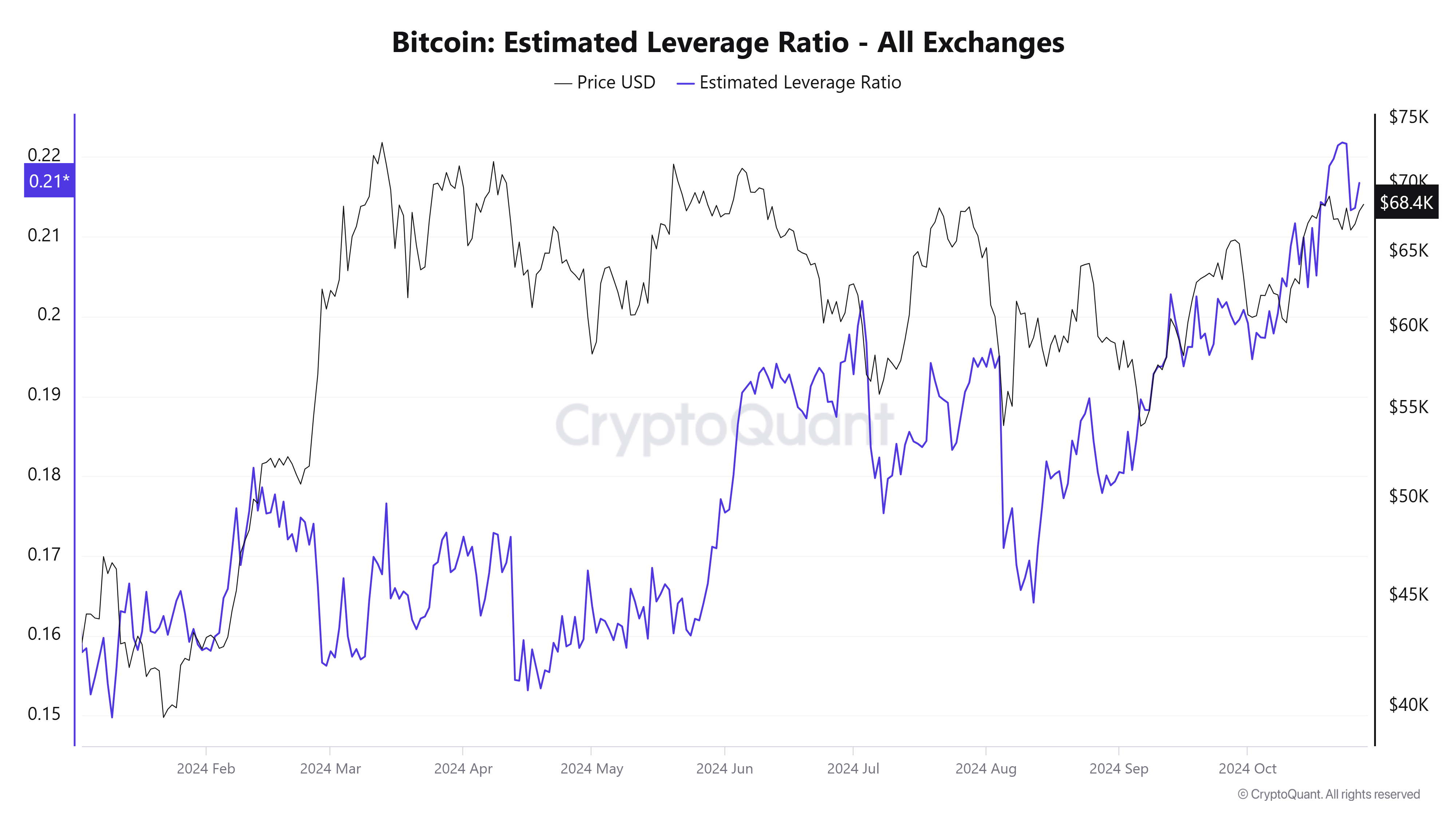

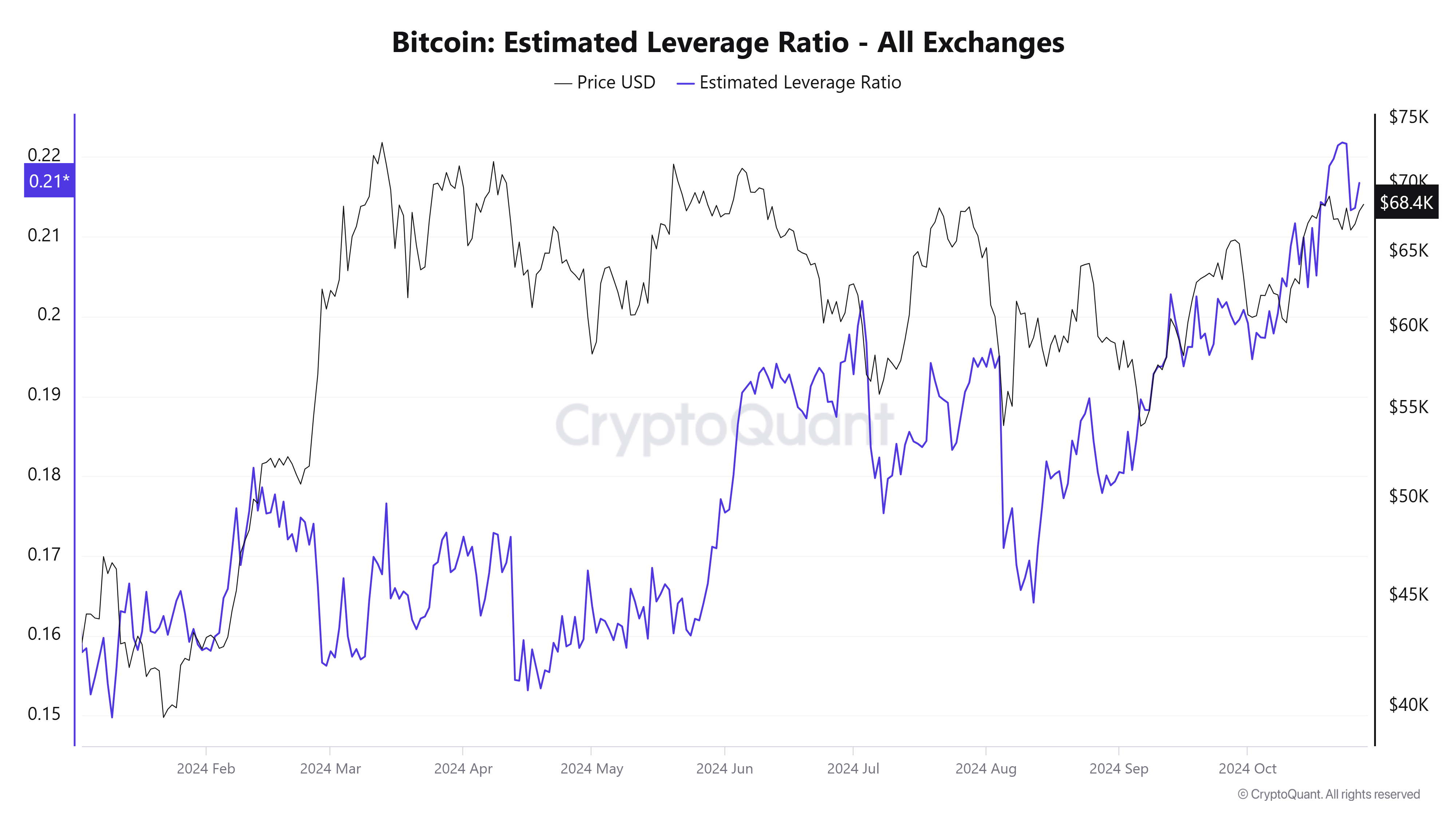

Bitcoin’s worth has gained momentum over the previous weeks and not too long ago touched a excessive of greater than $69,000, which is barely 6% away from its all-time excessive.

Nonetheless, the excessive quantities of leverage behind the spectacular efficiency raises considerations about its sustainability. Leverage buying and selling entails utilizing borrowed funds to extend the potential return on an funding. It permits merchants to regulate a bigger place in an asset than they might with their capital alone.

CryptoQuant information signifies that the Estimated Leverage Ratio hit a yearly excessive of 0.22 on Oct. 24 earlier than barely declining to 0.21 on Oct. 26. This ratio compares the open curiosity (OI) in futures contracts to the steadiness of the corresponding change.

Final week, Bitcoin’s open curiosity had surpassed $40 billion for the primary time, setting a brand new report within the crypto derivatives market.

Though OI dipped to round $37 billion over the weekend, the market has rebounded by 6% within the final 24 hours to $40.08 billion as of press time, based on CoinGlass information. This unsurprisingly contributed to BTC’s worth briefly climbing to as excessive as $69,225 earlier right this moment.

Whereas leverage can amplify earnings, it additionally introduces vital dangers, doubtlessly resulting in substantial losses and elevated market volatility.