Whereas Bitcoin’s present value of $95,600 remains to be traditionally excessive, the drop from its ATH of $106,800 led to a major quantity of distribution amongst holders.

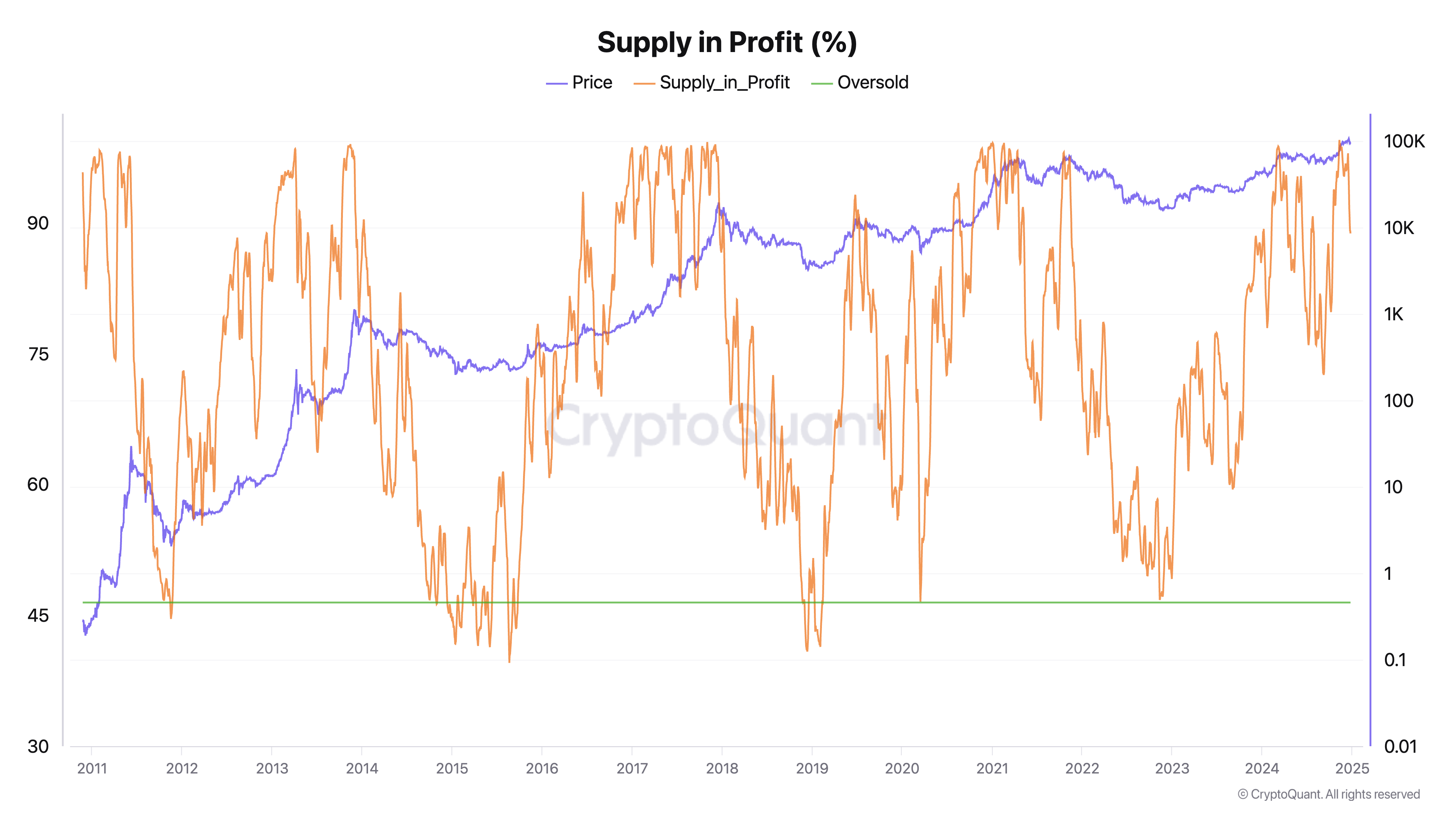

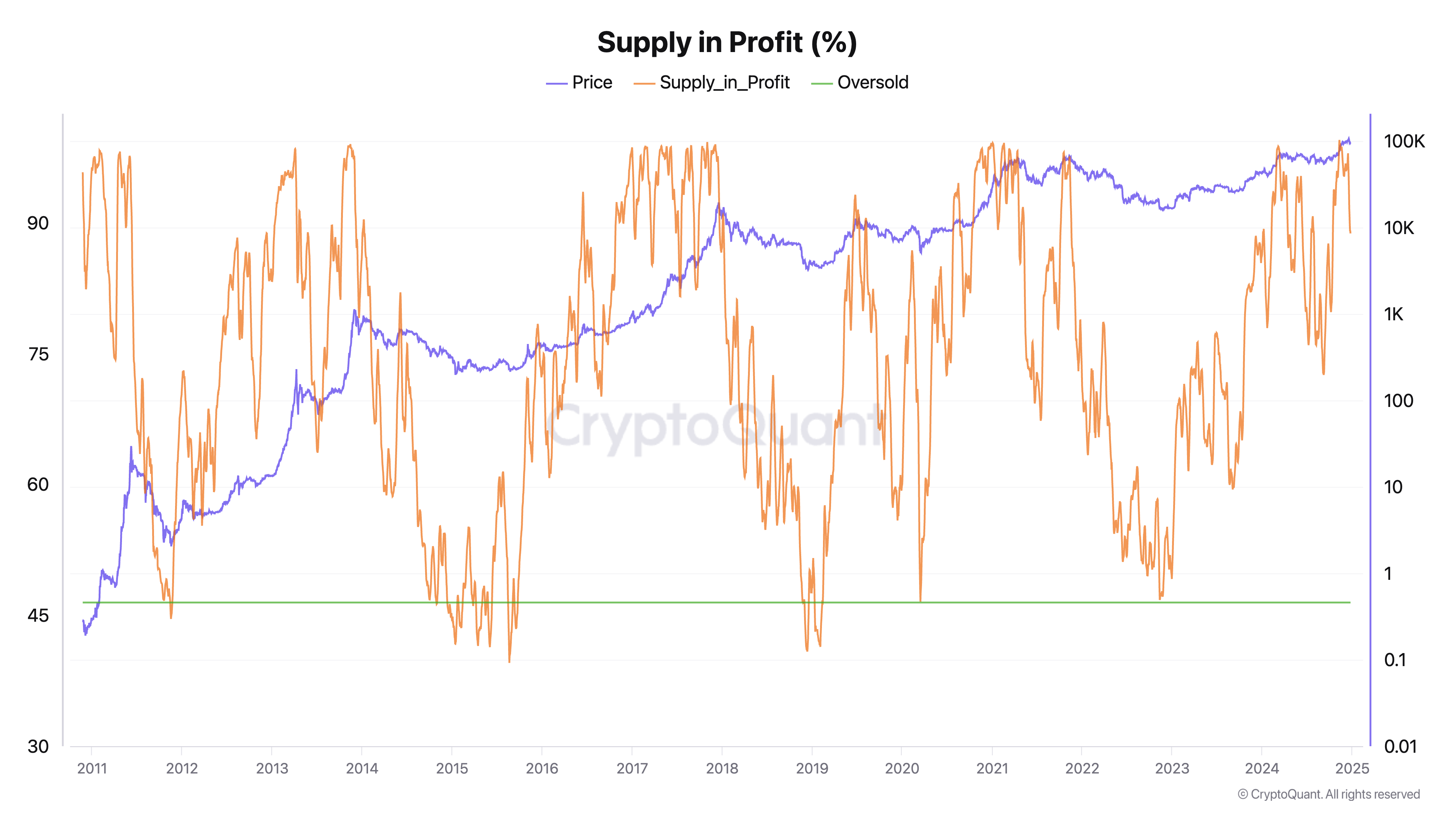

The rally that adopted the US Presidential elections in November pushed BTC to $89,000, bringing the overall provide in revenue to only over 99%. The next enhance to $016,800 by Dec. 17 led to a drop in provide in revenue to 94.88%. By Christmas Eve, the provision in revenue dropped to 88.89% as Bitcoin struggled to stay tied at $95,800.

Regardless of traditionally excessive costs, the lowering proportion of provide in revenue exhibits that important distribution is happening. The drop from 99.09% to 88.89% whereas costs remained above $95,000 signifies substantial new shopping for occurred close to the height of round $106,800. This implies roughly 11% of Bitcoin’s provide was both purchased or final moved at costs above present ranges, creating a brand new cohort of underwater holders.

It additionally signifies that these value ranges may act as resistance within the close to time period, as these holders might look to interrupt even on their positions if we see extra upward value motion.

The speedy decline in worthwhile provide since mid-December suggests a basic “good cash” distribution sample to retail buyers who usually purchase close to or at native tops. The present proportion of provide in unrealized loss creates potential promoting strain if these new holders develop into nervous about additional value declines. Nevertheless, such excessive ranges of provide in revenue (exceeding 80%) have traditionally indicated robust general market well being and have been an indispensable a part of earlier bull cycles.