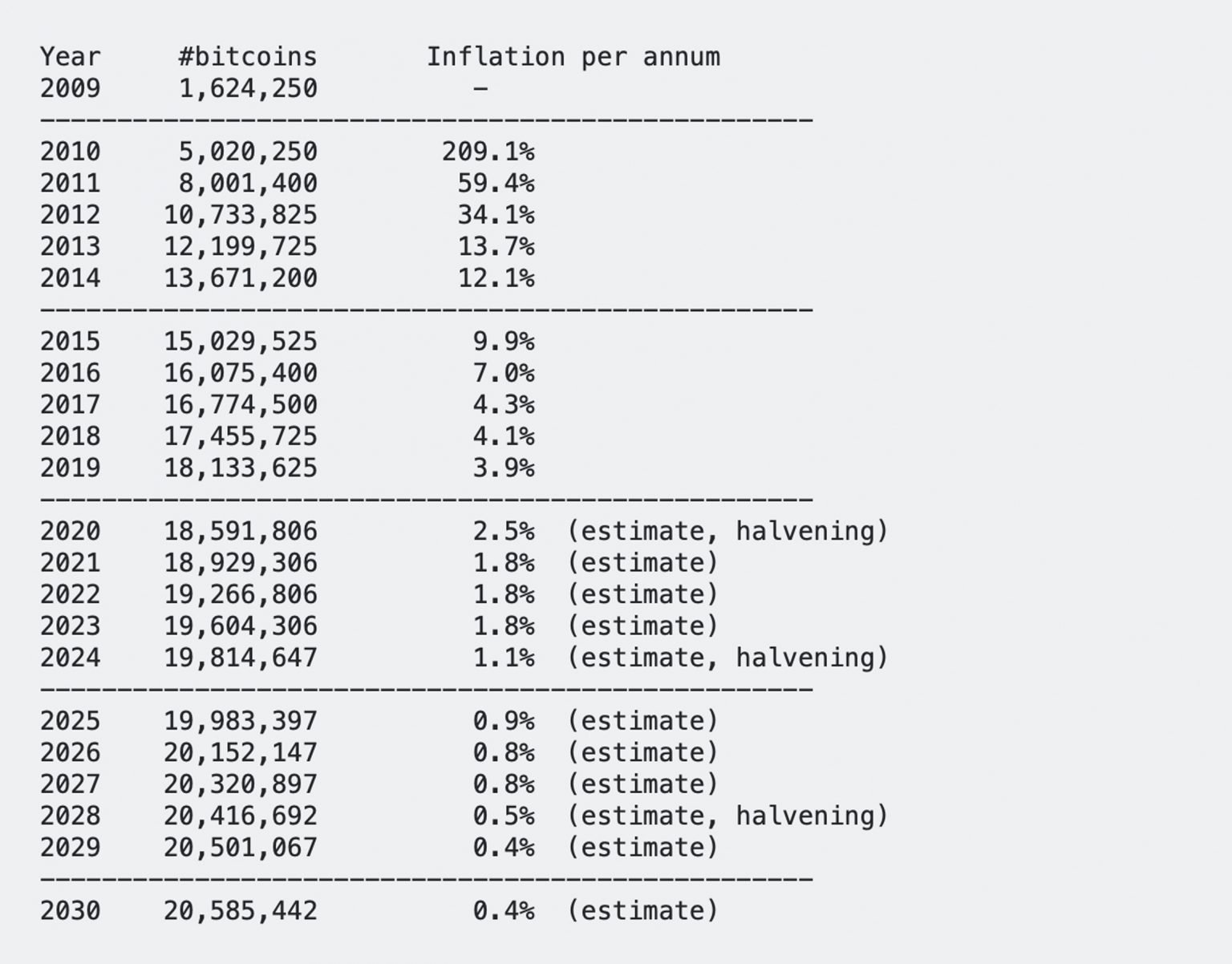

This previous April, information present that 19 million bitcoins have been mined into existence and 133 days later, there are 1.88 million bitcoins left to mint right now. The community’s block subsidy halving is predicted to happen on or round April 20, 2024, as there are lower than 91,000 bitcoins left to mine till that time. Whereas Bitcoin’s inflation fee each year is 1.73% right now, after the halving in 2024, the crypto asset’s yearly inflation fee will likely be right down to 1.1%.

The Institute of Arithmetic: ‘Bitcoin Can Solely Perform Due to the Intelligent Arithmetic Which Is within the Background Enabling It to Exist’

Time goes by quick and right now, there’s lower than two years left till the following Bitcoin reward halving takes place roughly 617 days from now. Bitcoin offers miners a reward each time a block is found by a miner dedicating hashrate to the community. On the time of writing, miners get 6.25 bitcoins per block and on or round April 20, 2024, the block reward will likely be minimize in half to three.125 bitcoins per block. At the moment, it will likely be much more tough to acquire bitcoins through the mining course of and right now, there are just one.88 million bitcoins left to mine.

Bitcoin is a really predictable financial community that operates in an autonomous vogue. Not like the unpredictable inflation fee within the U.S., folks can safely predict Bitcoin’s inflation fee each year. There’s no stimulus added to the equation and central bankers can not change Bitcoin’s issuance fee per 12 months on a whim as they usually do when there’s an ‘emergency.’ When the following Bitcoin halving takes place, Bitcoin’s issuance fee per 12 months will likely be 1.1%. With Bitcoin’s open community, the general public is aware of this for a reality. The Federal Reserve, alternatively, may cause busts and booms by growing the financial provide and mountaineering and reducing the benchmark federal funds fee.

Gold’s Correlation to Inflation and the Valuable Metallic’s so-Referred to as Shortage

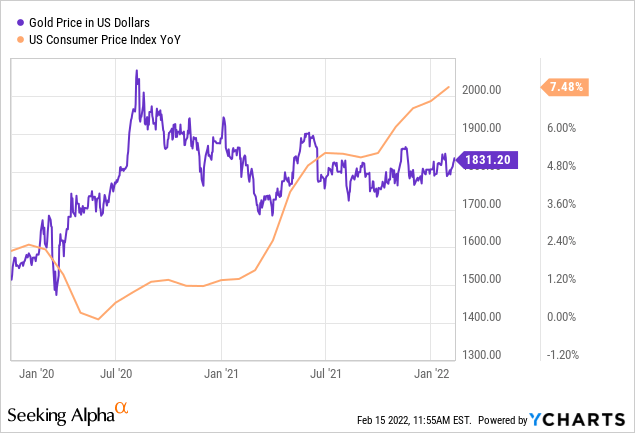

Whereas the valuable steel gold is taken into account scarce and other people suspect the worth of gold will rise throughout financial uncertainty, that’s not essentially a reality. Analysis reveals that gold has “a particularly low correlation to inflation.” Whereas Bitcoin is a really predictable monetary system, the crypto asset itself has a low correlation to inflation as effectively. As the buyer worth index (CPI) within the U.S. and inflation charges the world over have risen, bitcoin (BTC) dropped in worth whereas inflation printed increased peaks month after month. Whereas BTC hasn’t seen a lot correlation with inflation — like gold and silver — it’s nonetheless a extra predictable asset class than treasured metals.

We now have tough estimates on how a lot gold is mined yearly, as statistics present that roughly 2,500 tons are mined out of the earth yearly. However because of gold smuggling, that estimate is absolutely simply an informed guess. Shock gold deposits additionally damage gold’s alleged shortage issue and it’s well-known that there are huge gold deposits underneath the ocean flooring, and inside asteroids in house as effectively. Nonetheless, at current, people can not entry the gold in house or underneath the depths of the ocean. Gold remains to be thought-about scarce regardless of these parts. A U.S. Geological Survey estimate says there’s roughly 50,000 tons of gold underneath the earth’s floor, however the estimate is assessed as “a shifting quantity.”

Gold and Fiat Foreign money Issuance Charges Are Not Dependable, Whereas Bitcoin Is a Far Extra Predictable Financial Asset

So far as Bitcoin’s financial provide is anxious, the general public is aware of for a proven fact that there’ll solely be 21 million bitcoin. With gold we all know there’s roughly 20% of the earth’s gold remaining, however as a result of some strategies of mining are uneconomical proper now, there’s an opportunity they may change into worthwhile sooner or later. Which means, there’s an opportunity that expertise advances sufficient to the place gold miners can entry the valuable metals buried underneath the ocean flooring or in asteroids out in house. If this occurred, gold and different treasured metals may change into rather a lot much less scarce identical to the fiat cash central bankers print on a whim. With Bitcoin, we all know that’s not the case, and received’t be, because the community’s inflation fee each year will proceed to say no.

On the time of writing, we all know the Bitcoin inflation fee is round 1.73% and as talked about above, by the following halving it’s going to shrink to 1.1% in 2024. By the following 12 months in 2025, Bitcoin’s inflation fee each year will drop beneath 1% and by the 2028 halving, the issuance fee will likely be round 0.5% each year. We additionally know that the final bitcoins will likely be mined within the 12 months 2140, however we’re not sure concerning the finality of gold mining. Furthermore, after the central financial institution’s financial enlargement over the past two years, estimating the inflation fee bankers set is like making an attempt to learn tea leaves.

Whereas bitcoin is probably not the very best hedge towards inflation, a minimum of for proper now, we will assure that the asset is scarce and way more predictable than any fashionable financial asset issued or mined right now.

What do you consider Bitcoin’s Mathematical Financial Coverage being extra predictable than gold or fiat currencies? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any harm or loss triggered or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.