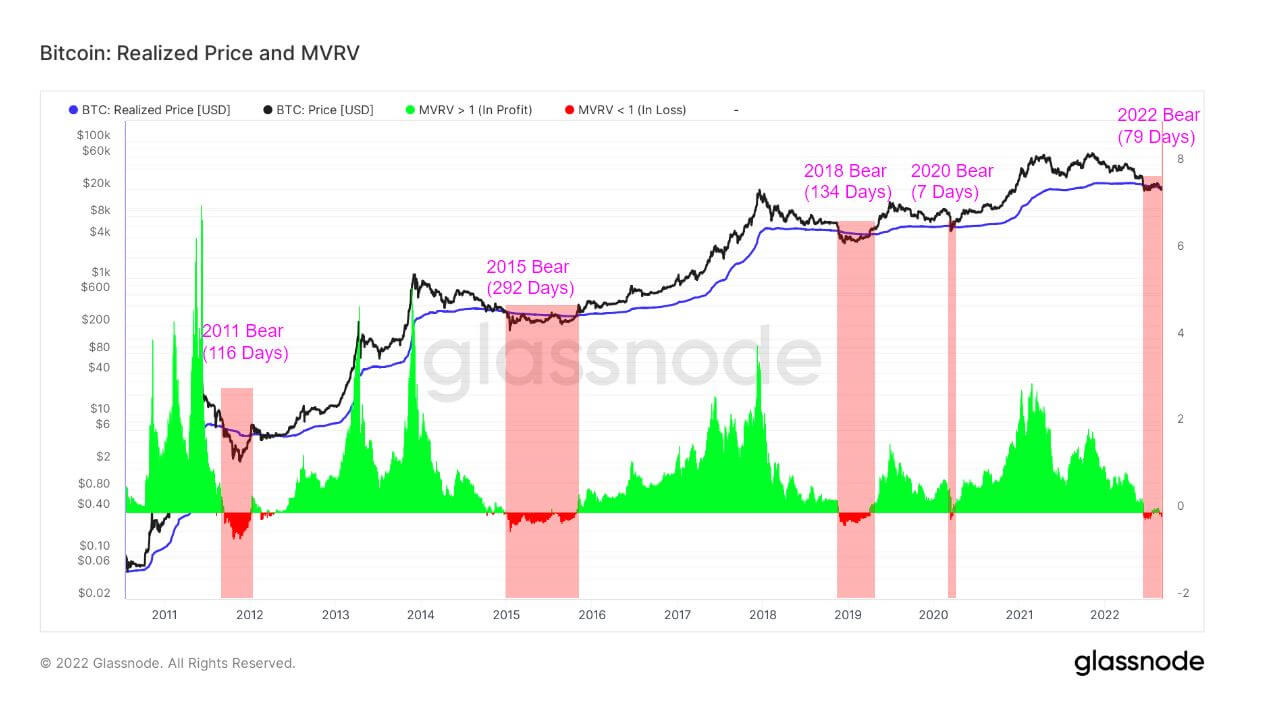

Figuring out a market backside requires taking a look at numerous totally different units of information. Nonetheless, with regards to Bitcoin, there are two often used on-chain metrics which have traditionally acted as stable indicators of its value backside — realized value and the MVRV ratio.

Realized value calculates the typical value of the Bitcoin provide valued on the day every coin final transacted on-chain. Realized value is an important metric and is taken into account to be the cost-basis of the market. The MVRV ratio is the ratio between the market capitalization of Bitcoin’s provide and its realized worth. The ratio is a stable indicator of whether or not Bitcoin’s present value stands above or under “honest worth” and is used to evaluate market profitability.

Every time Bitcoin’s spot value trades under the realized value, the MVRV ratio will fall under 1. This exhibits that traders are holding cash under their value foundation and carrying an unrealized loss.

A constant MVRV ratio exhibits the place help is being shaped and, when mixed with additional evaluation of the realized value, can sign a market backside.

All of Bitcoin’s earlier bear market cycles have seen costs fall under the 200-week transferring common realized value. Since 2011, the typical stint under the realized value lasted for 180 days, with the one exception being March 2020, the place the dip lasted solely 7 days.

The continuing bear market that started in Might with Terra’s collapse has seen Bitcoin’s value keep under the MVRV ratio for 79 days. Whereas Bitcoin’s value managed to climb above the MVRV ratio within the final week of August, it’s nonetheless too early to say whether or not it indicators the tip of the bear market.

What it does sign is robust resistance forming on the $20,000 ranges. This resistance is what finally determines the power of the market and the potential low it might drop to in a future bear cycle.

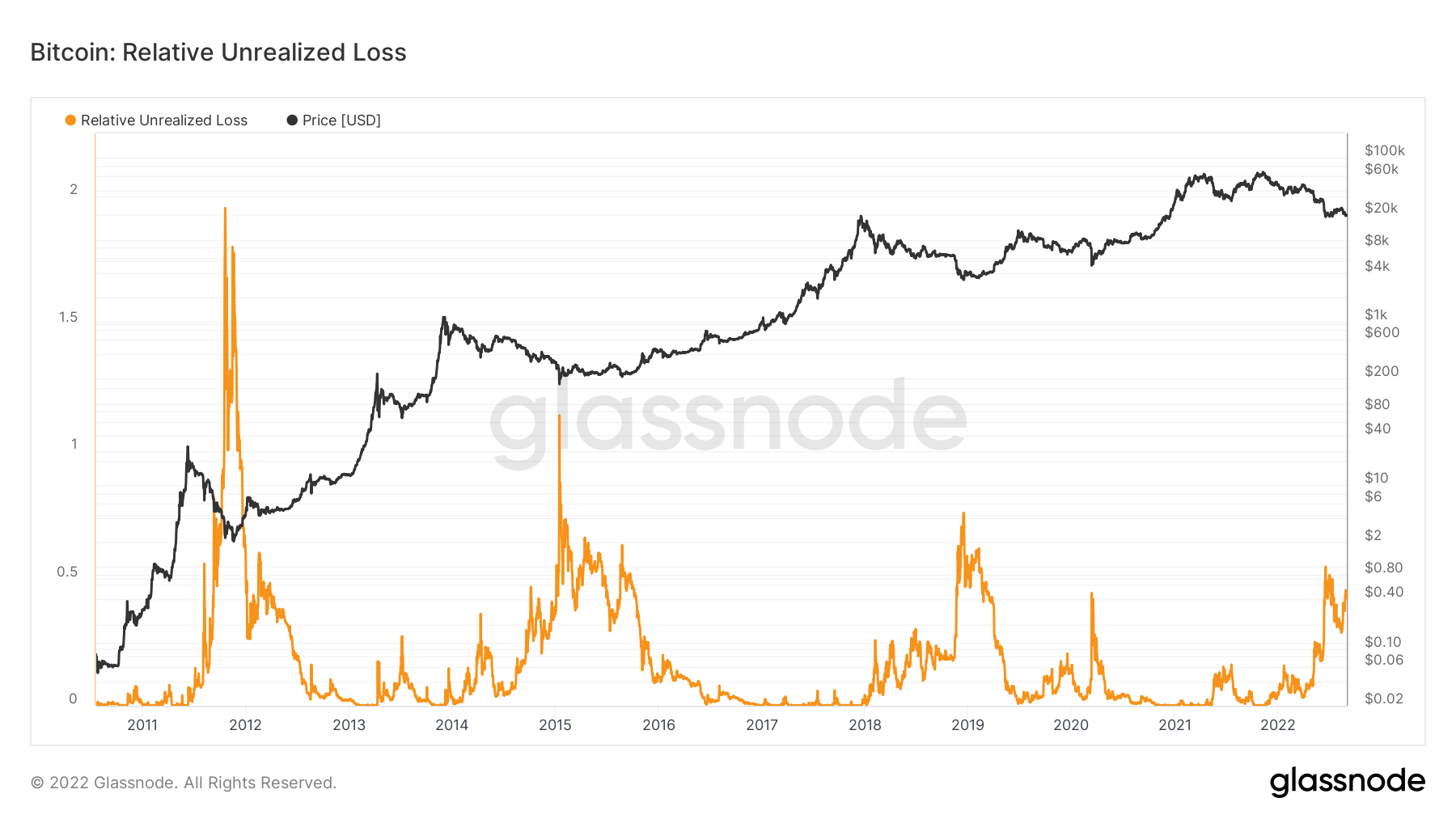

In keeping with information from Glassnode, Bitcoin has seen its relative unrealized loss bounce considerably in August, following a equally sharp spike at the start of the summer season. Relative unrealized loss exhibits how a lot worth cash whose value at realization was greater than the present value misplaced. A rising unrealized loss rating exhibits that addresses proceed to carry their cash regardless of their relative devaluation and aren’t promoting them at a loss.

historic information exhibits that each time the unrealized relative loss spiked, Bitcoin posted the next low. In each following market cycle, Bitcoin tried to retest the excessive it reached earlier than the bear market however nearly at all times didn’t beat it. It took at the least two years earlier than Bitcoin’s value reached the excessive of the earlier market cycle.

Trying on the information exhibits that there’s a excessive likelihood a backside might be forming. And whereas this means an upward value motion within the coming months, it might nonetheless be one other two years earlier than the market recovers in full and enters right into a full-blown bull run.